Introduction of Restoration of Cancelled Registration based on Appellate order

Communications have been received from field formations about passing judicial / appeal orders against cancellation orders, passed suo-motu by the Range officers u/s 29 of the CGST Act, 2017. It has also come to notice that taxpayers in certain cases, had obtained orders from High Courts / appellate authorities to restore registrations cancelled on their […]

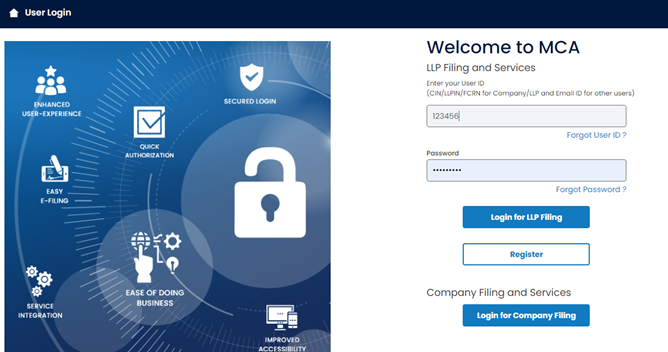

NEW V3 PORTAL FOR LLP (Limited Liability Partnership) by MCA

INTRODUCTION MCA has launched its new application (v3) for e-filing by LLPs on MCA V 3 portal to improve the delivery of LLP services. It may be noted that all the LLP e-filing services are being upgraded and migrated to MCA V3 portal. However, all the other services will continue to exist at MCA V3 (existing) […]

Standard Operating Procedure (SOP) for Scrutiny of returns for FY 2017-18 and FY 2018-19

Section 61 of the Central Goods and Services Tax Act, 2017 read with rule 99 of Central Goods and Services Tax Rules, 2017 provides for scrutiny of returns and related particulars furnished by the registered person. Till the time a Scrutiny Module for online scrutiny of returns is made available on the CBIC-GST application, as […]

E-invoicing – Next phase will apply to businesses with a turnover of 20 crores from April 1, 2022

Background E-invoicing in India will be a big move, due to the volume of business transactions undertaken every day, as well as the different, non-standardized formats used in invoice generation. The main objective is that an e-invoice generated by one software should be capable of being read by any other software. New system of […]

SECURITIES AND EXCHANGE BOARD OF INDIA (LISTING OBLIGATIONS AND DISCLOSURE REQUIREMENTS) (AMENDMENT) REGULATIONS, 2022

The SEBI notified SEBI (Listing Obligations And Disclosure Requirements) (Amendment) Regulations, 2022 (hereinafter referred to as “Amended Regulations”) vide Notification No. SEBI/LAD-NRO/GN/2022/66 Dated: January 24, 2022 to amend the existing Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015. These regulations shall come into force w.e.f. January 24, 2022 The Amended Regulations and its comparison and […]

MCA Extends Due Dates for e-forms AOC-4/ AOC-4 (CFS)/ AOC-4 (XBRL), AOC-4 (Non-XBRL), MGT-7/ MGT-7A

Further to various extensions granted previously by Ministry of Corporate Affairs (hereinafter referred to as “MCA”) to file e -forms AOC-4/ AOC-4 (CFS)/ AOC-4 (XBRL), AOC-4 (Non-XBRL), MGT-7/ 7A, under the Companies Act, 2013 (hereinafter referred to as “the Act”), MCA has again extended the due dates for filing of the aforesaid forms, via Circular […]

Advisory on Auto-population of E-invoice details into GSTR-1

Auto-population of e-invoice details into GSTR-1 Generation of e-invoice is mandatory for certain class of taxpayers, as notified by the Government. These taxpayers are required to prepare & issue their e-invoices by reporting their invoice data in the prescribed format (e-invoice schema in FORM GST INV-01) and reporting the same on the Invoice Registration Portal (IRP). Invoices […]

Advisory for Importers to avail benefit of IGCR Rules (Import of Goods at Concessional Rate of duty)

IGCR module is developed by ICEGATE, CBIC to provide a digital service to importers to avail benefits under the IGCR Rules (Import of Goods at Concessional Rate of Duty). The broad provisions are as under: i. Available post log in on ICEGATE for importers in their existing account, registered with valid DSC. ii. Provision of […]

GSTN has enabled facility for filing Letter of Understanding (“LUT”) for FY 2022-23 on GST Portal for taxpayers.

Disclaimer: This article is only a knowledge-sharing initiative and is based on the Relevant Provisions as applicable and as per the information existing at the time of the preparation. In no event, RMPS & Co. or the Author or any other persons be liable for any direct and indirect result from this Article or any […]

Major Benefits under New Gujarat IT & ITeS Policy 2022-27

Dear Readers, I hope you are doing well. Recently, Chief Minister Bhupendra Patel unveiled new “IT/ITES Policy 2022-27” which would replace the IT & ITeS policy, 2016-2021, which offers both capital and operational support to Information Technology (IT) firms making investments in Gujarat for existing and expansion units. The objectives of new policy are to create […]

- 1

- 2