AUTOMATION OF CONTINUAL DISCLOSURES UNDER REGULATION 7(2) OF SEBI (PROHIBITION OF INSIDER TRADING) REGULATIONS, 2015

SEBI has notified a circular ref no SEBI/HO/ISD/ISD/CIR/P/2021/578 dated June 16, 2021 for automation of continual disclosures under regulation 7(2) of Sebi (Prohibition of Insider Trading) Regulations, 2015 (“PIT Regulations”) – system driven disclosures for inclusion of listed debt securities. The system driven disclosures have already been implemented for entities of a listed company under […]

Landmark Judgement of Supreme Court on GST on ocean freight – 19th May 2022

Synopsis In a landmark Judgment in the case of Mohit Minerals Pvt Ltd Supreme court held that the impugned levy imposed on the ‘service’ aspect of the transaction is in violation of the principle of ‘composite supply’ enshrined under Section 2(30) read with Section 8 of the CGST Act. Since the Indian importer is liable […]

Due date extended for GSTR 3B and PMT-06 for the month of April,2022

Due date for furnishing Form GSTR-3B for the month of April, 2022 extended till the May 24, 2022 due to the non-availability of Form GSTR-2B for the month of April, 2022 on time.(vide Notification No. 05/2022- Central Tax dated May 17, 2022 ) Due date for furnishing Form GST PMT-06 (for taxpayers under QRMP Scheme) […]

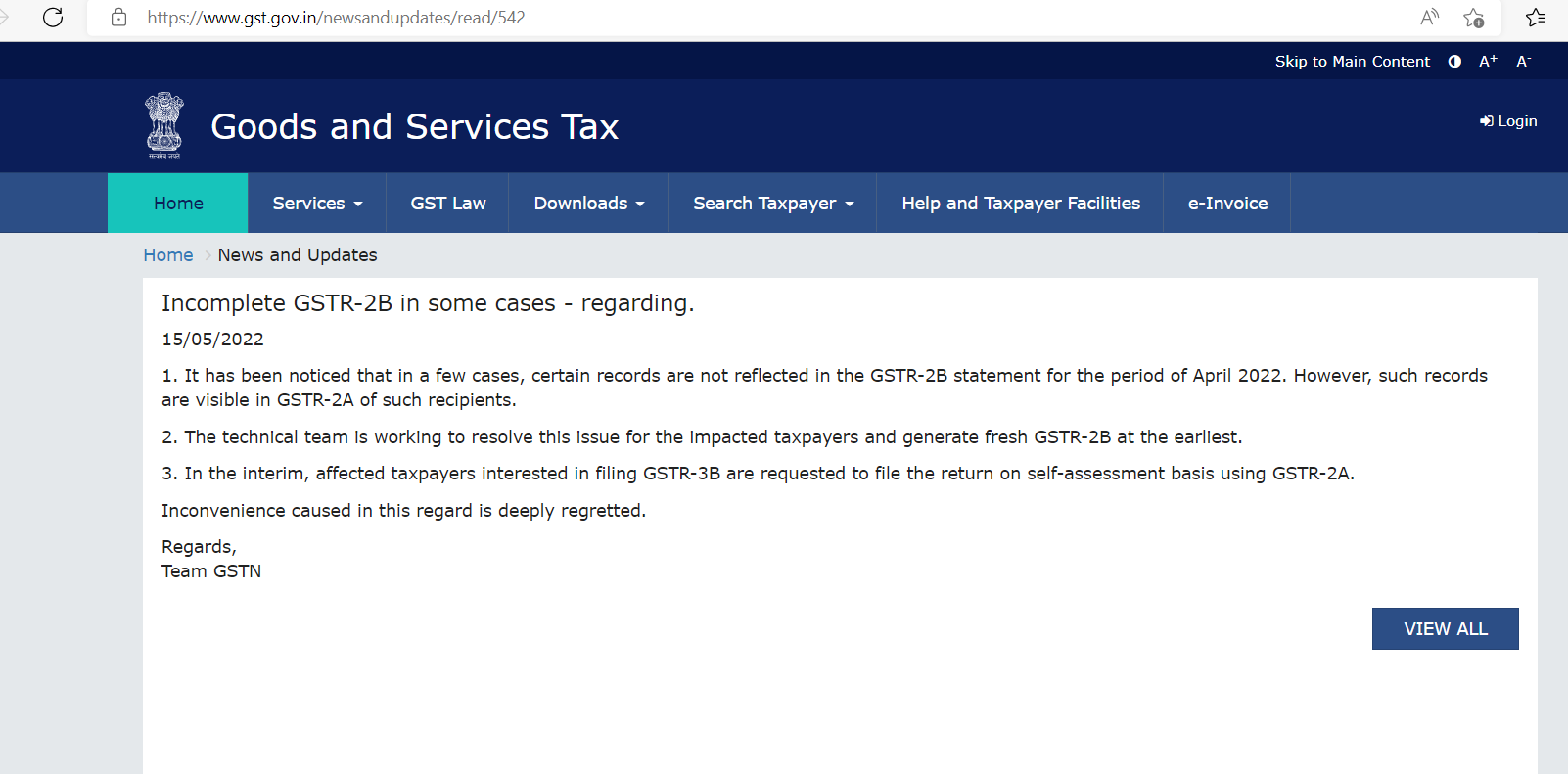

GSTN issued advisory on GSTR-2B issues

There is Problem while generating GSTR-2B for April month on GST Portal. It has been noticed that in a few cases, certain records are not reflected in the GSTR-2B statement for the period of April 2022. However, such records are visible in GSTR-2A of such recipients. The technical team is working to resolve this issue […]

Reporting of GST @ 6% in GSTR-1

A new tax rate of 6% IGST or 3% CGST+ 3% SGST has been introduced on certain goods vide Notification No. 02/2022 dated 31st March 2022. Rate Amendment in Notification No 02/2022 was related to person engaged in making supply of the goods as per below HSN code: • Fly ash bricks or fly ash […]

MCA GENERAL CIRCULAR FOR HOLDING OF AGM THROUGH VC OR OAVM UP TO DECEMBER 31, 2022

MCA GENERAL CIRCULAR NO. 02/2022 DATED 05TH MAY, 2022 FOR HOLDING OF AGM THROUGH VC OR OAVM UP TO DECEMBER 31, 2022 The MCA in continuation to its previous General Circulars (last being General Circular No. 21/2021 dated 14th December, 2021), issued in respect to allowing Companies to hold AGM through video conferencing (VC) or […]

1/3rd deduction for land value under GST is optional – MUNJAAL MANISHBHAI BHATT Versus UNION OF INDIA (Gujarat High Court)

1/3rd deduction for land value under GST is optional and can be permitted at the option of a taxable person, particularly in cases where the value of land or undivided share of land is not ascertainable- MUNJAAL MANISHBHAI BHATT Versus UNION OF INDIA (Gujarat High Court) Sale of land is included in the Entry No. […]

GSTN enabled functionality of Annual Aggregate Turnover (“AATO”) computation for the FY 2021-22 on taxpayers’ Dashboard

The functionality of AATO for the FY 2021-22 has now been made live on taxpayers’ dashboards with the following features: The taxpayers can view the exact Annual Aggregate Turnover (AATO) for the previous Financial Year (FY). The taxpayers can also view the Aggregate Turnover of the current FY based on the returns filed till date. […]

Advisory to composition taxpayers

Background: Since FY 2019-20, composition taxpayers has to pay the liability through Form GST CMP-08 on quarterly basis while return in Form GSTR-4 is required to be filed on annual basis after end of a financial year. Reason of Negative Liability in GSTR-4: The liability of the complete year is required to be declared in […]