For Existing Units – 05-09-2022-Last date to register for availing Gujarat IT/ITeS Policy FY 2022-27

Hello Readers, With an ambitious target to increase exports from the existing Rs 3,000 crore to as high as rs 25,000 crore in the information technology (IT) sector, the Gujarat government rolled out its new Information Technology & Information Technology-enabled Services (IT & ITeS) policy, 2022-2027. The Policy will enable all innovative ecosystem, establish a […]

TAXABILITY OF RENTING OF RESIDENTIAL DWELLING UNDER GST

Renting of residential dwelling for the purpose of residence was earlier exempted. However, the exemption on such service has been withdrawn with effect from 18.07.2022. Now onwards renting of residential property for the purpose of residence is also taxable if the recipient of service is registered under GST. Prior to July 18th,2022 Services by way […]

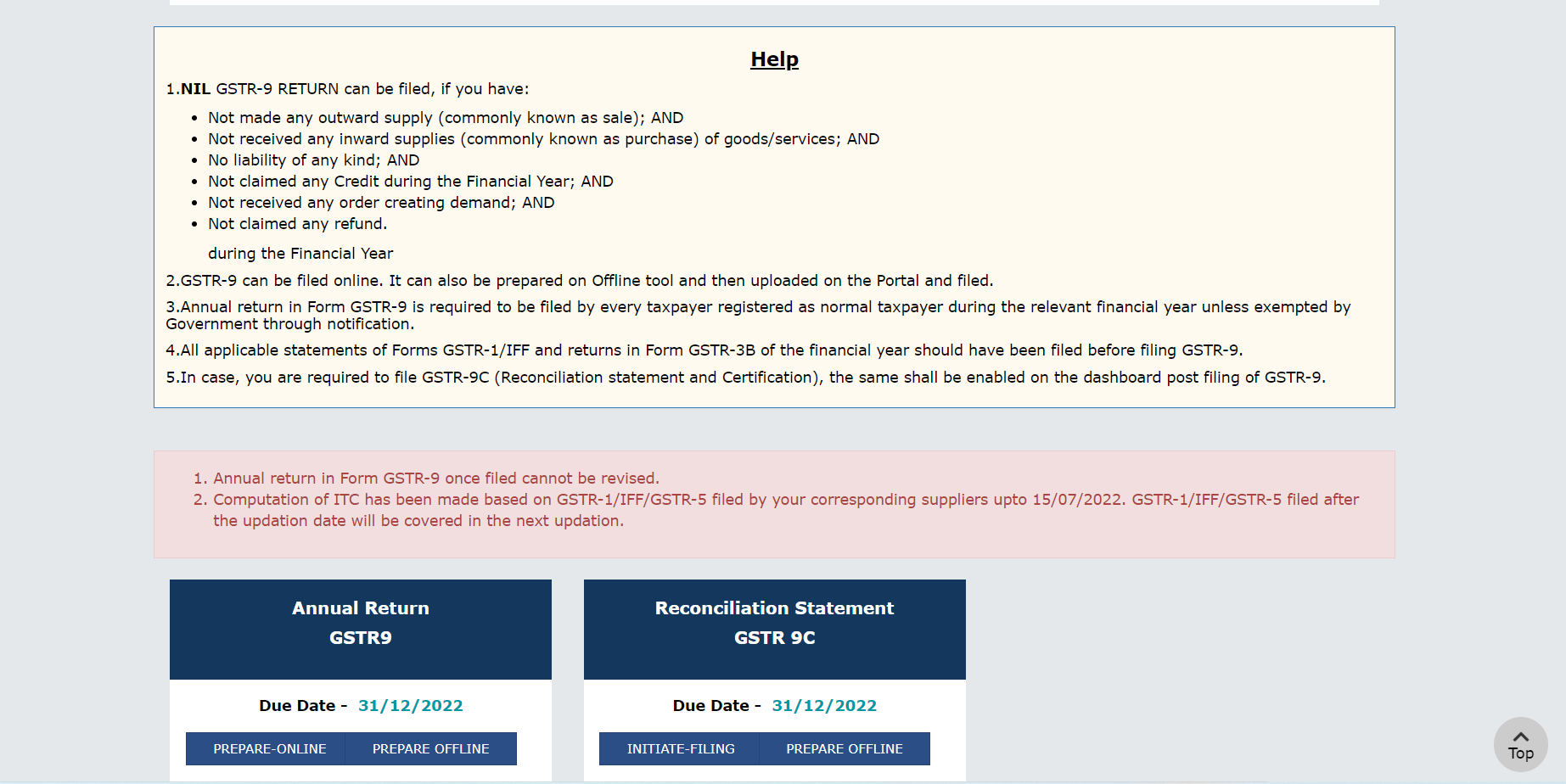

GSTR 9-9C for FY 2021-22 has been enabled on GSTN Portal

GSTR-9 [GST Annual Return] It is mandatory for turnover exceeding 2 Crores and optional for taxpayers having annual aggregate turnover of up-to Rs. 2 crores. GSTR-9C [GST Audit- Reconciliation Statement] It is applicable to taxpayers having annual aggregate turnover of more than Rs.5 crore. It is optional for taxpayers whose turnover is exceeding Rs.2 Crore […]

First set of Nine Forms to be launched on August 31, 2022

As per update from Ministry of Corporate Affairs (“MCA”) on July 15, 2022, the MCA is launching first set of Company Forms on MCA21 V3 portal. These forms will be launched on 31st Aug 2022 at 12:00 AM. Following forms will be rolled-out in this phase: DIR3-KYC Web, DIR3-KYC Eform, DPT-3, DPT-4, CHG-1, CHG-4, CHG-6, […]

E-Invoicing (B2B) under GST for Taxpayer having Turnover more than Rs.10 Crore w.e.f. 01 October 2022 (Turnover in any FY from 2017-18 onwards)

The CBIC issued Notification No. 17/2022–Central Tax dated August 01, 2022, to amend Notification No. 13/2020 – Central Tax, dated March 21, 2020, to decrease the e-Invoicing aggregate turnover limit from 20 crores to 10 crore w.e.f. October 01, 2022. CBIC has made the e-invoicing system mandatory for all registered persons with a turnover of more than Rs.10 crore […]