15th Sept 2023 – 2nd Installment of Advance Income Tax

What is advance tax? As the name suggests, advance tax is the practice of paying taxes in advance rather than paying a lump sum amount at the end of the financial year. Also known as ‘pay as you earn’ scheme, these taxes are supposed to be paid in the same year the income is received. […]

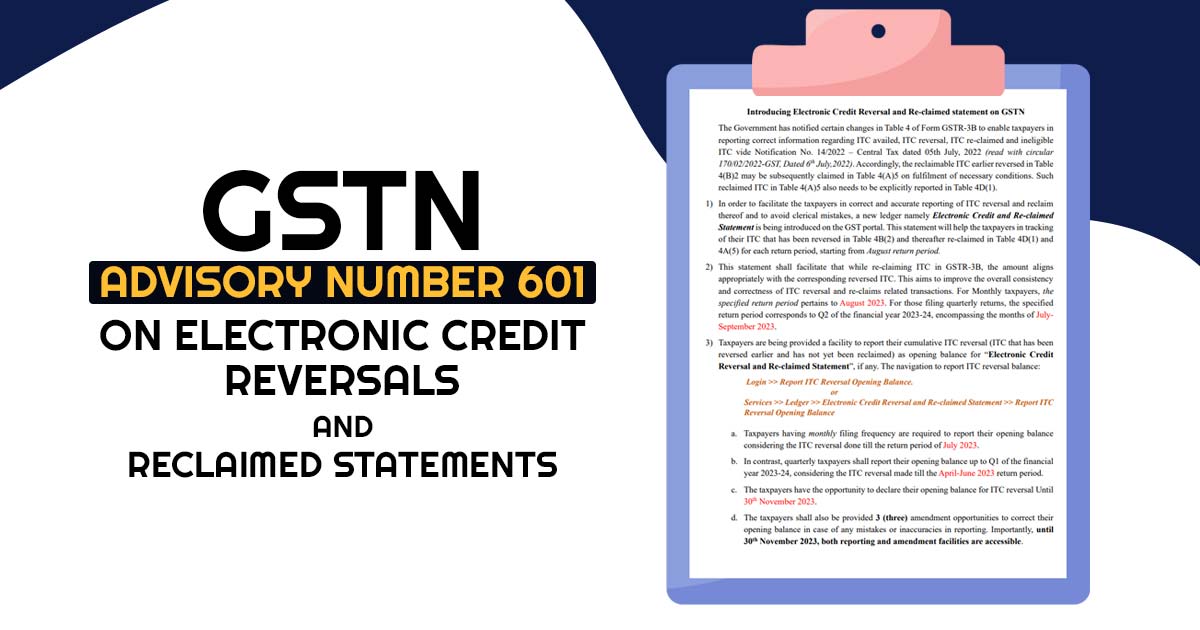

Maximize Your ITC Tracking Efficiency with GSTN’s New Electronic Credit Reversal and Re-claimed Statements!

A new feature called Electronic Credit Reversal and Re-claimed Statements on the GSTN portal has been introduced. This statement is here to help you keep track of your ITC, from reversing it (Table 4B(2)) to reclaiming it (Table 4D(1) and 4A(5)). It covers each return period, starting from the August 2023 return period. Correct Reporting, […]

🌱 Early Indications of a Promising Startup Business Model 📈💡

In the early stages of a startup, identifying a viable and scalable business model is crucial for long-term success. While each startup is unique, there are some key indicators that can signal a promising business model. Here are a few early indications to look out for: 1️⃣ Clear Value Proposition: A strong startup business model […]

- 1

- 2