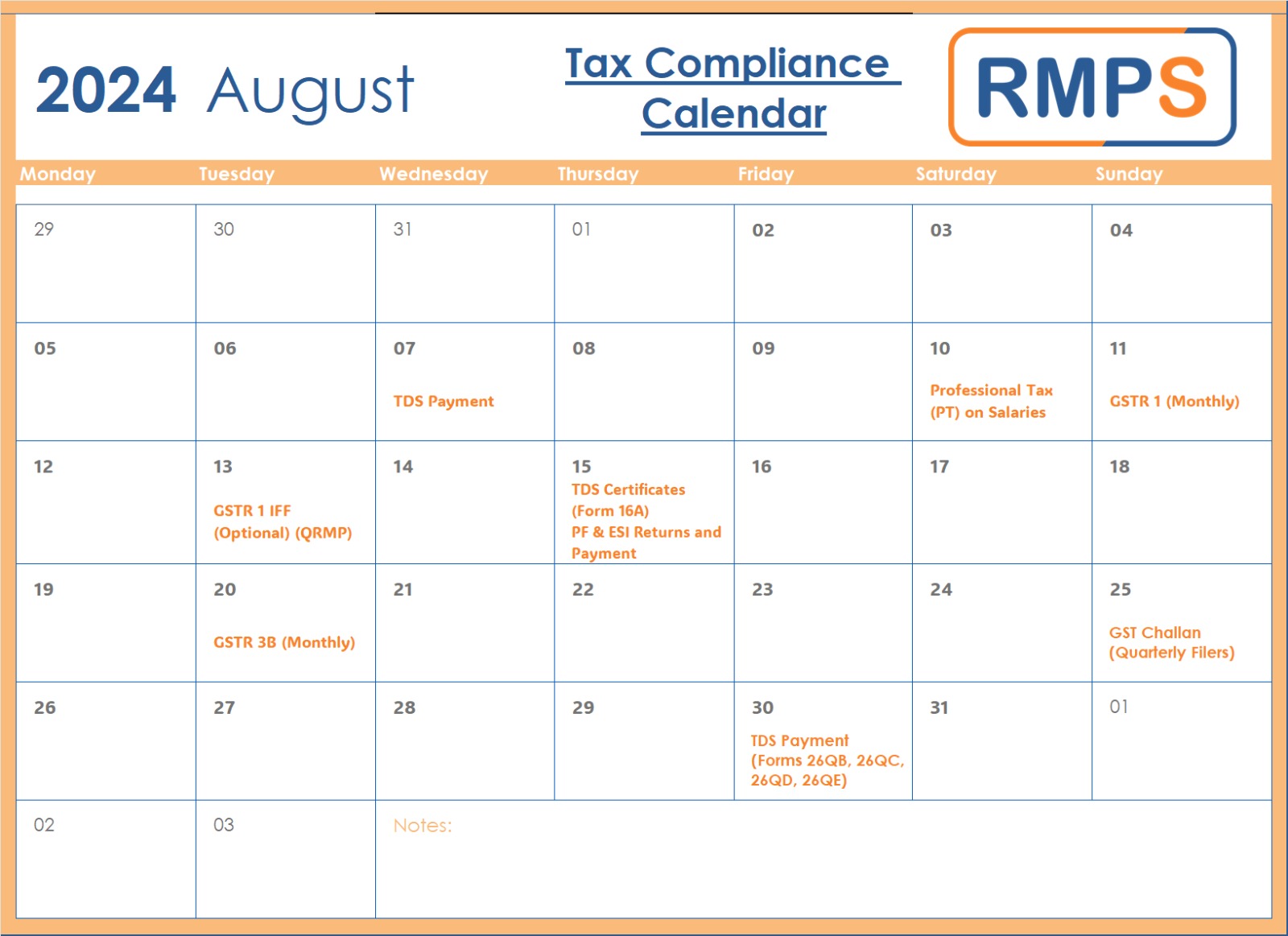

August 2024 Compliance Calendar: Key Deadlines for Businesses

As a business owner or financial professional, staying on top of compliance deadlines is crucial to avoid penalties and ensure smooth operations. Here’s a guide to the essential tax and regulatory deadlines for August 2024. 07 August: TDS Payment for July 2024 Ensure you complete your Tax Deducted at Source (TDS) payments for July by […]

GST Form 8 Updates: New TDS Rates Effective July 10, 2024

In a recent development, the Central Government has announced significant changes to GST Form 8 and TDS rates. Effective from July 10, 2024, these changes aim to streamline compliance for taxpayers and reduce the financial burden on businesses. Key Changes: Detailed Overview: The government has revised GST Form 8, used by e-commerce operators for filing […]

Understanding Form GSTR-1A: Amendments Made Easy

When it comes to managing GST returns, accuracy is key. Mistakes in filing can lead to discrepancies, affecting your business’s compliance and financial standing. Fortunately, the Indian GST system provides a mechanism to correct such errors: Form GSTR-1A. This blog will guide you through the essentials of GSTR-1A, its purpose, filing procedure, and critical considerations. […]

Navigating Digital Waves: Top Business Models for Modern Entrepreneurs!

In the digital era, entrepreneurs are presented with an array of business models that harness the power of technology and innovation. These models are not only revolutionizing traditional industries but also creating new opportunities for growth and success. In this blog, we’ll explore the top business models that modern entrepreneurs can adopt to navigate the […]

A Guide to Filing Form GSTR-1A: A New Opportunity for Taxpayers

Introduction The Government of India has introduced Form GSTR-1A, an optional tool for taxpayers. This form allows businesses to amend, add, or correct details of supplies reported in the current tax period’s GSTR-1. It was introduced following the Government’s notification no. 12/2024 dated 10th July 2024, and is available starting from the July 2024 tax […]

RegTech: Revolutionizing Compliance in the Financial Industry!

In today’s fast-paced and highly regulated financial environment, the task of staying compliant with ever-changing regulations can be daunting. RegTech, short for Regulatory Technology, is utilized to streamline and automate regulatory compliance processes by leveraging advanced technology, particularly Artificial Intelligence and Machine Learning. What is RegTech? RegTech, known as Regulatory Technology, refers to the use […]