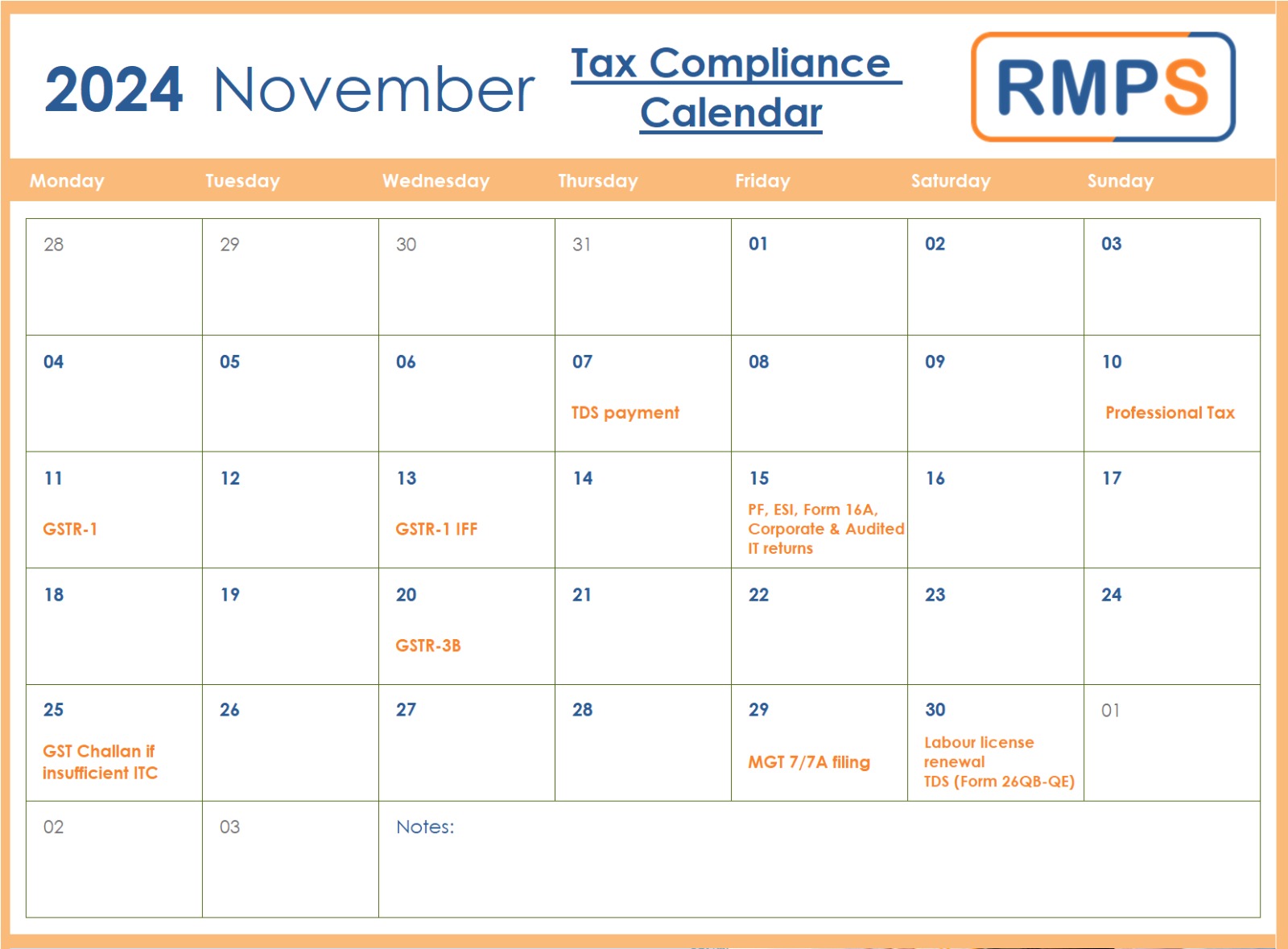

Essential Tax and Compliance Deadlines in November 2024: A Quick Guide for Businesses

November is a significant month for businesses, with multiple tax and regulatory deadlines. Meeting these deadlines is essential to avoid penalties, maintain compliance, and ensure seamless business operations. Here’s a quick rundown of what to keep in mind for November 2024. 1. TDS Payment (Due by November 7th) Businesses need to deposit the Tax Deducted […]

Advisory on Waiver Scheme Under Section 128A of the CGST Act

The GST Council’s recent decision to waive interest and penalties under Section 128A of the CGST Act, 2017, offers welcome relief for many taxpayers. Announced at the Council’s 53rd meeting on June 22, 2024, the waiver applies to cases where no fraud is involved, helping reduce tax disputes and simplifying compliance. Key Points About the […]

Form GST DRC-03A: A Guide for Taxpayers to Ensure Accurate Payment Adjustment

The Goods and Services Tax (GST) system recently introduced Form GST DRC-03A to help taxpayers link their demand payments accurately to outstanding demand orders. This update addresses issues where payments made via Form GST DRC-03 do not close the demand in the electronic liability register. This blog provides a step-by-step guide to using Form DRC-03A, […]