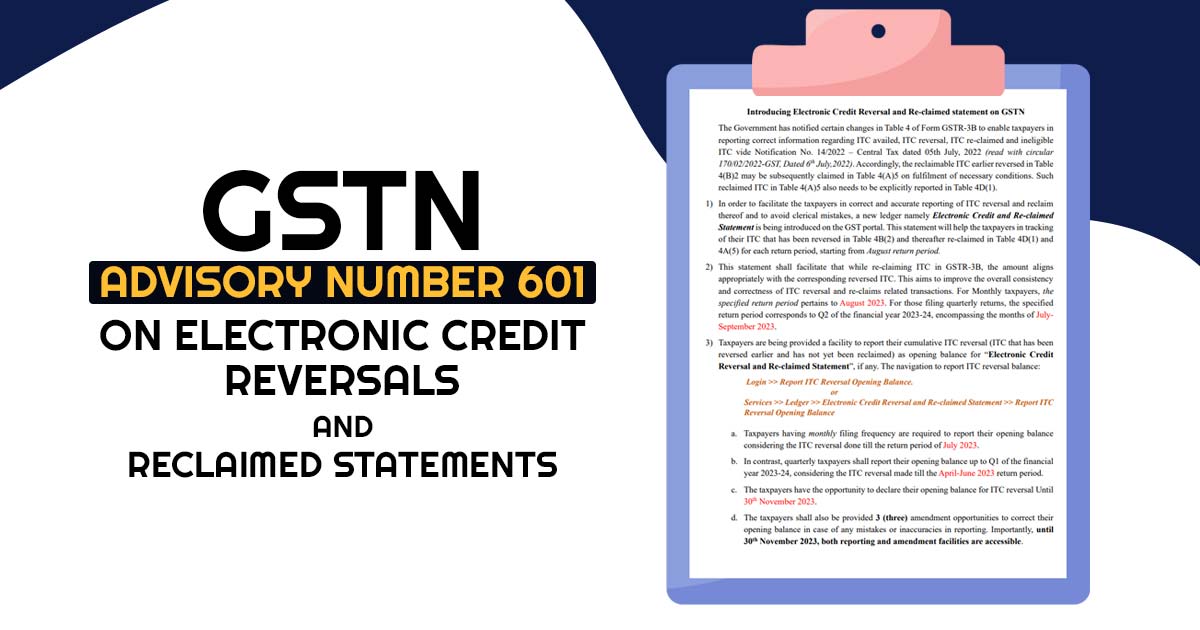

A new feature called Electronic Credit Reversal and Re-claimed Statements on the GSTN portal has been introduced.

This statement is here to help you keep track of your ITC, from reversing it (Table 4B(2)) to reclaiming it (Table 4D(1) and 4A(5)).

It covers each return period, starting from the August 2023 return period.

Correct Reporting, No More Mistakes

- Changes have been made to Form GSTR-3B, specifically in Table 4, to help you do this.

- Notification No. 14/2022 – Central Tax dated 05th July, 2022, along with circular 170/02/2022-GST, Dated 6th July, 2022, laid the groundwork.

- Now, if you’ve reversed ITC (Table 4(B)2) and meet the conditions, you can reclaim it in Table 4(A)5.

- But don’t forget to report it in Table 4D(1).

Synchronization of ITC Reclaim and Reversed ITC

- When you reclaim ITC in GSTR-3B, it should match the corresponding reversed ITC.

- Monthly taxpayers, this applies to you starting from August 2023.

- Quarterly taxpayers, it’s for Q2 of the financial year 2023-24 (July-September 2023).

Reporting of Opening Balance of ITC Reversed and to be Reclaimed in the Future

- You can report your cumulative ITC reversal balance as an opening balance for the Electronic Credit Reversal and Re-claimed Statement.

- Monthly filers, consider ITC reversal until July 2023.

- Quarterly filers, look back to April-June 2023.

- You have until November 30, 2023, to declare this balance.

- You also get three chances to correct any mistakes until the same date.

- After November 30 but before December 31, 2023, you can only make amendments.

- Fresh reporting won’t be an option after December 31, 2023.

Helpful Alerts to Prevent Mistakes

- If you try to reclaim more ITC in Table 4D(1) than what’s available in the Electronic Credit Reversal and Re-claimed Statement, you’ll get a friendly warning.

- You can still proceed, but it’s a gentle reminder not to overdo it.

- It is better to report any pending reversed ITC as an ITC reversal opening balance.

When Will You See These Warning Messages?

- For monthly taxpayers, the warning message will commence appearing from the GSTR-3B filing for the August 2023 return period.

- Similarly, for quarterly taxpayers, this warning message would start from the filing period covering July to September 2023.

Our View’s

The introduction of Electronic Credit Reversal and Re-claimed Statements on the GSTN portal is a positive step toward simplifying the tax process for all taxpayers. It aims to reduce errors and ensure that you report your ITC accurately. So, embrace these changes, stay on top of your ITC, and enjoy a smoother GST filing experience.

Loading…

Loading…

Published on: September 9, 2023