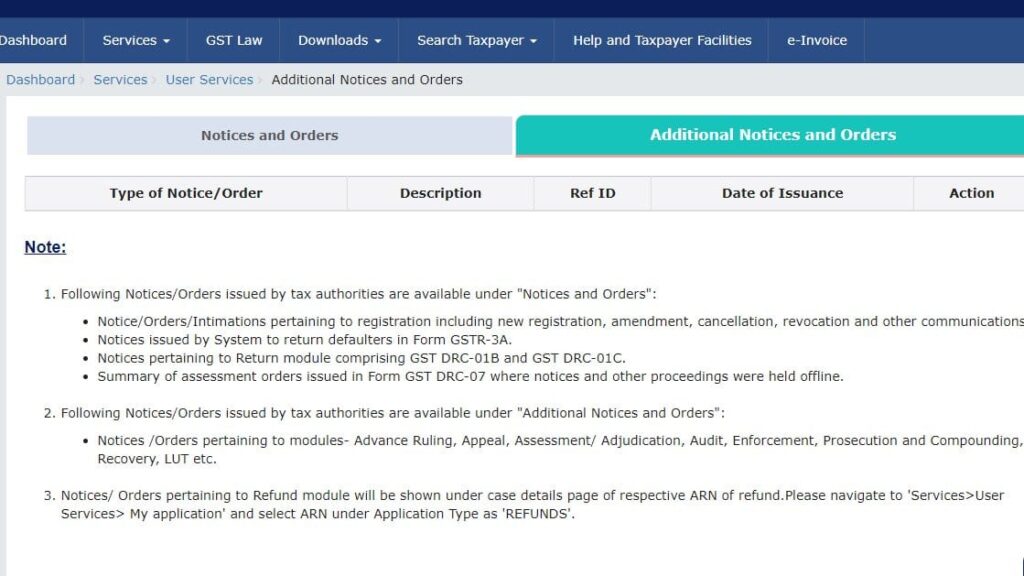

The Goods and Services Tax (GST) Portal introduces a user-friendly redesign, consolidating “Notice and Order” and “Additional Notices and Orders” tabs into a single window. This unified interface enhances efficiency and simplifies access for users. It offers a comprehensive view of diverse tax-related communications, including registration, return defaults, and assessment orders. Notably, the Refund module notices seamlessly integrate into the same window. The updated design underscores the portal’s commitment to user-centricity and smooth compliance.

- Following Notices/Orders issued by tax authorities are available under “Notices and Orders”:

- Notice/Orders/Intimations pertaining to registration including new registration, amendment, cancellation, revocation and other communications.

- Notices issued by System to return defaulters in Form GSTR-3A.

- Notices pertaining to Return module comprising GST DRC-01B and GST DRC-01C.

- Summary of assessment orders issued in Form GST DRC-07 where notices and other proceedings were held offline.

2. Additional Notices and Orders:

This section encompasses a broader spectrum of notices and orders related to various modules, including:

- Advance Ruling: Pertaining to queries and clarifications sought in advance.

- Appeal: Notices related to appeals made by taxpayers against decisions made by lower authorities.

- Assessment/Adjudication: Notices related to the assessment of tax liability or adjudication of disputes.

- Audit: Communication related to the audit process undertaken by tax authorities.

- Enforcement: Notices related to enforcement actions, ensuring compliance with GST regulations.

- Prosecution and Compounding: Notices issued for prosecution or compounding of offenses under GST laws.

- Recovery: Communication related to the recovery of dues from taxpayers.

- LUT (Letter of Undertaking): Notices pertaining to the Letter of Undertaking for exporters availing GST benefits.

- Notices/ Orders pertaining to Refund module will be shown under case details page of respective ARN of refund. Please navigate to ‘Services>User Services> My application’ and select ARN under Application Type as ‘REFUNDS’.

Published on: January 18, 2024

Subscribe

Login

0 Comments

Oldest