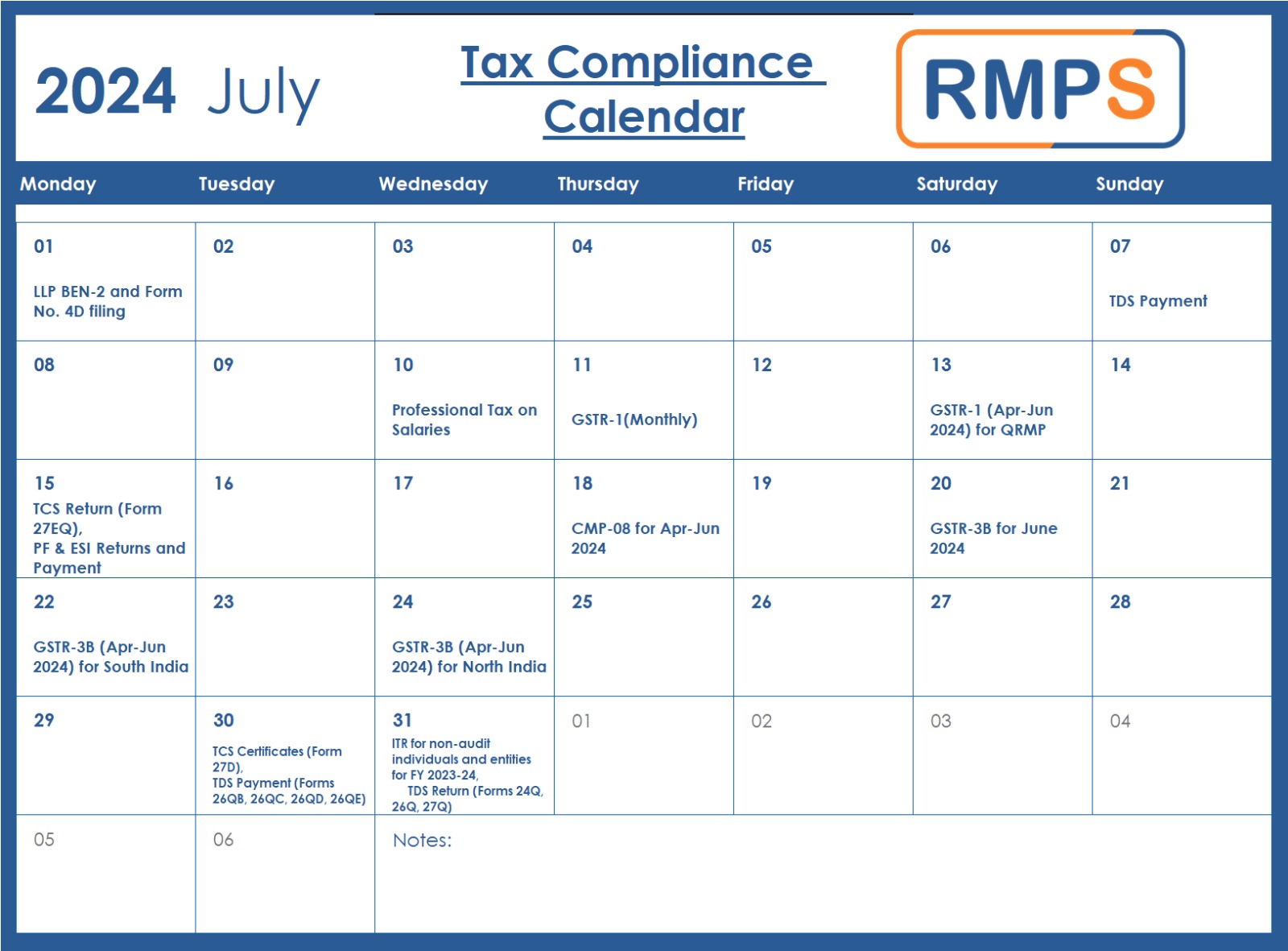

Staying on top of tax and regulatory filings is vital for every business. Here’s a detailed, easy-to-follow guide to the key compliance deadlines in July 2024. Mark these dates to ensure you remain compliant and avoid penalties.

Key Compliance Dates for July 2024

1st July

LLP BEN-2 and Form No. 4D Filing:

Make sure to submit LLP BEN-2 to declare significant beneficial ownership and Form No. 4D for other necessary filings. Keeping your documents in order ensures smooth operations.

7th July

TDS Payment:

Ensure your Tax Deducted at Source (TDS) for June 2024 is deposited by this date. Timely TDS payments are crucial to avoid interest and penalties.

10th July

Professional Tax on Salaries:

Pay the professional tax on salaries for June 2024. This state-specific tax is essential for maintaining compliance and avoiding fines.

11th July

GSTR-1 (Monthly):

Monthly GST filers must submit GSTR-1 for June 2024. This filing details all outward supplies and ensures you stay GST compliant.

13th July

GSTR-1 (QRMP):

Quarterly Return Monthly Payment Scheme (QRMP) filers need to submit GSTR-1 for the quarter April to June 2024. Keeping up with this filing is key to staying on track with your quarterly returns.

15th July

TCS Return (Form 27EQ):

File the Tax Collected at Source (TCS) return for the quarter ending June 2024. Staying prompt with TCS returns is crucial for smooth operations.

PF & ESI Returns and Payment:

Ensure compliance with Provident Fund (PF) and Employee State Insurance (ESI) contributions and filings for June 2024. This is vital for employee welfare and avoiding legal hassles.

18th July

CMP-08:

Composition taxpayers must file CMP-08 for the quarter April to June 2024. This filing is essential for reporting your self-assessed tax under the composition scheme.

20th July

GSTR-3B (Monthly):

Monthly filers must submit GSTR-3B for June 2024. This summary return is crucial for reporting sales and input tax credit, keeping your GST compliance in check.

22nd July

GSTR-3B (QRMP for South India):

Quarterly filers in South India must submit GSTR-3B for the quarter April to June 2024. Ensure timely filing to avoid penalties and interest.

24th July

GSTR-3B (QRMP for North India):

Quarterly filers in North India must submit GSTR-3B for the quarter April to June 2024. Staying prompt with these filings helps in smooth quarterly compliance.

30th July

TCS Certificates (Form 27D):

Issue TCS certificates for the quarter April to June 2024. Providing these certificates on time is crucial for transparency and compliance.

TDS Payment:

Pay TDS for property transactions (Forms 26QB, 26QC, 26QD, 26QE) for June 2024. Ensure timely payments to avoid penalties and maintain smooth operations.

31st July

ITR for Non-Audit Individuals and Entities:

File your Income Tax Return for non-audit individuals and entities for the financial year 2023-24. This is essential for staying tax compliant and avoiding last-minute rushes.

TDS Return (Forms 24Q, 26Q, 27Q):

File TDS returns for various categories for the quarter ending June 2024. Timely filings ensure smooth tax operations and compliance.

Importance of Compliance

Adhering to these compliance deadlines is mandatory to avoid late fees and penalties. Failing to meet these deadlines can result in hefty fines, interest charges, and potential legal issues, which can disrupt your business operations and financial stability. By staying informed and proactive, you can ensure a hassle-free compliance process and maintain good standing with regulatory authorities.

Stay Compliant, Stay Ahead!

By staying ahead of your compliance requirements, you not only avoid penalties but also ensure the smooth running of your business. Keep this guide handy and make sure to meet all the deadlines for a hassle-free July 2024.

LinkedIn Link : RMPS Profile

This article is only a knowledge-sharing initiative and is based on the Relevant Provisions as applicable and as per the information existing at the time of the preparation. In no event, RMPS & Co. or the Author or any other persons be liable for any direct and indirect result from this Article or any inadvertent omission of the provisions, update, etc if any.

Published on: July 2, 2024