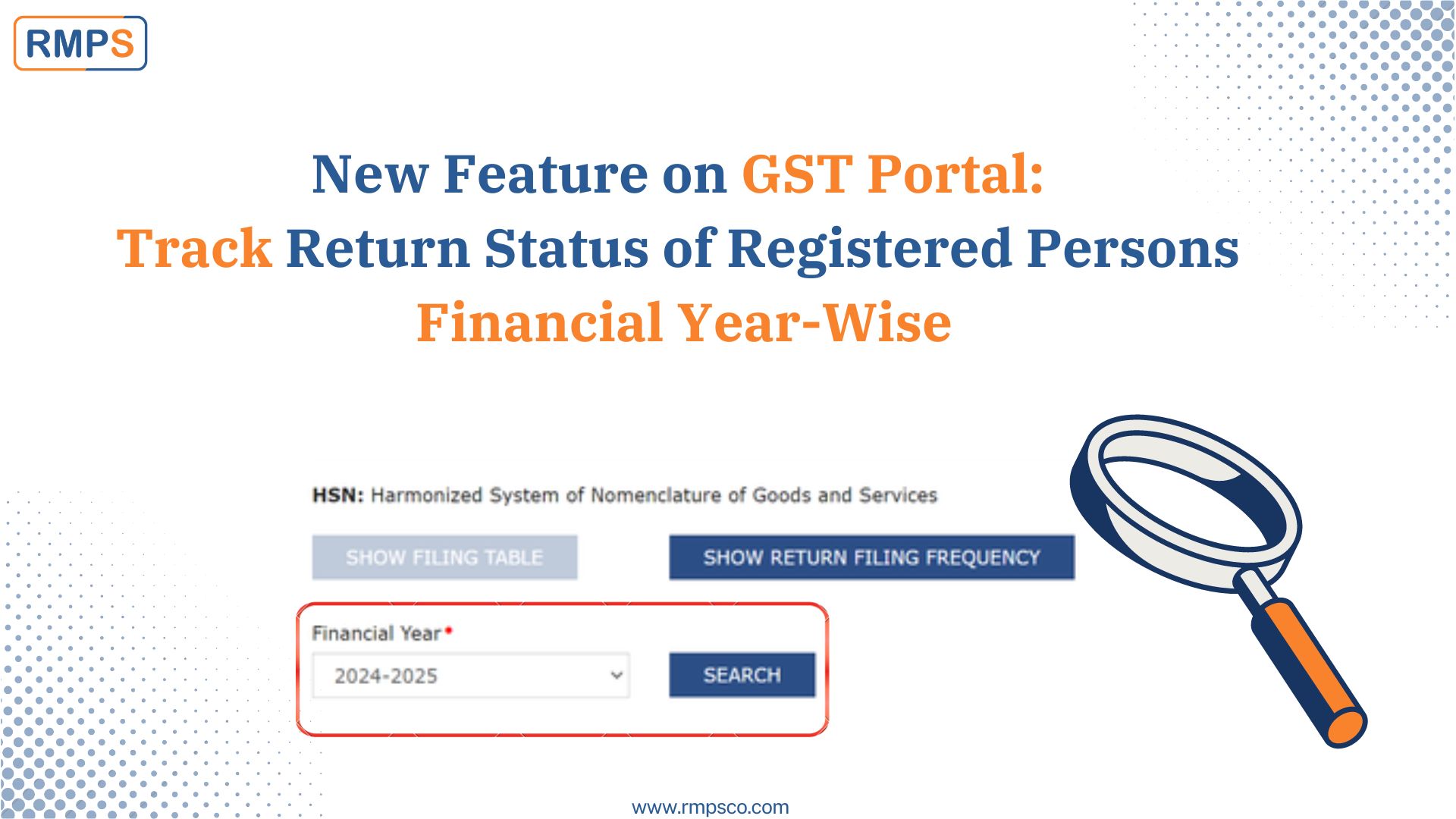

New functionality on the GST portal that will significantly ease the process of tracking the return status of registered taxpayers. This new feature allows you to see the status of GST taxpayers on a yearly basis through the “Search Taxpayer” tab.

Key Benefits

Yearly Overview

Gain a comprehensive view of the return status for each financial year, making it easier to monitor compliance over time.

Enhanced Vendor Management

Quickly check if your vendors are filing all their returns timely. This is particularly useful for businesses that rely on multiple suppliers and need to ensure GST compliance.

Streamlined Processes

Simplify your compliance tracking processes by accessing return statuses in one place, reducing the need for multiple follow-ups and checks.

How to Use the New Feature

- Login to the GST Portal: Access the portal using your credentials.

- Navigate to the ‘Search Taxpayer’ Tab: Click on this tab to begin your search.

- Select the Financial Year: Choose the financial year for which you want to view the return status.

- View the Status: The portal will display the return status of the taxpayer for the selected year.

Why This Matters

Keeping track of your vendors’ GST return status is crucial for ensuring your business remains compliant and avoids any potential legal issues. This new feature provides a straightforward way to verify that all your vendors are fulfilling their GST obligations on time, which can also help in maintaining good business relationships.

With this enhancement, the GST portal continues to improve its user-friendliness and functionality, supporting businesses in their compliance efforts. Make sure to take advantage of this new feature to streamline your GST return tracking processes.

Stay compliant and keep your business running smoothly with the latest updates from the GST portal!

LinkedIn Link : RMPS Profile

This article is only a knowledge-sharing initiative and is based on the Relevant Provisions as applicable and as per the information existing at the time of the preparation. In no event, RMPS & Co. or the Author or any other persons be liable for any direct and indirect result from this Article or any inadvertent omission of the provisions, update, etc if any.

Published on: July 4, 2024