Introduction

The Government of India has issued Circular No. 228/22/2024-GST And Notification No. 04/ 2024 – Central Tax (Rate). It’s providing clarifications on Recent Amendments in GST on Railway, Accommodation’s and Certain Services.

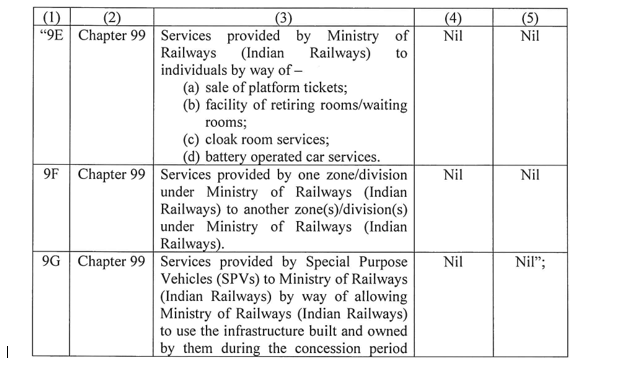

1. GST Exemption on the Outward Supplies Made by Ministry of Railways (Indian Railways)

Based on the recommendations of the 52nd and 53rd GST Council meetings, several changes have been made regarding the GST on Railway supplies made by the Ministry of Railways:

- Forward Charge Mechanism: Initially, the Ministry of Railways brought all supplies under the Forward Charge Mechanism, withdrawing previous exemptions.

- Implementation Issues: The Ministry faced difficulties, prompting further examination by the GST Council.

- Exemptions Recommended: The GST Council recommended exempting services such as platform tickets, retiring rooms, cloakroom services, and battery-operated car services provided by Indian Railways.

- Regularization of GST Liability: The authorities have regularized GST liability for the period between 20.10.2023 and 14.07.2024 on an ‘as is where is’ basis.

2. GST Exemption on Transactions Between SPVs and Ministry of Railways

The GST Council recommended exemptions for services provided by Special Purpose Vehicles (SPVs) to the Ministry of Railways. These services are exempt for the period from 01.07.2017 to 14.07.2024, regularized on an ‘as is where is’ basis.

3. Applicability of GST on Statutory Collections by RERA

The circular clarifies that statutory collections made by the Real Estate Regulatory Authority (RERA) fall under the GST exemption category, as specified in Notification No. 12/2017-CT(R) dated 28.06.2017.

4. GST on Digital Payment Ecosystem Incentives

The GST Council clarified the GST applicability on incentives shared among acquiring banks and other stakeholders under the notified Incentive Scheme for promoting RuPay Debit Cards and BHIM-UPI transactions. These incentives are considered subsidies and are not taxable.

5. GST Liability on Reinsurance of Specified General and Life Insurance Schemes

The GST liability on reinsurance services for specified general and life insurance schemes, exempt from 01.07.2017 to 24.01.2018, has been regularized on an ‘as is where is’ basis.

6. GST on Reinsurance of Insurance Schemes by the Government

Services provided to the government under insurance schemes with total premium paid by the government are exempt from GST, effective from 27.07.2018.

7. GST on Retrocession Services

The term ‘reinsurance’ includes ‘retrocession’ services, which are also exempt from GST as clarified by the GST Council.

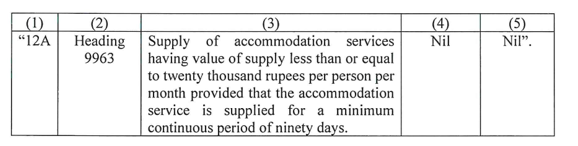

8. GST Liability on Certain Accommodation Services

Services related to hostel accommodation, service apartments, and hotels for longer periods are exempt from GST if the value is less than or equal to twenty thousand rupees per person per month for a continuous period of ninety days.

Conclusion

These clarifications aim to streamline GST applicability and ensure compliance across various sectors. Businesses should carefully review these updates to align their practices with the latest GST regulations.

For More Details Please Refer Official Links :

228/22/2024-GST-Clarifications

04/2024-Notification – Central Tax (Rate)

LinkedIn Link : RMPS Profile

This article is only a knowledge-sharing initiative and is based on the Relevant Provisions as applicable and as per the information existing at the time of the preparation. In no event, RMPS & Co. or the Author or any other persons be liable for any direct and indirect result from this Article or any inadvertent omission of the provisions, update, etc if any.

Published on: July 16, 2024