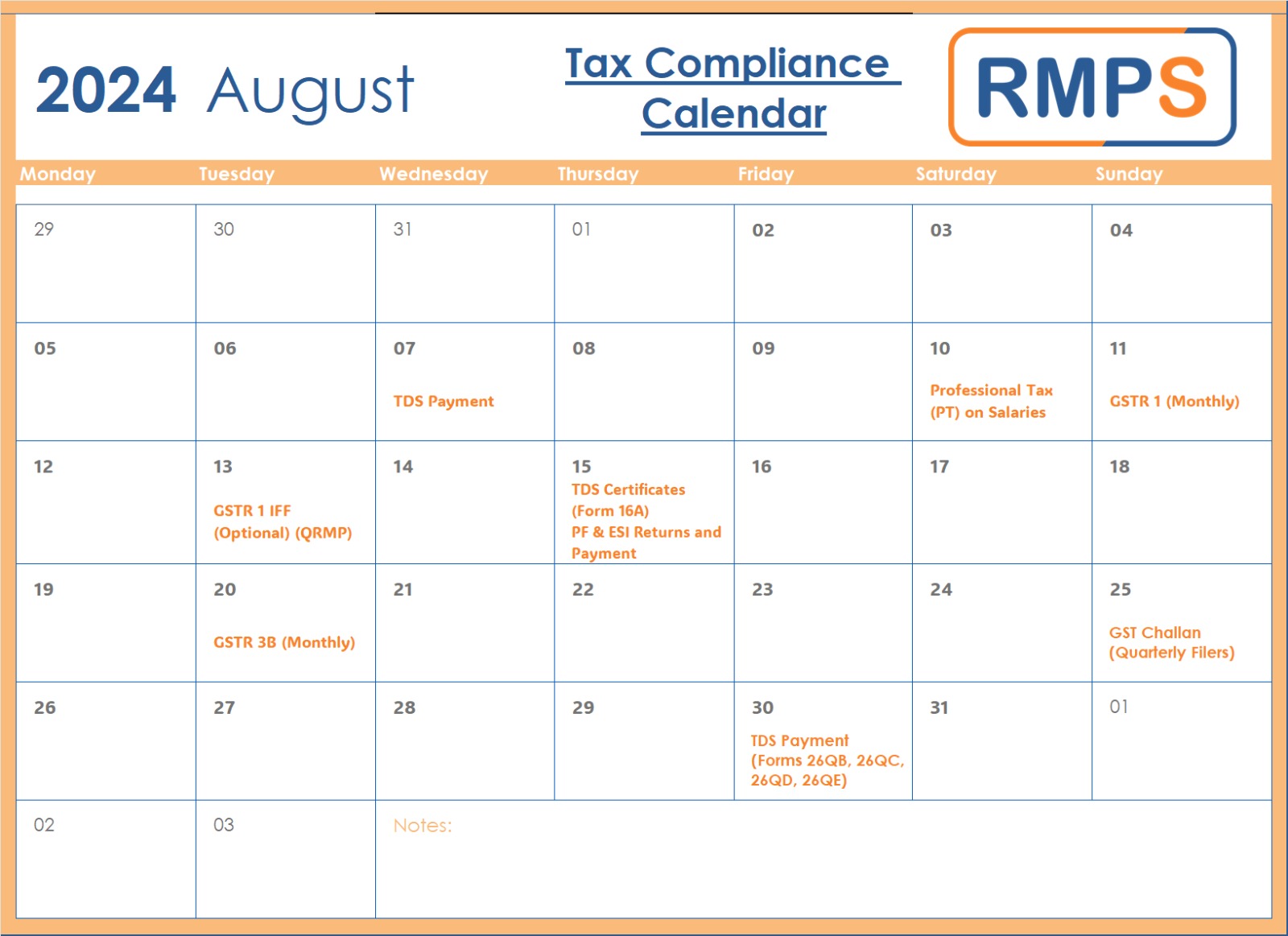

As a business owner or financial professional, staying on top of compliance deadlines is crucial to avoid penalties and ensure smooth operations. Here’s a guide to the essential tax and regulatory deadlines for August 2024.

07 August: TDS Payment for July 2024

Ensure you complete your Tax Deducted at Source (TDS) payments for July by this date to avoid interest and late fees.

10 August: Professional Tax on Salaries for July 2024

Don’t forget to pay your Professional Tax (PT) on salaries for July by this date. Remember, the due date can vary by state, so check your local deadlines.

11 August: GSTR 1 (Monthly) for July 2024

File your GSTR 1 return for July if you are a monthly filer. This return details all outward supplies made during the month.

13 August: GSTR 1 IFF (Optional) for QRMP (July 2024)

If you are a Quarterly Return Monthly Payment (QRMP) scheme participant, the Invoice Furnishing Facility (IFF) for July is optional but recommended for efficient reconciliation.

15 August: TDS Certificates and Provident Fund & ESI Returns

- Issue TDS certificates in Form 16A for the quarter April to June 2024.

- File your Provident Fund (PF) and Employee State Insurance (ESI) returns and make payments for July 2024.

20 August: GSTR 3B for July 2024 (Monthly Filers)

Monthly filers need to submit their GSTR 3B return for July. This summary return includes details of all inward and outward supplies.

25 August: GST Challan Payment for July 2024 (Quarterly Filers)

Quarterly filers under the GST regime should pay their GST challan if there is insufficient Input Tax Credit (ITC) for July.

30 August: TDS Payments in Forms 26QB, 26QC, 26QD, 26QE for July 2024

Ensure TDS payments for:

- Form 26QB (Property transactions)

- Form 26QC (Rent)

- Form 26QD (Contractor payments)

- Form 26QE (Crypto assets)

Conclusion:

Staying organized and proactive with compliance deadlines is essential for every business owner and financial professional. By adhering to these critical dates, you can avoid penalties and ensure the smooth operation of your business. Consider setting reminders or seeking professional assistance to manage these obligations effectively. Compliance isn’t just about avoiding fines; it’s about fostering a responsible and trustworthy business environment.

LinkedIn Link : RMPS Profile

This article is only a knowledge-sharing initiative and is based on the Relevant Provisions as applicable and as per the information existing at the time of the preparation. In no event, RMPS & Co. or the Author or any other persons be liable for any direct and indirect result from this Article or any inadvertent omission of the provisions, update, etc if any.

Published on: August 6, 2024