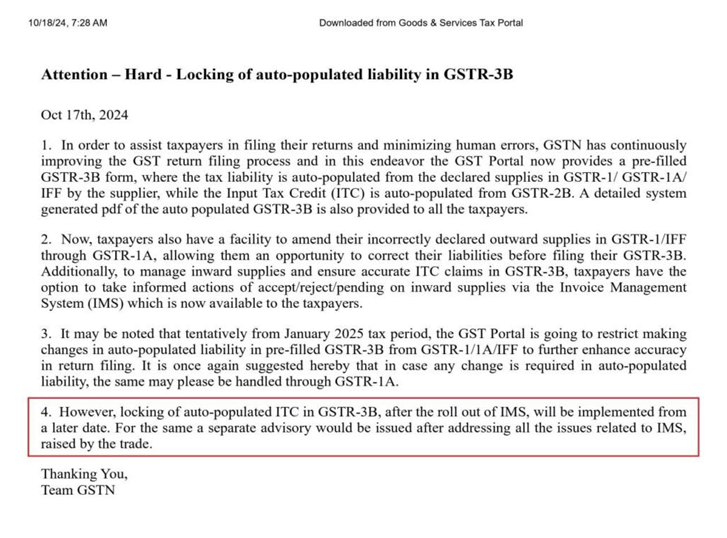

The Goods and Services Tax Network (GSTN) issued an advisory on October 17, 2024, regarding the hard locking of auto-populated values in GSTR-3B. This new step aims to reduce human errors and improve accuracy in GST return filings.

What is Form GSTR-3B?

Form GSTR-3B is a simplified summary return. Taxpayers use this form to report their GST liabilities for a specific tax period and pay those liabilities. Every taxpayer must file GSTR-3B for each tax period.

Filing Deadlines for GSTR-3B

- Monthly filers: You must file by the 20th of the month after the tax period.

- Quarterly filers: Filing is due on the 22nd or 24th of the month after the quarter, depending on the state or union territory.

However, the government can extend the deadlines if needed.

Key Updates

- Pre-filled GSTR-3B Forms: The GST Portal now provides pre-filled GSTR-3B forms to simplify the filing process. Tax liabilities are auto-filled based on GSTR-1, GSTR-1A, or the Invoice Furnishing Facility. Input Tax Credit (ITC) comes from GSTR-2B. A PDF of the form is available for review before submission.

- Amendments to Outward Supplies: Taxpayers can correct mistakes in their outward supplies using GSTR-1A before submitting GSTR-3B. This ensures that the tax liabilities are accurate.

- Restrictions on Changes (Effective January 2025): Starting in January 2025, changes to the auto-populated values in GSTR-3B will not be allowed. Values from GSTR-1, GSTR-1A, the Invoice Furnishing Facility, or GSTR-2B cannot be directly changed in GSTR-3B. You must handle adjustments through GSTR-1A or the Invoice Management System (IMS).

- Invoice Management System (IMS): Taxpayers can use the IMS to manage inward supplies and ensure accurate ITC claims. They can either accept, reject, or mark invoices as pending.

- Timeline for Changes: The restriction on changing GSTR-3B auto-populated values starts in January 2025. Taxpayers should review their values and make necessary adjustments before filing.

GST liability adjustments must be made through GSTR-1A, while ITC changes will be managed through the IMS dashboard.

Impact and Benefits of Hard Locking GSTR-3B Auto-Populated Values

- Fewer Errors: The automation in GSTR-3B aims to reduce human errors and ensure accurate tax liability and ITC claims.

- Improved Filing Process: Hard locking makes the filing process more reliable, preventing mismatches between returns, supplies, and ITC claims.

Taxpayers should use the amendment features and become familiar with IMS to manage inward and outward supplies more efficiently.

Conclusion

The hard-locking feature locks the auto-populated tax liability from GSTR-1 into GSTR-3B. This prevents discrepancies and manual changes, ensuring that the tax declared in GSTR-1 matches GSTR-3B. Although this improves accuracy, taxpayers may face challenges when making corrections. Thus, this system strikes a balance between accuracy and flexibility to handle genuine discrepancies.

LinkedIn Link : RMPS Profile

This article is only a knowledge-sharing initiative and is based on the Relevant Provisions as applicable and as per the information existing at the time of the preparation. In no event, RMPS & Co. or the Author or any other persons be liable for any direct and indirect result from this Article or any inadvertent omission of the provisions, update, etc if any.

Published on: October 24, 2024