The Economic Survey 2024-25 outlines India’s economic prospects, highlighting the importance of deregulation, economic freedom, and structural reforms to sustain high growth rates over the next decade. With geo-economic fragmentation reshaping global trade and investment flows, India must reduce regulatory burdens to drive domestic growth.

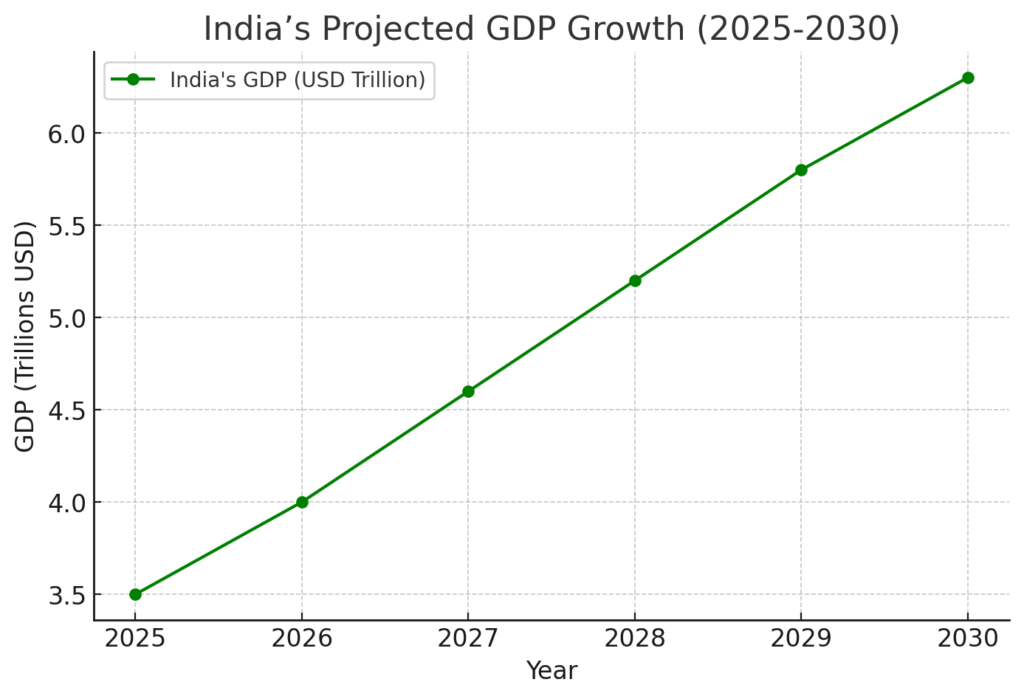

This blog explores India’s growth trajectory, policy actions, and key economic levers necessary to achieve its long-term vision of becoming a USD 6.3 trillion economy by 2030 and a developed nation (Viksit Bharat) by 2047.

1. India’s Growth Projections and Economic Potential

- IMF Projections (2025-30): India’s GDP is expected to grow at 10.2% annually in USD terms, reaching USD 6.3 trillion by 2030.

- Growth Target: To achieve the Viksit Bharat goal, India must sustain an 8% growth rate for the next two decades.

- Investment Requirements: The investment rate must rise to 35% of GDP, up from 31% currently, with a focus on manufacturing, technology, and infrastructure.

Key Takeaways:

- India is poised for strong economic expansion, but sustained growth requires structural reforms.

- Policy efforts must focus on investment-friendly regulations and a competitive business environment.

2. Global Trade and Investment: The Changing Landscape

Geo-Economic Fragmentation and Its Impact

- Trade Growth Slowdown: Global trade grew from 39% of world GDP (1980) to 60% (2012), but new trade restrictions are reversing integration.

- Foreign Direct Investment (FDI) Relocation: Investments are shifting towards geopolitically aligned countries, affecting emerging markets.

- Protectionism & Friend-Shoring: More than 24,000 new trade and investment restrictions were introduced globally between 2020-2024.

Key Takeaways:

- India must strengthen trade partnerships and diversify export markets to mitigate risks.

- Reducing regulatory complexity will enhance India’s appeal as an investment destination.

3. The Role of China in Global Supply Chains

- Manufacturing Dominance: China’s share of global industrial production is projected to reach 45% by 2030.

- Energy Transition Dependence: China controls 80% of the world’s solar panel production and 60% of global wind energy components.

- Rare Earth Minerals: China processes 70% of global rare earth minerals, critical for EVs, batteries, and renewable energy technologies.

Key Takeaways:

- India must build domestic manufacturing capacity in critical industries like EVs, renewable energy, and semiconductors.

- Reducing import dependence on China will improve supply chain resilience.

4. Domestic Growth Levers: The Case for Deregulation

Challenges of Over-Regulation in India

- High Compliance Costs: Small businesses face significant bureaucratic hurdles, discouraging formalization and expansion.

- Labour Market Restrictions: Rigid labour laws limit job creation and workforce flexibility.

- Complex Taxation & Licensing: Multiple permits and compliance requirements slow down new business formation.

Key Takeaways:

- Simplifying business regulations will encourage MSME growth and increase job creation.

- Labour law flexibility and tax simplifications will enhance India’s ease of doing business.

5. Reforms for Economic Freedom and Business Growth

Strategic Deregulation Measures

- Reduce Compliance Costs: Streamline tax structures and licensing requirements.

- Ease Labour Market Restrictions: Introduce flexible hiring policies to improve workforce efficiency.

- Strengthen Digital Infrastructure: Expand the India Stack model for seamless business operations.

- Improve Land and Building Regulations: Simplify land acquisition processes to accelerate industrial expansion.

- Encourage Foreign and Domestic Investments: Enhance ease of business registration and compliance.

6. Conclusion: The Path to Sustained Growth

India’s economic future depends on leveraging domestic growth drivers, deregulating key sectors, and building resilience against global disruptions. With the right policy mix, India can achieve its USD 6.3 trillion GDP goal by 2030 and position itself as a global economic powerhouse.

LinkedIn Link : RMPS Profile

This article is only a knowledge-sharing initiative and is based on the Relevant Provisions as applicable and as per the information existing at the time of the preparation. In no event, RMPS & Co. or the Author or any other persons be liable for any direct and indirect result from this Article or any inadvertent omission of the provisions, update, etc if any.

Published on: February 1, 2025