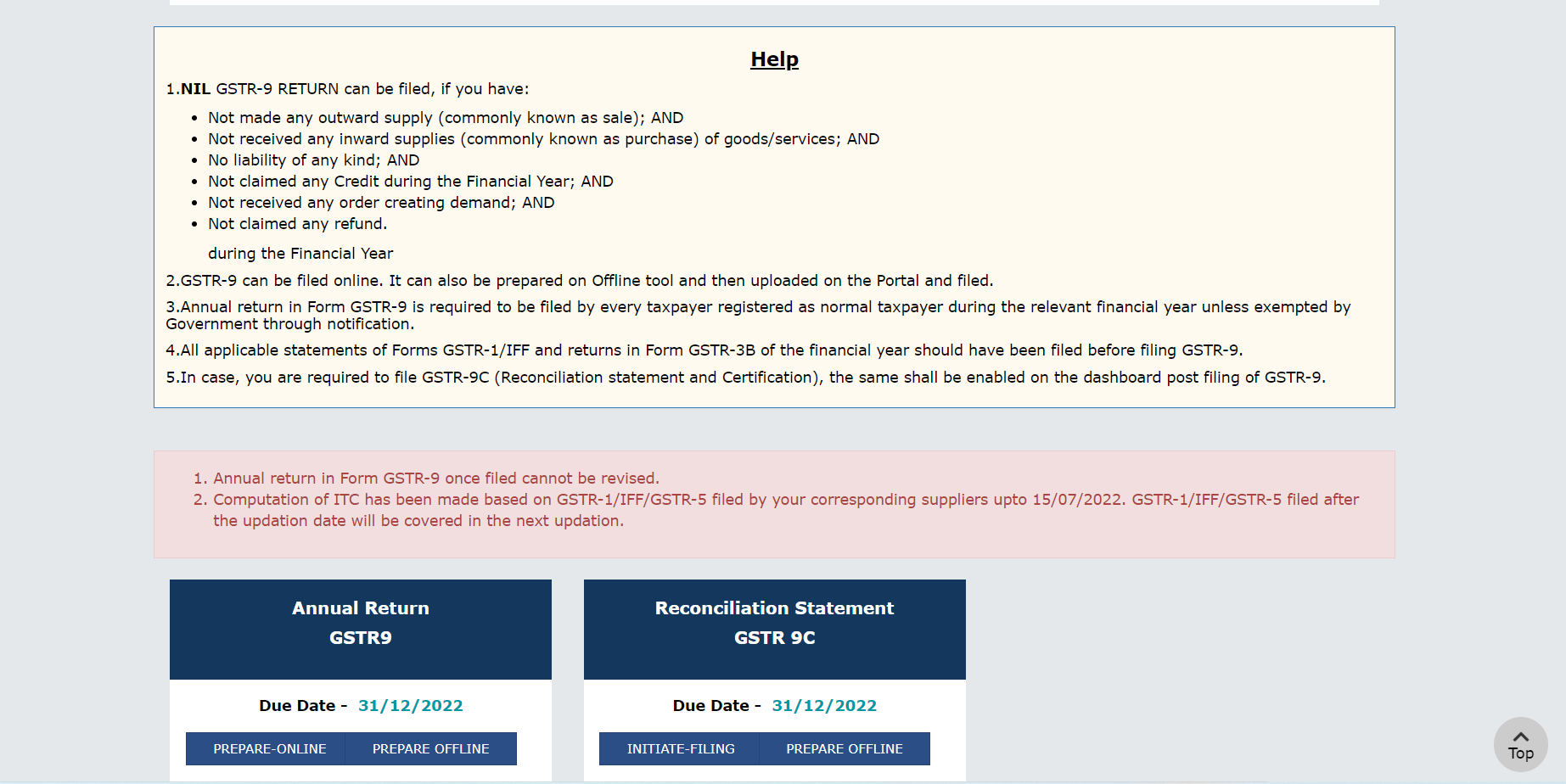

GSTR-9 [GST Annual Return]

It is mandatory for turnover exceeding 2 Crores and optional for taxpayers having annual aggregate turnover of up-to Rs. 2 crores.

GSTR-9C [GST Audit- Reconciliation Statement]

It is applicable to taxpayers having annual aggregate turnover of more than Rs.5 crore.

It is optional for taxpayers whose turnover is exceeding Rs.2 Crore but not exceeding Rs. 5 crores.

GSTR-9C is not applicable to those taxpayers whose turnover is up to 2crore.

| Sales | GSTR 9 | GSTR 9C |

| Up to 2 Cr | Optional | N/A |

| More than 2Cr. – 5 Cr | Filing is mandatory | Optional (Benefit Given) |

| More than 5Cr | Filing is mandatory | Filing is mandatory |

Due Date for FY 2021-22 for Annual Return GSTR 9/Reconciliation statement GSTR-9C is 31/12/2022.

Disclaimer: This article is only a knowledge-sharing initiative and is based on the Relevant Provisions as applicable and as per the information existing at the time of the preparation. In no event, RMPS & Co. or the Author or any other persons be liable for any direct and indirect result from this Article or any inadvertent omission of the provisions, update, etc if any.

Published on: August 24, 2022