Introduction

Goods and Services Tax (GST) is applicable in India from 1st July 2017. Under the new GST regime, nearly 1.4 crore businesses in India have obtained GST registration. All entities having GST registration are required to file GST returns every month. GST return filing is mandatory for all entities having GST registration, irrespective of business activity or sales or profitability during the return filing period. Hence, even a dormant business that obtained GST registration must file a GST return.

Businesses that are registered under GST must file the GST returns monthly, quarterly, and annually based on the business. Here it is necessary to provide the details of the sales or purchases of the goods and services along with the tax that is collected and paid. Implementation of a comprehensive Income Tax System like GST in India has ensured that taxpayer services such as registration, returns, and compliance are in range and perfectly aligned.

Monthly/ Quarterly GST Check Points

Invoice Verification:

- Ensure all GST invoices, both for purchases and sales, are correctly issued and received.

- Validate that the invoices contain the mandatory details such as GSTIN, invoice number, date, and customer/vendor details.

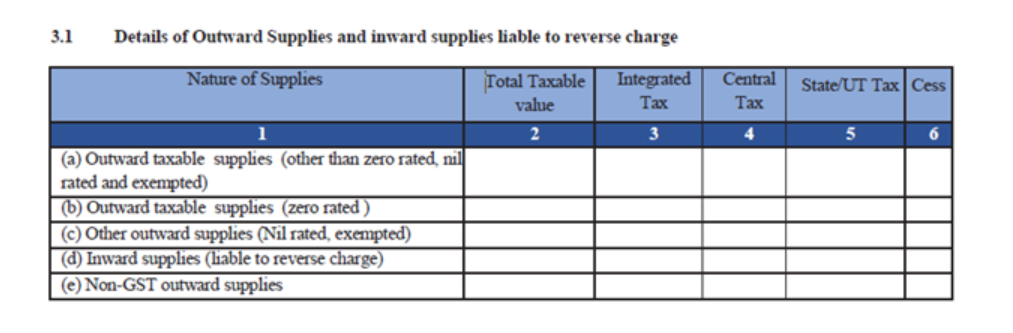

Sales Reconciliation:

- GSTR 3B Vs GSTR 1: Check the Differences in outward liability of GSTR3B and GSTR 1

- GSTR 3B VS BOOKS: Ensure that Total taxable supply as per GSTR 3B and Books is matching.

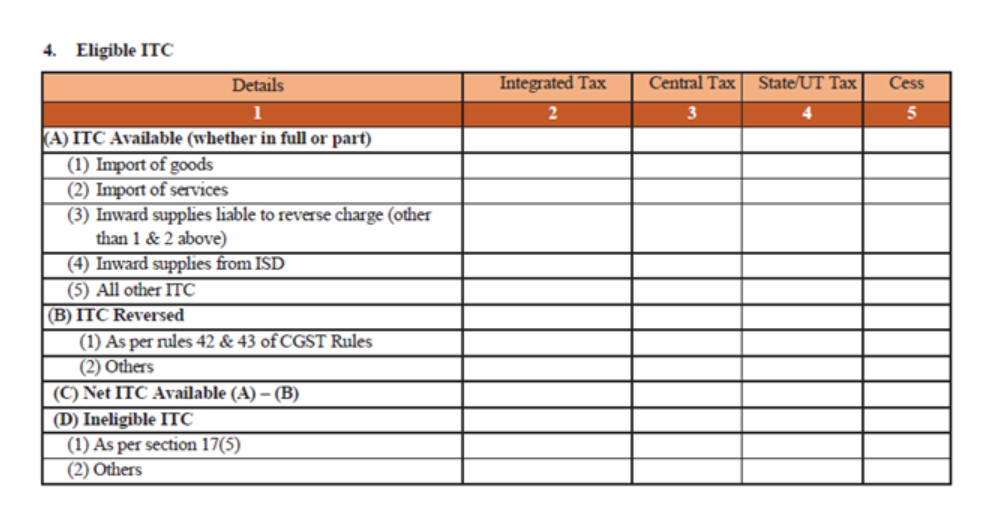

Input Tax Credit (ITC):

- Prepare ITC reconciliation of ITC availed in Books/GSTR 3B and GSTR 2B.

- Ensure that, ITC closing balance as per Electronic Credit Ledger and Books is matching.

- Check that ITC utilisation entries for whole FY 2022-23 is correctly passed in books.

- Ensure that all Import ITC is reflected in GSTR 2A/2B.

- Check whether any block ITC is availed.

- Annual effect of Reversal of Input Tax credit under Rule 42 of CGST Rules 2017, for Exempt Supply, No GST Supply etc.

- Check whether Payment to supplier has been made within 180 Days from the invoice date of supplier, if not then reverse ITC on the same in GSTR 3B of Mar-23.

- Reconcile RCM liability reported in books and paid in GSTR-3B.

- Reconcile RCM liability Reflected in GSTR2B and RCM liability paid in GSTR 3B.

- Check RCM ITC with respect to all eligible RCM liabilities is taken in GSTR 3B.

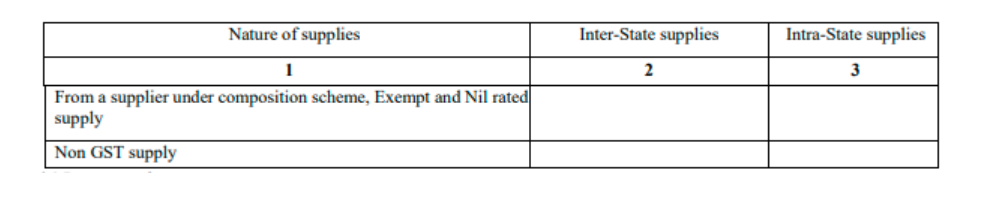

- you have to report any purchases made by you of goods or services, which are from a composition dealer, are exempt, nil rated or not covered by GST at all. This information must be broken down into inter-state and intra-state.

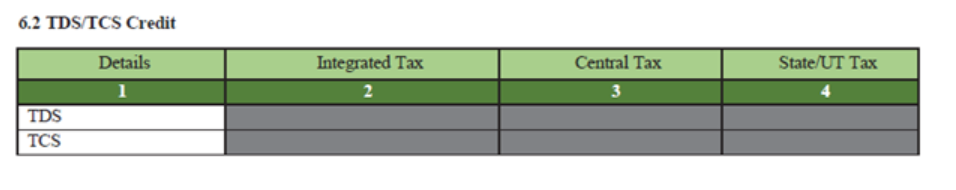

- The section requires taxpayers to report the value of TDS and TCS deducted or collected for the tax period.

- Generate e-way bills for interstate movement of goods as required.

- Confirm that the e-way bill details match the invoice details.

Payment of Taxes:

- Make GST payments by the due date to avoid interest and penalties.

- Use the appropriate challan to pay taxes.

Composition Scheme:

- If you are under the composition scheme, ensure you meet the necessary quarterly compliance requirements.

- File GSTR-4 and pay taxes accordingly.

OTHER CHECK POINTS

- Application for Letter of Undertaking (LUT) to be filed for FY 2023-24 on GST Portal.

- Kindly ensure to file refund claim within 2 years as specified in GST Law.

- Ensure that new invoice series has maximum 16 characters/numbers/alphabets/special character.

Conclusion

GST compliance is not just about meeting legal requirements; it’s about ensuring the financial health and reputation of your business. By diligently checking these mandatory points on a monthly and quarterly basis, you can avoid penalties, reduce tax liability, and enjoy the benefits of a hassle-free GST journey. Remember that staying compliant is an ongoing process, and staying informed about any changes in GST laws is equally important. Consider seeking professional guidance if you are unsure about any aspect of GST compliance to keep your business on the right track.

This Article is only a knowledge-sharing initiative and is based on the Relevant Provisions as applicable and as per the information existing at the time of the preparation. In no event RMPS & Co. or the Author or any other persons be liable for any direct and indirect result from this Article or any inadvertent omission of the provisions, update etc. if any

Published on: October 27, 2023