As the financial year 2024-25 unfolds, taxpayers find themselves grappling with various compliance requirements, including those related to the Goods and Services Tax (GST). Among the options available to taxpayers is the Composition Scheme, a simplified taxation scheme aimed at easing the compliance burden for small businesses. In this blog post, we will delve into the details of the Composition Scheme and guide taxpayers through the process of opting for it for the upcoming financial year.

Understanding the Composition Scheme:

The Composition Scheme under GST is designed for small businesses with an annual turnover below a specified threshold. Under this scheme, eligible taxpayers are subject to a lower rate of tax and are required to file simplified quarterly returns instead of the regular monthly returns.

Key features of the Composition Scheme include:

- Threshold Limit:

To be eligible for the Composition Scheme, businesses must have an annual turnover below the prescribed threshold, which varies from state to state.

- Lower Tax Rate:

Taxpayers opting for the Composition Scheme are subject to a lower rate of tax compared to regular taxpayers. This lower rate helps in reducing the tax liability for small businesses.

- Simplified Compliance:

Under the Composition Scheme, taxpayers need to file quarterly returns instead of monthly returns, thereby reducing the compliance burden.

Update by GSTN:

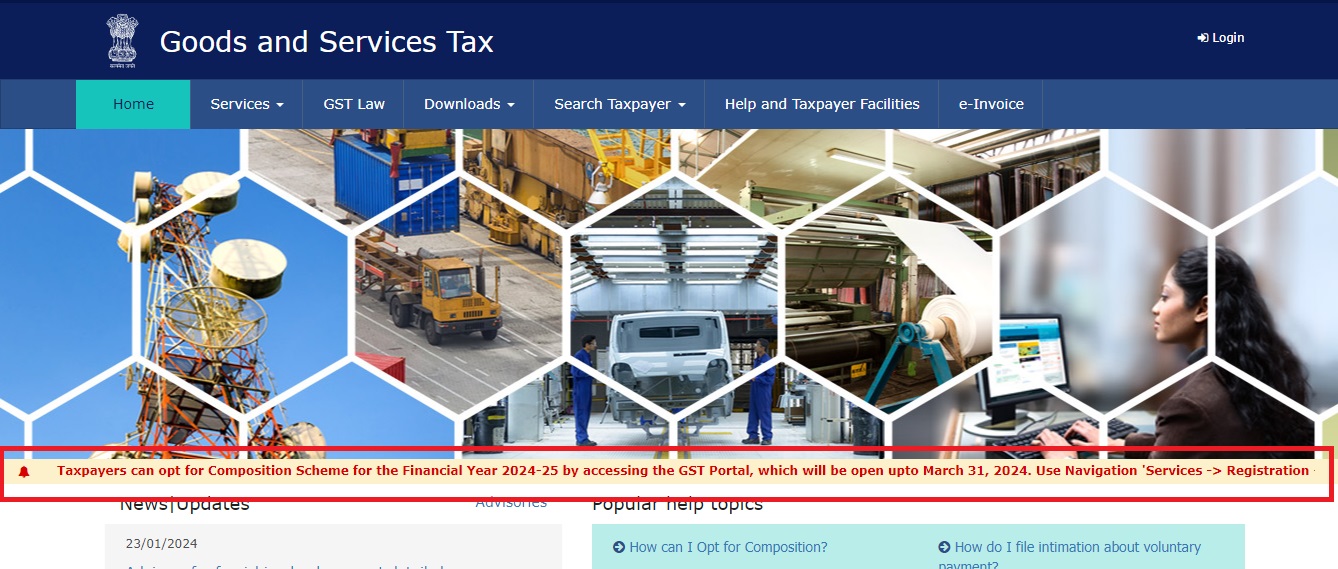

- The GSTN, which manages the technological infrastructure for GST implementation, has issued an update facilitating taxpayers to opt for the Composition Scheme for the FY 2024-25.

- This update underscores the GSTN’s commitment to enhancing taxpayer convenience and easing the compliance process.

Procedure to Opt for Composition Scheme:

- Taxpayers intending to avail themselves of the Composition Scheme need to access the GST Portal.

- They can navigate to ‘Services -> Registration -> Application to Opt for Composition Levy’.

- Once there, taxpayers are required to file Form CMP-02, providing necessary details and opting for the Composition Scheme.

Deadline and Availability:

- The GST Portal will remain open for taxpayers to opt for the Composition Scheme until March 31, 2024.

- It’s crucial for eligible businesses to take advantage of this opportunity within the stipulated timeline to benefit from the simplified tax regime for the upcoming financial year.

Conclusion

The Composition Scheme offers a simplified taxation alternative for small businesses, reducing the compliance burden and providing relief from the complexities of regular GST filings. By following the steps outlined in this guide, taxpayers can easily opt for the Composition Scheme for the financial year 2024-25 and avail its benefits. However, it’s essential to assess your eligibility and consider the implications before making the switch. Stay compliant, stay informed, and make the most suitable choice for your business’s tax obligations.

This article is only a knowledge-sharing initiative and is based on the Relevant Provisions as applicable and as per the information existing at the time of the preparation. In no event, RMPS & Co. or the Author or any other persons be liable for any direct and indirect result from this Article or any inadvertent omission of the provisions, update, etc if any

Published on: February 17, 2024