The Production Linked Incentive Scheme for White Goods (PLIWG) proposes a financial incentive to boost domestic manufacturing and attract large investments in the White Goods manufacturing value chain.

Quantum of Incentive: The PLI Scheme has an incentive of 4% to 6% on incremental sales (net of taxes) over the base year of goods manufactured in India and covered under target segments, to eligible companies, for a period of five (5) years after the base year and one year of gestation period.

Tenure of the scheme: The tenure of the scheme is from FY 2021-22 to FY 2028-29.

List of eligible targeted segments covering below products:

- Air conditioners:

- Air Conditioners (Components- High value Intermediates or Low Value Intermediates or sub-assemblies or a combination thereof)

- Large Investments

- Normal Investments

- High Value Intermediates (Copper Tubes, Aluminium Foil and Compressors)

- Large Investments

- Normal Investments

- Low Value Intermediates (PCB assembly for controllers, BLDC motors, Service Valves and Cross Flow fans for AC and other components)

- Large Investments

- Normal Investments

- LED Lights:

- LED Lighting Products (Core Components like LED Chip Packaging, Resisters, ICs, Fusesand large-scale investments in other components etc.)

- Large Investments

- Normal Investments

- Components of LED Lighting Products (like LED Chips, LED Drivers, LED Engines,Mechanicals, Packaging, Modules, Wire Wound Inductors and other components)

- Large Investments

- Normal Investments

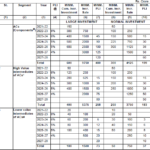

Eligibility threshold Criteria: Air Conditioners:

@ ACs Components: High Value Intermediates or Low Value intermediates or sub-assemblies or a

combination thereof.

*High value: Intermediates of ACs: Aluminium Foil, Cu tube, Compressor.

#Lower Value: Intermediates of ACs: PCB Assembly for Controllers, BLDC Motors, Service Valves for ACs, Cross Flow Fans and other components.

Column(4).: Actual disbursement of PLI for a respective year will be subsequent to that year. For example, subject to fulfilling the conditions of cumulative threshold incremental investment up to FY 2021-22 over base year and threshold incremental sales of manufactured goods over the base year in FY 2022-23, PLI will be disbursed in FY 2023-24.

Eligibility Threshold Criteria for LED Lights:

#LED Lights: (Core Components like LED Chip Packaging, Resisters, ICs, Fuses and large scale

investments in other components etc.)

*Components of LED Lights: LED Chips, LED Drivers, LED Engines, Mechanicals, Packaging, Modules,

Wire Wound Inductors and other components.

Column 4.: Actual disbursement of PLI for a respective year will be subsequent to that year. For example, subject to fulfilling the conditions of cumulative threshold incremental investment up to FY 2021-22 over base year and threshold incremental sales of manufactured goods over the base year in FY 2022-23, PLI will be disbursed in FY 2023-24.

Important Notes:

- The applicant will have to fulfil both criteria of cumulative incremental investment in plant and machinery as well as incremental sales over the base year in that respective year to be eligible for PLI. The first year of investment will be FY 2021-22 and the first year of incremental sale will be FY 2022-23. Actual disbursement of PLI for a respective year will be subsequent to that year.

- One entity may apply for one target segment only. However, separate Group companies may apply for different target segments. Further, sales by entities to their group companies should be at an arm’s length price as those to outside group companies.

- Any entity availing benefits under any other PLI Scheme of Govt. of India will not be eligible under this scheme for same products but the entity may take benefits under other applicable schemes of Govt. of India or schemes of State governments.

- The applicant shall, in its application, declare plan for domestic value addition, employment generation and exports during the tenure of the Scheme.

For queries, you can write us at rajnikant@rmpsco.com

Published on: May 4, 2021