The Path to Eternal Peace in Entrepreneurship

Bhagavad Gita: 2.51 Verse 2.51: कर्मजं बुद्धियुक्ता हि फलं त्यक्त्वा मनीषिण: | जन्मबन्धविनिर्मुक्ता: पदं गच्छन्त्यनामयम् || 51 || Translation: “Endowed with wisdom, renouncing the fruits of their actions, the wise are freed from the bonds of birth and attain a state beyond all suffering.” Key Insights for Entrepreneurs: In this verse, Lord Krishna explains that […]

Decoding Budget 2025 All-in-One Insights on GST Changes

The Union Budget 2025, presented on February 1, 2025, introduces significant GST amendments. These changes aim to streamline compliance, simplify tax procedures, and enhance trade efficiency. Below is a breakdown of the most critical updates. 1. Key Changes in GST Definitions a) Input Service Distributors (ISD) – ITC Distribution for RCM on Inter-State Supplies 📢 […]

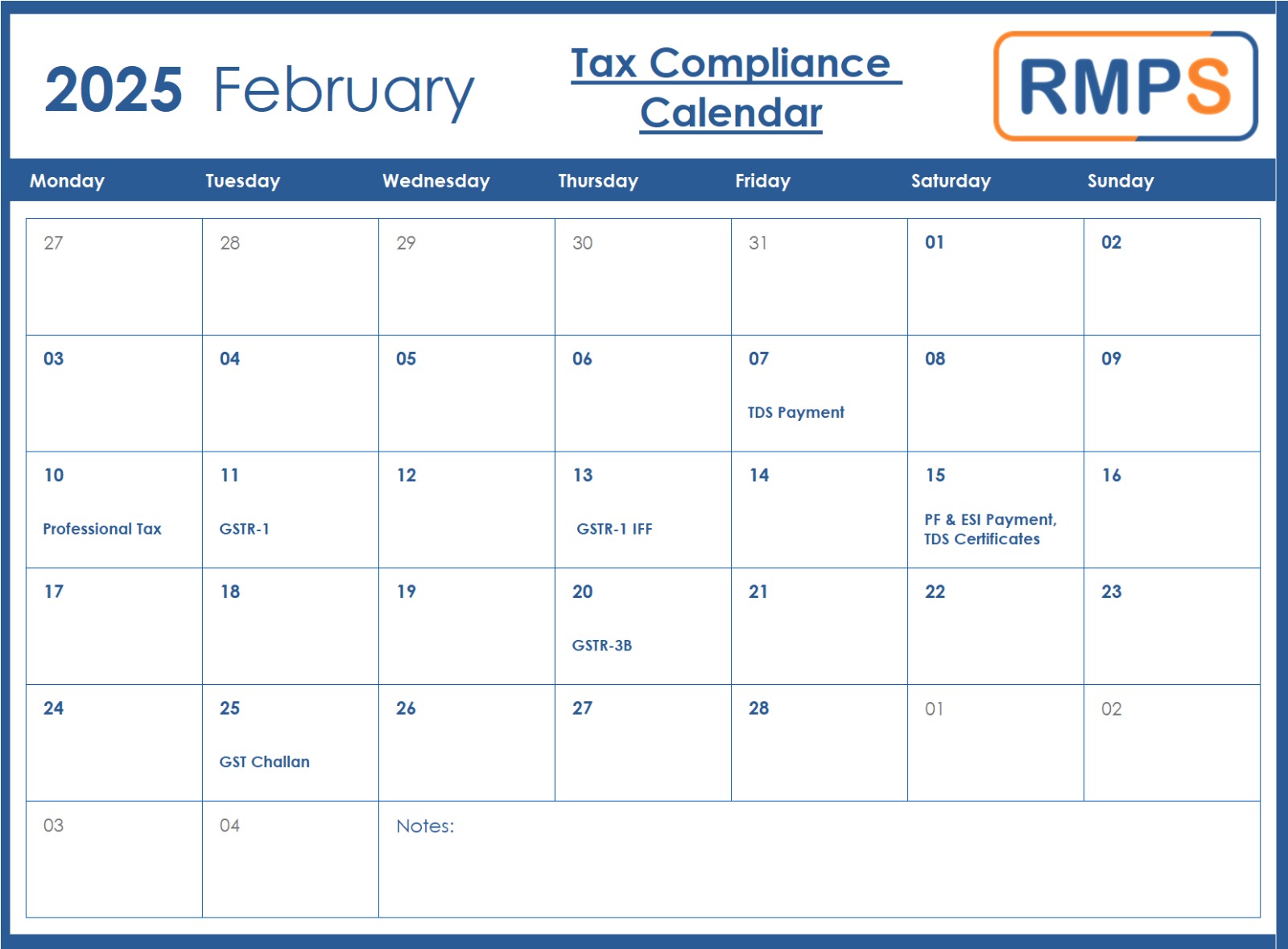

Key Tax Compliance Deadlines for February 2025: A Simple Guide

Tax compliance is essential for smooth business operations. Missing deadlines can lead to penalties, interest charges, and unnecessary hassles. By staying informed and planning ahead, businesses can avoid financial burdens and ensure compliance. Below are the critical tax deadlines for February 2025. Important Tax Deadlines – February 2025 7th February – TDS Payment for January […]

Viksit Bharat 2047: How Budget 2025-26 Aligns with India’s Growth Vision

Dear Readers, India’s economic landscape is at an inflection point, driven by strategic reforms, resilient growth, and an ambitious vision for “Viksit Bharat 2047.” As the nation moves toward becoming a developed economy by 2047, the Economic Survey 2024-25 and the Union Budget 2025-26 provide a roadmap for sustainable, inclusive, and innovation-led growth, catering to […]

TDS & TCS Rates for FY 2025-26 Key Budget Updates You Need to Know

1. Rationalization of TDS Rates and Thresholds (A) Reduction in TDS Rates for Section 194LBC (B) Increase in TDS Thresholds for Various Payments In addition to the changes to TDS/TCS rates, the budget proposals also aim to rationalize various TDS provisions by adjusting the thresholds beyond which tax must be deducted. Below is the detailed […]

AI and the Future of Work: Crisis or Catalyst?

Introduction The rapid advancement of Artificial Intelligence (AI) is reshaping the global labor market, presenting both opportunities and challenges. While AI-driven automation enhances productivity and efficiency, it also raises concerns over job displacement and inequality. The Economic Survey 2024-25 explores the potential impact of AI on India’s workforce and how policymakers, businesses, and institutions can […]

India’s Employment and Skill Development: A Roadmap for Future Growth

Introduction India stands at a critical juncture where employment generation and skill development are key to harnessing its demographic dividend. With over 26% of the population in the 10-24 age group, creating quality jobs and ensuring workforce readiness are essential for sustained economic growth. The Economic Survey 2024-25 highlights declining unemployment rates, rising self-employment, and […]

India’s Social Sector: Expanding Welfare and Driving Empowerment

India’s economic growth is increasingly centered on inclusive development, with a strong focus on education, healthcare, skill development, and social welfare. The Economic Survey 2024-25 highlights the government’s commitment to ensuring equitable access to social services while leveraging technology and innovation to improve welfare delivery. This blog provides insights into trends in social sector expenditure, […]

India’s Climate and Environmental Strategy: Adaptation, Energy Transition, and Sustainability Initiatives

India is steadily advancing toward a low-carbon future while balancing economic growth and sustainability. Despite low per capita carbon emissions compared to global averages, the country faces significant challenges in renewable energy adoption, climate adaptation, and international climate finance gaps. The Economic Survey 2024-25 underscores India’s commitment to climate resilience, energy security, and environmental sustainability. […]

The Best Blogs for Growing Your E-Commerce Exports!

Expanding your business globally? Staying updated with the latest trends, strategies, and regulations in e-commerce exports is crucial for success. To make things easier, we’ve compiled a list of the best blogs that cover everything from cross-border trade, international marketplaces, logistics, and compliance to digital marketing strategies for global sellers. Explore these blogs and take […]