Temporary Identification Number (TIN) and Recent GST Amendments

Managing taxes can feel complicated, especially for those who don’t have permanent tax registration. To help with this, the government has introduced a Temporary Identification Number (TIN). This number is for individuals or businesses that need to pay taxes temporarily without registering fully. Let’s break it down step by step so it’s easier to understand. […]

IPO Boom: Indian Startups Shine in 2024

The Indian startup ecosystem has seen a remarkable transformation in 2024, with IPOs becoming a dominant theme in the growth story. After a challenging period marked by a slowdown in funding, Indian startups are now flourishing, showcasing resilience and renewed investor confidence. This resurgence presents a compelling opportunity for businesses to consider going public and […]

Union Budget 2025 Expectations: A Comprehensive Analysis

As the 2025-26 financial year approaches, Finance Minister Nirmala Sitharaman faces the task of addressing pressing economic challenges while steering India toward sustainable growth. With multiple sectors sharing their expectations, this budget has the potential to reshape the country’s economic trajectory. Below is a sector-wise overview of the primary expectations from the Union Budget 2025. […]

From Product to Platform: Transitioning Your Business Model

In today’s rapidly evolving marketplace, businesses are no longer confined to traditional product or service-based models. The shift towards platform-based business models is transforming industries, offering new growth opportunities, and creating unprecedented value for customers and stakeholders alike. This blog explores what it takes to transition your business from a product-centric approach to a platform-driven […]

Key GST Compliance Activities for the Financial Year-End

As the financial year draws to a close, businesses must prioritize GST compliance to avoid potential issues and ensure smooth operations. This checklist provides actionable steps for seamless compliance. 1. Sales Reconciliation 2. Input Tax Credit (ITC) Reconciliation for FY 2024-25 3. Reverse Charge Mechanism (RCM) Compliance 4. Letter of Undertaking (LUT) Application 5. Refund […]

How Recent Amendment Impact Tax Rules for Sponsorship Services

The GST Council has introduced significant updates to the Reverse Charge Mechanism (RCM) under Notification No. 13/2017 (Central Tax – Rate), specifically Entry No. 4. These changes, effective from January 16, 2025, as per Notification No. 07/2025, aim to enhance tax compliance and clarify the responsibilities under RCM for sponsorship services. RCM (Reverse Charge Mechanism) […]

New GST Update: Redefinition of “Specified Premises” Effective April 2025

The Indian government has introduced a crucial update under GST with Notification No. 08/2025-Central Tax (Rate), redefining the concept of “Specified Premises.” This change, effective from April 1, 2025, aims to bring greater clarity and compliance to hotel accommodation services. What Are “Specified Premises”? As per the latest notification, premises offering hotel accommodation services with […]

What Are the Challenges of Business Valuation Beyond Financial Metrics?

Introduction In the realm of business valuation, investors and analysts often depend on various financial techniques, such as the Discounted Cash Flow (DCF) model and market comparable, to estimate a company’s worth. However, the process is rarely as straightforward as these structured approaches suggest. For instance, the DCF method relies on forecasting future cash flows […]

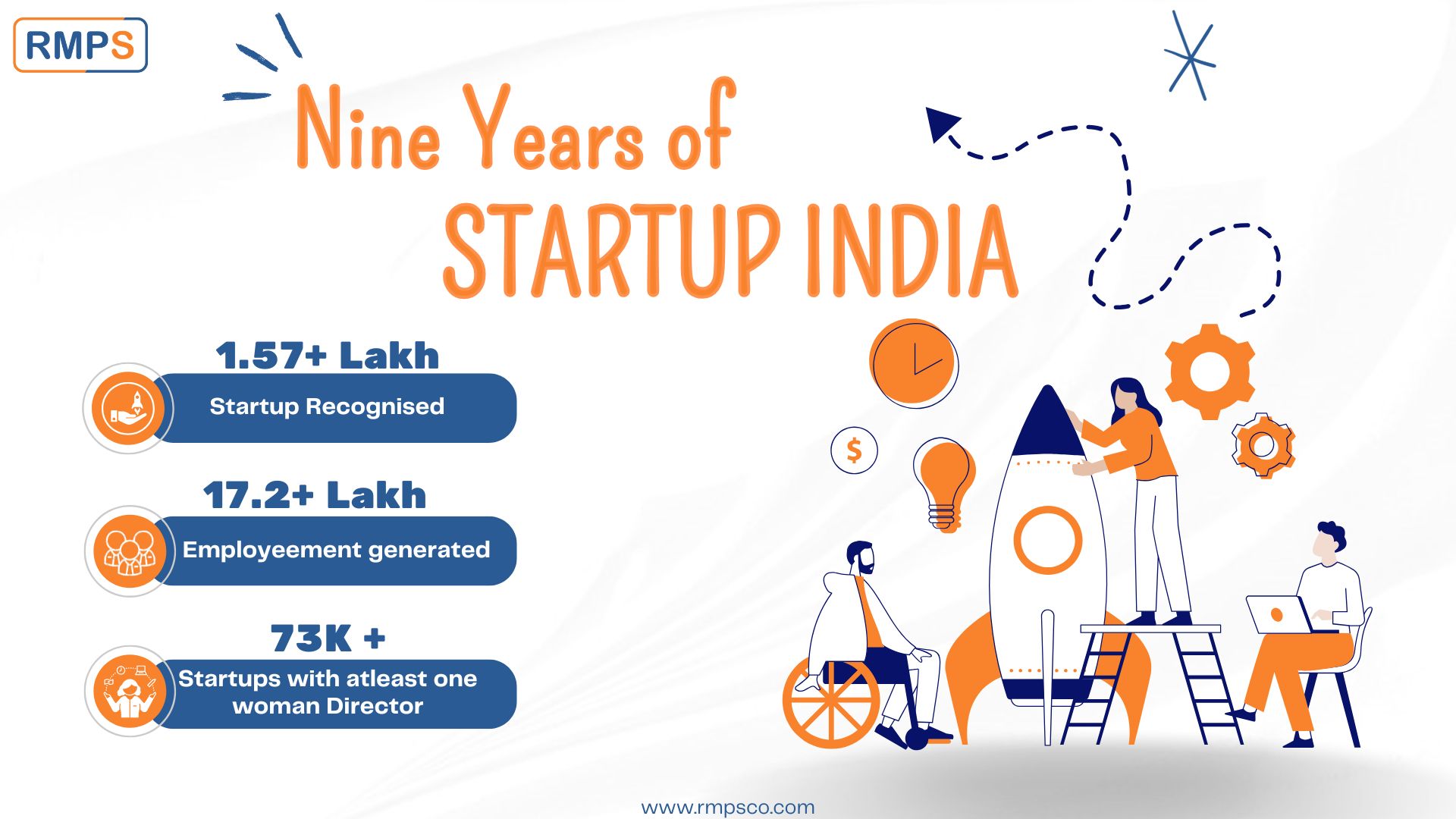

9 Years of Startup India: Transforming the Entrepreneurial Landscape!

In 2016, India’s startup ecosystem was at a nascent stage. With only a handful of startups and minimal representation on the global map. The idea of a thriving entrepreneurial culture seemed ambitious. Fast forward nine years, and the landscape has been completely transformed. Thanks to the vision and initiatives under the Startup India campaign. From […]

Advisory on Waiver Scheme under Section 128A: A Guide for Taxpayers

The Goods and Services Tax Network (GSTN) has recently issued an important advisory regarding the waiver scheme under Section 128A. To help taxpayers benefit from the scheme, this guide simplifies the advisory and provides actionable steps. Key Updates and Guidelines 1.Official NotificationThe advisory was released on December 29, 2024. Taxpayers can find the complete details […]