In the intricate landscape of Goods and Services Tax (GST) compliance, one key element often overlooked is the precise reporting of Harmonized System of Nomenclature (HSN) and Service Accounting Code (SAC) details in GSTR-1. Yet, these codes hold the key to seamless tax reporting and compliance for businesses under the GST regime.

Breaking the Silence: The Epidemic of Overlooked Codes

Despite their significance, a startling number of taxpayers tend to gloss over or inaccurately report their HSN and SAC codes, risking the integrity of the entire GST framework. But fear not, for a solution is on the horizon.

Enter Auto-Population: Revolutionizing Compliance Efforts

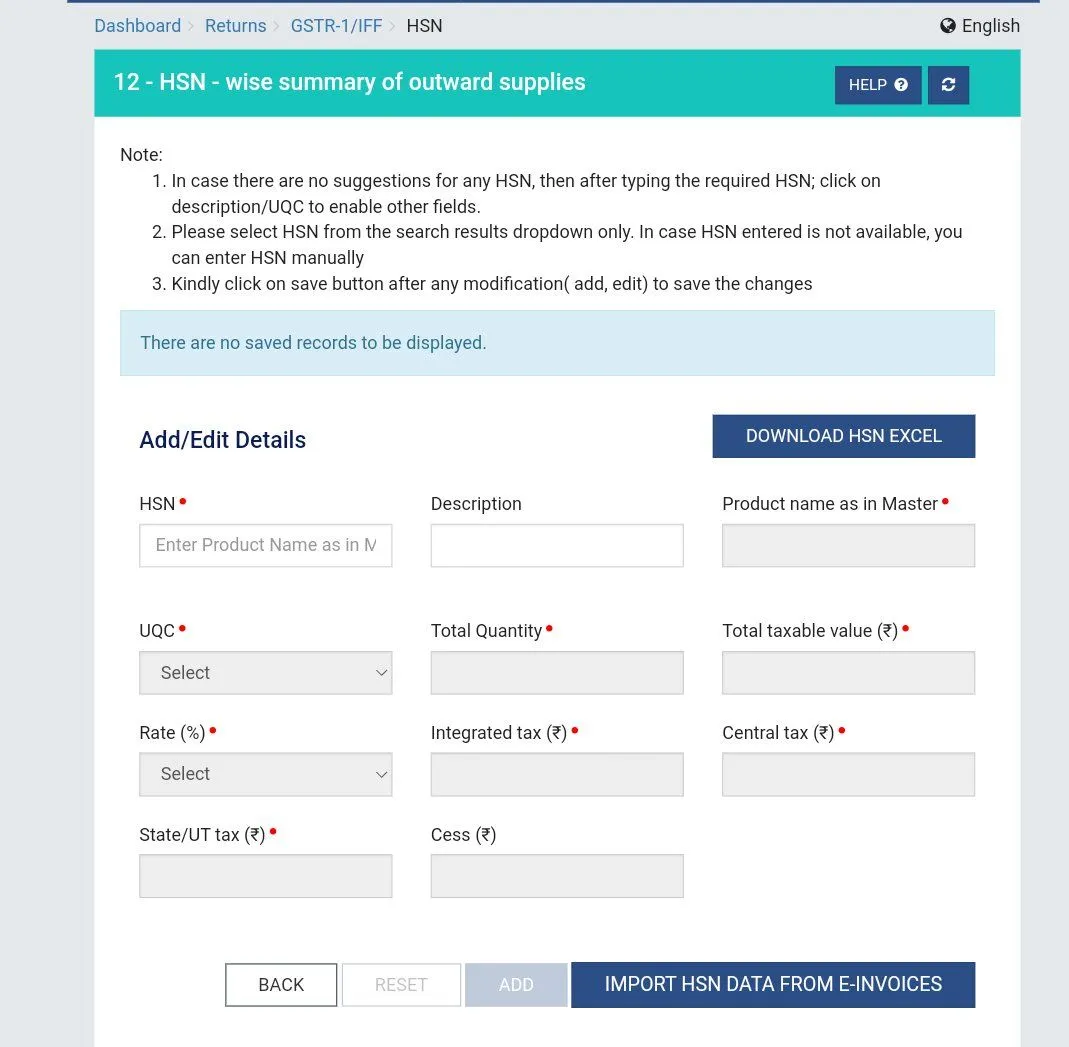

In a game-changing move, the latest enhancement in “Table 12 – HSN Wise Summary of Outward Supplies” in GSTR-1 introduces an ingenious feature: the ability to import HSN data from e-invoices. This promises to revolutionize the tax reporting landscape, saving time, minimizing errors, and ensuring compliance at every step.

Bridging the Gap: The Marriage of Automation and Diligence

While the auto-population feature is indeed a game-changer, it’s essential to remember that it’s not a silver bullet. Transactions not covered by e-invoices still require manual entry, and overlooking these could spell trouble. The mantra remains the same: diligence is key.

The Power of Double-Checking: Safeguarding Compliance in a Click-and-File World

So, before hitting that submit button, take a moment to review. Every entry deserves meticulous scrutiny to ensure compliance with GST regulations. Think of the auto-population feature as your trusty sidekick, not a substitute for thorough verification.

Beyond the Click: Navigating the Complexities of GST Compliance

In the world of GST compliance, there are no shortcuts. While automation has certainly eased the burden, it hasn’t eliminated the need for careful attention to detail. The journey to compliance is paved with thorough verification and unwavering diligence.

Conclusion: Unlocking the Code to Seamless GST Compliance

In essence, GST compliance is a journey, not a destination. The inclusion of HSN and SAC codes in GSTR-1 is just one part of the puzzle, albeit a crucial one. With the right tools and a commitment to diligence, businesses can navigate the complexities of GST compliance with confidence and ease.

This article is only a knowledge-sharing initiative and is based on the Relevant Provisions as applicable and as per the information existing at the time of the preparation. In no event, RMPS & Co. or the Author or any other persons be liable for any direct and indirect result from this Article or any inadvertent omission of the provisions, update, etc if any.

Published on: April 8, 2024