Simplifying GST Registration in India: CBIC’s Latest Instructions for 2025

Introduction Getting a GST registration in India has often been seen as a slow and confusing process. Many businesses have struggled with unclear documentation, multiple follow-ups, and unnecessary delays. Thankfully, there’s good news for entrepreneurs and professionals alike. In April 2025, the Central Board of Indirect Taxes & Customs (CBIC) released Instruction No. 03/2025-GST. These […]

Nil Rated, Exempted, Non-GST & Schedule III Items: A Practical Comparison for Businesses

Introduction: Understanding the different categories of supplies under GST, such as Nil Rated, Exempted, Non-GST Supplies, can be tricky, but it’s essential for businesses to get it right. Mistakes in classifying these supplies can lead to tax issues, missed opportunities to claim tax credits, and even fines. Whether you run a business or are involved […]

The Focused Founder: Mastering the Senses for Strategic Success

Bhagavad Gita: 2.68 Sanskrit Verse: तस्माद्यस्य महाबाहो निगृहीतानि सर्वशः | इन्द्रियाणीन्द्रियार्थेभ्यस्तस्य प्रज्ञा प्रतिष्ठिता || 68 || Translation: “Therefore, O mighty-armed Arjuna, the one whose senses are completely restrained from their objects—his wisdom is firmly established.” Understanding the Verse This verse from the Bhagavad Gita delivers a timeless message: Self-mastery is the foundation of sound judgment. […]

GST Waiver Applications: Common Challenges and Solutions

Filing waiver applications (SPL 01/SPL 02) under the GST waiver scheme has presented several challenges for taxpayers. The Goods and Services Tax Network (GSTN) has acknowledged these issues and is working towards resolving them. Meanwhile, understanding the problems and available solutions can help taxpayers navigate the process smoothly. Challenges Faced While Filing GST Waiver Applications […]

The Path to a Fulfilling Entrepreneurial Journey: 2.66

नास्ति बुद्धिरयुक्तस्य न चायुक्तस्य भावना | न चाभावयतः शान्तिरशान्तस्य कुतः सुखम् || Translation: “For one who lacks self-discipline, there is no intelligence; nor is there a steady mind without discipline. Without a steady mind, there is no peace, and without peace, how can there be happiness in Entrepreneurial Journey?” The Entrepreneur’s Dilemma: The Role of […]

Mastering Discipline in Entrepreneurship: Bhagavad Gita: 2.61

Sanskrit Verse: तानि सर्वाणि संयम्य युक्त आसीत मत्पर: | वशे हि यस्येन्द्रियाणि तस्य प्रज्ञा प्रतिष्ठिता || Translation: “One who controls the senses and remains focused on a higher goal, with complete dedication, is firmly established in wisdom.” Understanding the Verse In this verse, Krishna advises that true wisdom comes from self-discipline and higher focus. Success […]

Small Business? Simplify GST with Composition Levy – Deadline March 31

The Goods and Services Tax (GST) framework provides a Composition Levy scheme for eligible taxpayers seeking a simplified tax compliance process. This guide outlines the key details, eligibility, and process for opting for Composition Levy under GST for the financial year 2025-26. What is the Composition Levy under GST? The Composition Levy is a simplified […]

Can a Co-Owner Block GST Registration? Insights from Satya Dev Singh Case

Introduction This case deals with the question of whether the consent of all co-owners is required for obtaining Goods and Services Tax (GST) registration when one co-owner provides proof of ownership, such as an electricity bill, in their name. The Allahabad High Court ruled that when an applicant furnishes documentary proof of ownership, such as […]

Mastering Desires in Entrepreneurship – Bhagavad Gita: 2.59

विषया विनिवर्तन्ते निराहारस्य देहिन: | रसवर्जं रसोऽप्यस्य परं दृष्ट्वा निवर्तते || Translation: “The objects of the senses turn away from the one who abstains from them, but the craving for them remains. However, even this craving disappears when one experiences a higher taste.” Understanding the Verse This verse highlights the concept of “higher fulfillment.” Krishna […]

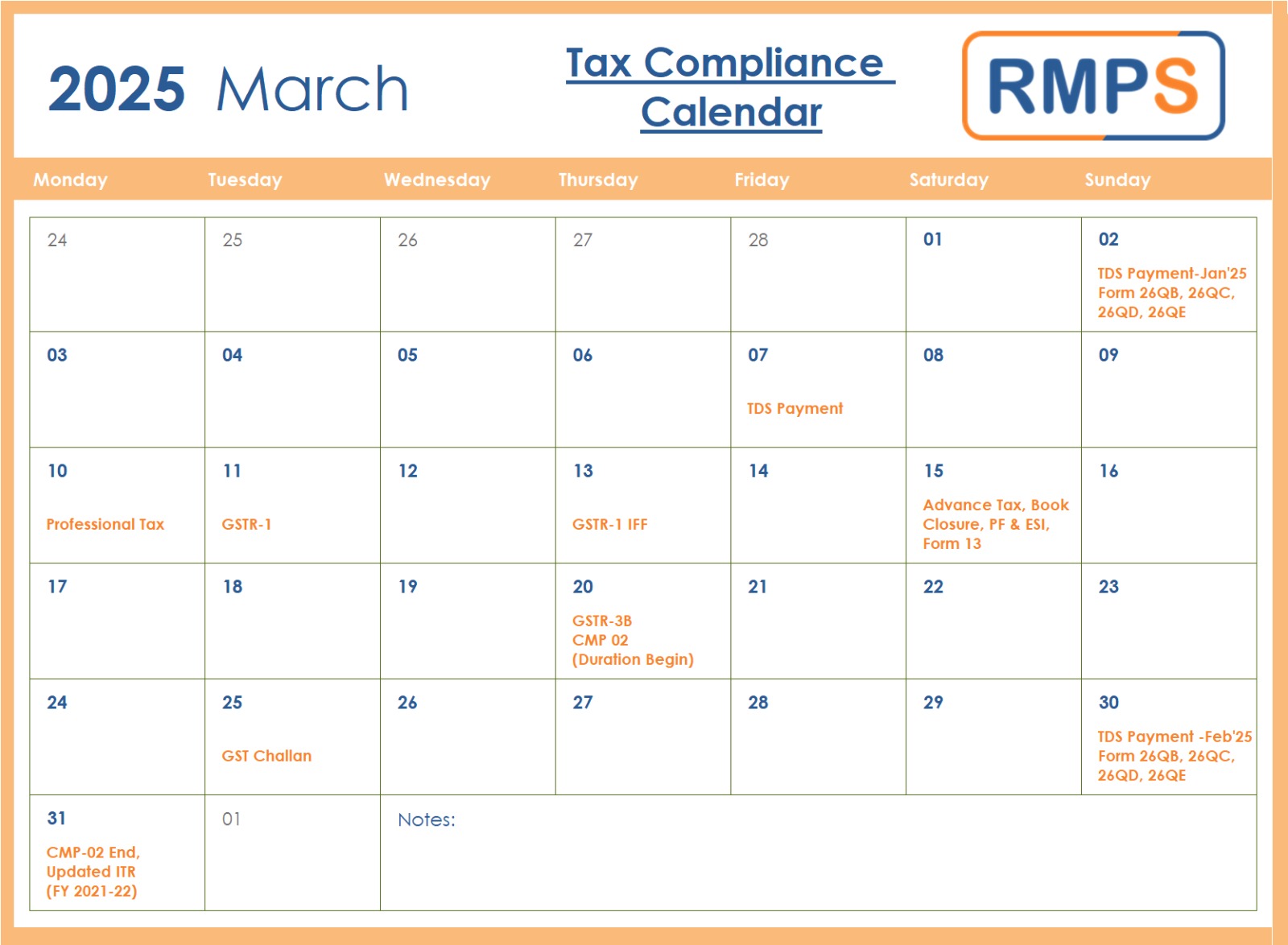

March 2025 Tax Compliance Calendar: Key Deadlines & Due Dates

March is a crucial month for tax compliance, with several key deadlines for businesses and individuals. Staying on top of these due dates helps avoid penalties and ensures smooth financial operations. Below is a structured compliance calendar for March 2025. Key Tax Deadlines for March 2025 Early March Compliance Mid-March Compliance Late March Compliance Why […]