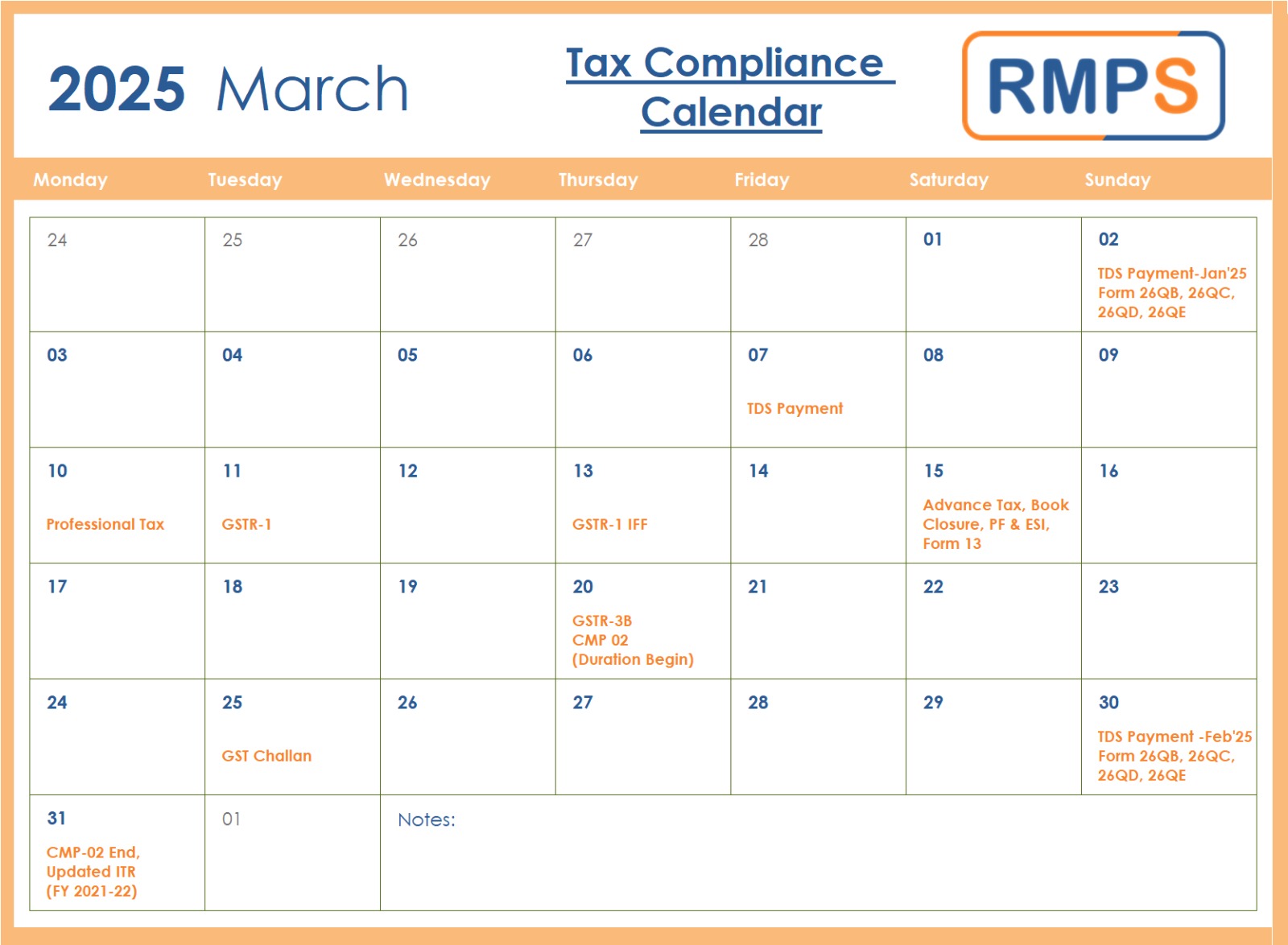

March 2025 Tax Compliance Calendar: Key Deadlines & Due Dates

March is a crucial month for tax compliance, with several key deadlines for businesses and individuals. Staying on top of these due dates helps avoid penalties and ensures smooth financial operations. Below is a structured compliance calendar for March 2025. Key Tax Deadlines for March 2025 Early March Compliance Mid-March Compliance Late March Compliance Why […]

The Entrepreneurial Tortoise : Inner Discipline and Focus

Bhagavad Gita: 2.58 Sanskrit Verse: यदा संहरते चायं कूर्मोऽङ्गानीव सर्वश: इन्द्रियानिन्द्रियार्थेभ्यस्तस्य प्रज्ञा प्रतिष्ठिता ॥ Translation: “When one completely withdraws the senses from their objects, just as a tortoise withdraws its limbs into its shell, his wisdom becomes firmly established.” Deep Dive into the Verse In this verse, Lord Krishna uses a vivid analogy: just as […]

ITC in Real Estate: A Guide for Developers, Contractors & Buyers

Introduction The restriction on Input Tax Credit (ITC) in real estate arises from Section 17(5) of the CGST Act, 2017. This section classifies specific expenses as ineligible for credit. Further, amendments and notifications have added constraints, mainly affecting residential and commercial projects. ITC under GST allows businesses to offset tax paid on inputs like raw […]

The Entrepreneur’s Guide for Sustainable Success:

Bhagavad Gita: Chapter 2, Verse 57 Sanskrit Verse: य: सर्वत्रानभिस्नेहस्तत्तत्प्राप्य शुभाशुभम् | नाभिनन्दति न द्वेष्टि तस्य प्रज्ञा प्रतिष्ठिता || Translation:” He who remains unattached to everything, neither rejoicing when meeting with good nor despising evil, is firmly fixed in perfect wisdom.” “He who remains unattached to everything, neither rejoicing when meeting with good nor despising […]

Equanimity in Entrepreneurship !

Bhagavad Gita: Chapter 2.56Sanskrit Verse: दुःखेष्वनुद्विग्नमना: सुखेषु विगतस्पृह:। वीतरागभयक्रोध: स्थितधीर्मुनिरुच्यते।। Translation: One whose mind remains undisturbed amidst sorrow, who is free from craving for pleasure, and who is devoid of attachment, fear, and anger is called a sage of steady wisdom. Relevance to Entrepreneurship Krishna highlights the qualities of emotional resilience and detachment, essential for […]

The Path to Steady Wisdom!

Bhagavad Gita: Chapter 2.5 Sanskrit Verse: श्रीभगवानुवाच: प्रजहाति यदा कामान्सर्वान्पार्थ मनोगतान्। आत्मन्येवात्मना तुष्ट: स्थितप्रज्ञस्तदोच्यते।। Translation: The Blessed Lord said: “O Partha, when a person gives up all desires arising from the mind and finds satisfaction in the self alone, such a person is said to be of steady wisdom.” Context and Explanation In this verse, […]

New Income Tax Bill 2025: Key Changes Taxpayers Can Expect

The Income Tax Bill, 2025, introduced in Parliament on February 13, 2025, marks a significant step toward modernizing India’s taxation framework. This new bill replaces the Income Tax Act, 1961, aiming to simplify tax laws, improve compliance, and enhance transparency. The government’s objective is to align taxation with the evolving economic landscape, making it easier […]

Accounting is the Language of Business!

In the world of business, communication is key. But beyond spoken words and written reports, there exists a universal language that transcends industries and geographies—Accounting. Often referred to as the “language of business,” accounting plays a crucial role in recording, analyzing, and interpreting financial data to help businesses make informed decisions. Why is Accounting Called […]

Practical Tips for Entrepreneurs: A Business Perspective on Bhagavad Gita!

Bhagavad Gita Verse 2.52 Original Verse: यदा ते मोहकलिलं बुद्धिर्व्यतितरिष्यति। तदा गन्तासि निर्वेदं श्रोतव्यस्य श्रुतस्य च।। Translation: When your intellect transcends the murky waters of delusion, you will attain a state of detachment, indifferent to both the heard and the unheard. Your Inner Wisdom as an Entrepreneur: In the heart of the Bhagavad Gita, a […]

Beware of Fake GST Notices: Finance Ministry Issues Alert

Fake GST summons are increasing, and the Finance Ministry has alerted taxpayers to verify all notices before acting. Fraudsters create fake documents that appear official, misleading businesses and individuals. To stay safe, taxpayers should confirm the authenticity of any notice received. How to Spot Fake GST Notices Fraudsters replicate official GST documents by using department […]