Missed Your ITR Filing or e-Verification Deadline? Here’s How to Fix It (2025 Update)

If you’ve missed filing your Income Tax Return (ITR) or didn’t e-verify it on time, you’re not alone. Many taxpayers run into this issue each year. Fortunately, the Income Tax Department offers a remedy — the Condonation Request. Think of it as your official request for a second chance to stay compliant without penalties. In […]

New Income Tax Bill 2025: Key Changes Taxpayers Can Expect

The Income Tax Bill, 2025, introduced in Parliament on February 13, 2025, marks a significant step toward modernizing India’s taxation framework. This new bill replaces the Income Tax Act, 1961, aiming to simplify tax laws, improve compliance, and enhance transparency. The government’s objective is to align taxation with the evolving economic landscape, making it easier […]

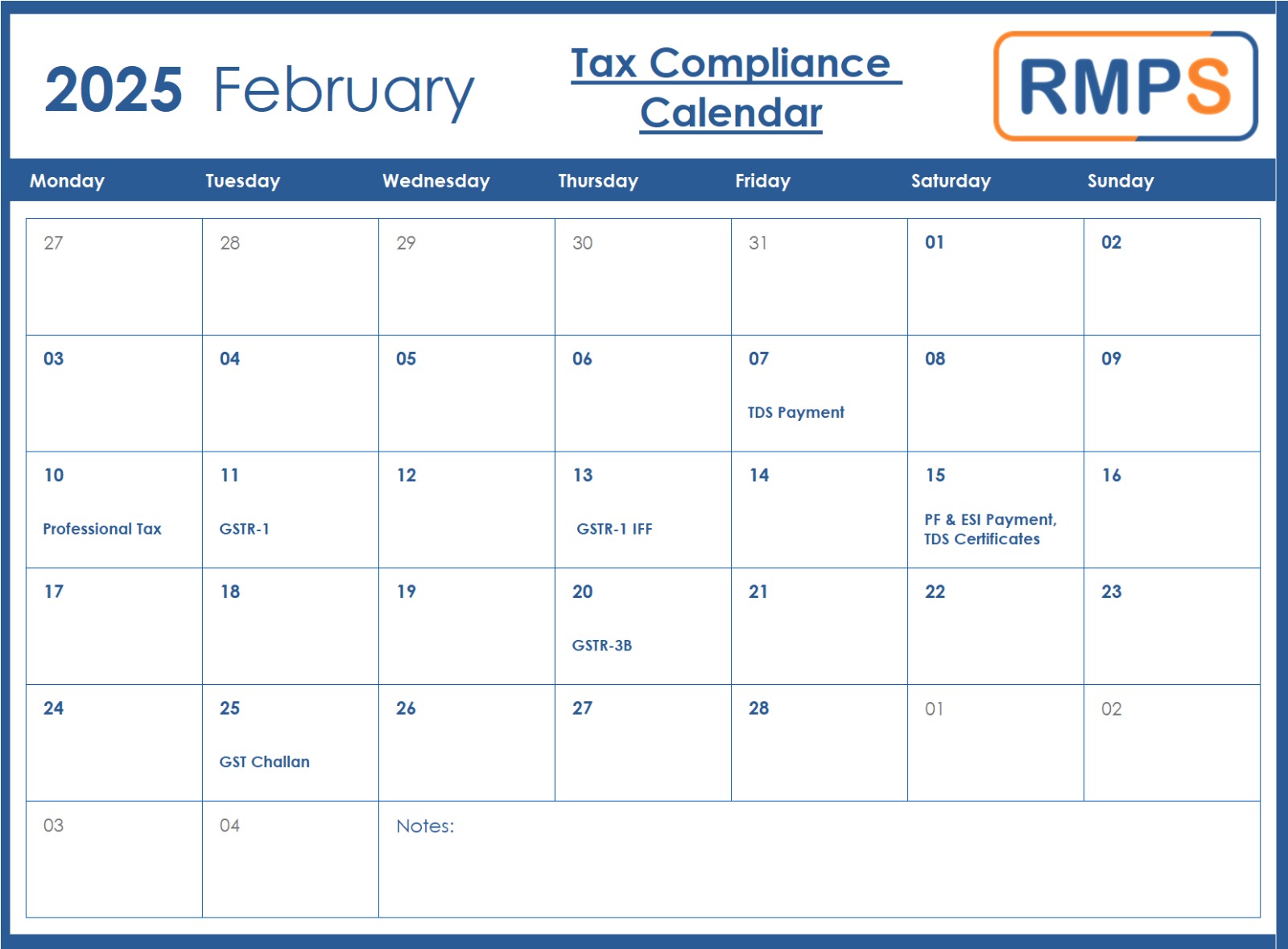

Key Tax Compliance Deadlines for February 2025: A Simple Guide

Tax compliance is essential for smooth business operations. Missing deadlines can lead to penalties, interest charges, and unnecessary hassles. By staying informed and planning ahead, businesses can avoid financial burdens and ensure compliance. Below are the critical tax deadlines for February 2025. Important Tax Deadlines – February 2025 7th February – TDS Payment for January […]

TDS & TCS Rates for FY 2025-26 Key Budget Updates You Need to Know

1. Rationalization of TDS Rates and Thresholds (A) Reduction in TDS Rates for Section 194LBC (B) Increase in TDS Thresholds for Various Payments In addition to the changes to TDS/TCS rates, the budget proposals also aim to rationalize various TDS provisions by adjusting the thresholds beyond which tax must be deducted. Below is the detailed […]

Union Budget 2025 Expectations: A Comprehensive Analysis

As the 2025-26 financial year approaches, Finance Minister Nirmala Sitharaman faces the task of addressing pressing economic challenges while steering India toward sustainable growth. With multiple sectors sharing their expectations, this budget has the potential to reshape the country’s economic trajectory. Below is a sector-wise overview of the primary expectations from the Union Budget 2025. […]

Understanding Tax Collected at Source (TCS) and Its Accounting Entries

Introduction Tax Collected at Source (TCS) is a provision under the Income Tax Act, 1961, where the seller collects tax at the time of sale and deposits it with the government. This system ensures tax compliance, minimizes evasion, and promotes accountability. For businesses, accurate accounting of TCS is essential for both financial management and legal […]

TDS Entries: How They Affect Accounting

Tax Deducted at Source (TDS) is a vital component of the Indian tax system. Understanding TDS is essential for businesses and accountants because it impacts cash flow, compliance with tax laws, and the accuracy of financial records. This blog will explain what TDS is, its importance, how it affects accounting practices, and how to manage […]

Archival of GST Returns Data on GST Portal: What You Need to Know

Keeping up with tax updates is essential for every taxpayer. A new data archival policy on the GST portal could affect how long you can access your past GST returns. Let’s break down the key points and what actions you need to take. Key Update: Section 39(11) of the CGST Act, 2017 From October 1, […]

Understanding Tax Audits and Form 3CA-3CD: A Comprehensive Guide

Tax audits and form 3CA-3CD are vital for ensuring compliance with tax laws and preventing tax evasion. Established by the Finance Act of 1984 under Section 44AB, this requirement took effect from the Assessment Year 1985-86. The goal is to enhance the accuracy and transparency of income reporting. What is a Tax Audit? A tax […]

New TDS Rules for Partner Payments: What You Need to Know!

Introduction: Starting April 1, 2025, a new section called 194T will change how partnership firms and Limited Liability Partnerships (LLPs) handle payments to their partners. Under this rule, firms must deduct 10% Tax Deducted at Source (TDS) on payments made to partners if the total amount exceeds ₹20,000 in a financial year. Let’s explore what […]