New GST Rules Simplify Preferential Location Charges (PLC) for Builders and Buyers

The 54th GST Council Meeting has brought much-needed clarity on how Preferential Location Charges (PLC) should be taxed. PLCs are the extra charges builders apply for prime spots in a project, such as units on higher floors or with better views. The recent decision makes it clear that PLCs are part of a composite supply. […]

Navigating GST Changes for Metal Scrap: Essential RCM and TDS Guidelines

“Metal scrap” refers to discarded or waste metal materials that are often recycled or sold as raw materials for further use. Recycling metal scrap plays a crucial role in conserving resources and promoting sustainability. In India, businesses involved in the sale or purchase of metal scrap need to understand various tax implications such as GST […]

Key Highlights from the 54th GST Council Meeting: Major Updates

The 54th GST Council meeting, led by Union Minister of Finance and Corporate Affairs Smt. Nirmala Sitharaman, brought important changes. These updates aim to simplify GST rates, improve compliance, and streamline procedures. Let’s go over the most significant changes. A. Changes in GST Tax Rates Namkeens and Savory Products:The GST rate on extruded savory products […]

Quick Guide: Aadhaar & Document Verification for GST Registration in 4 States

If you are registering for GST Registration in Bihar, Delhi, Karnataka, or Punjab, the process has changed. These changes make the verification faster and more secure. Here’s a brief look at what you need to know. Key Updates: 1.Biometric Aadhaar Authentication: Applicants are now identified using biometric-based Aadhaar authentication. This includes a photograph and verification […]

Key Court Rulings on GST Seizures: What Businesses Should Know

Understanding GST law, especially regarding asset GST seizures, can be challenging. Recent court rulings have clarified the limits of CGST authorities’ power to seize assets. This blog will break down a key legal case that affects businesses dealing with the Goods and Services Tax (GST). The Case: CGST vs. Deepak Khandelwal In January 2020, CGST […]

GST Filing and Compliance: Recent Changes in Late Filing, Assessments, and Case Updates

Staying compliant with GST regulations is essential for businesses to avoid penalties. Recent legal changes emphasize the need for timely GST returns and provide updates on filing extensions. Let’s explore the latest updates and a case example that highlights these important changes. Why Timely GST Return Filing Matters Filing GST returns, like GSTR-1 and GSTR-3B, […]

Understanding the Invoice Management System (IMS) Under GST: A Comprehensive Guide

The Goods and Services Tax (GST) in India is evolving to make compliance easier for taxpayers. A key improvement is the Invoice Management System (IMS), which is set to launch on the GST portal from October 1st. This new tool aims to help taxpayers manage invoice corrections and amendments more efficiently. It also ensures that […]

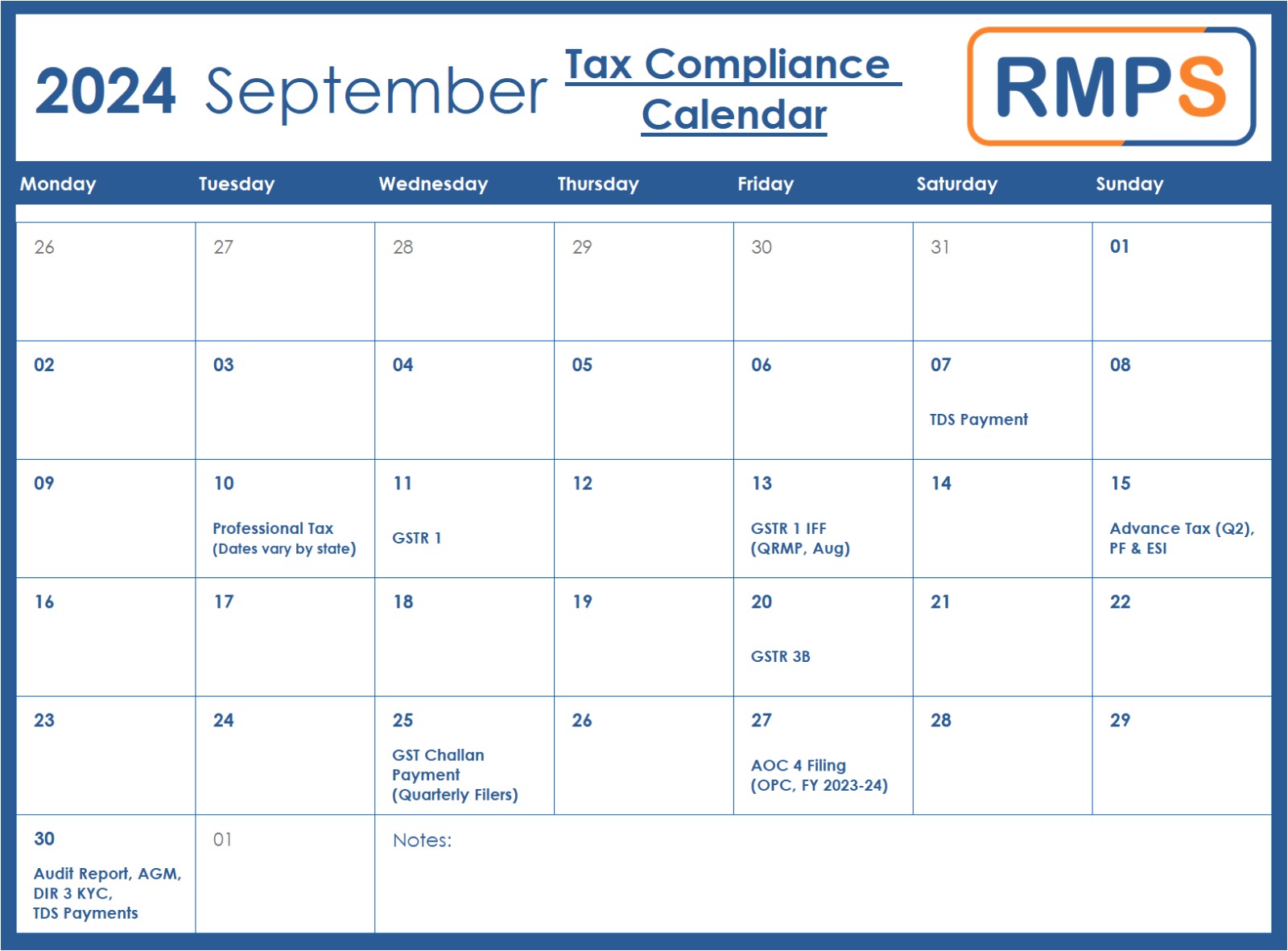

September 2024 Compliance Calendar: Key Deadlines You Shouldn’t Miss

As September 2024 rolls in, it’s essential for businesses and professionals to stay on top of their compliance requirements. Missing key deadlines can lead to penalties, so here’s a quick guide to the crucial dates this month. 7th September: TDS Payment for August 2024 Ensure that your TDS (Tax Deducted at Source) for August 2024 […]

Avoiding Costly GST Filing Errors: Insights from the Recent Court Judgment

In GST compliance, even small mistakes can lead to big problems. A recent court judgment highlights the importance of filing returns correctly and the consequences of errors. Let’s explore the details of this case and what it means for businesses. The Error: Filing GSTR-1 for the Wrong Period In the case of Veeran Mehhta vs. […]

RCM Liability/ITC Statement: A New Transparency Tool on the GST Portal

The GST landscape is evolving to better support taxpayers and enhance transparency in tax transactions. A significant addition to this framework is the new “RCM Liability/ITC Statement” on the GST Portal. Designed to help taxpayers report Reverse Charge Mechanism (RCM) transactions more accurately, this statement bridges the gap between RCM liabilities and corresponding Input Tax […]