Key Updates to the Central GST(CGST) Rules 2024

The Indian government recently issued Notification No. 12/2024 – Central Tax. This notification introduces changes to the Central Goods and Services Tax (CGST) Rules, 2017. These updates, effective from July 10, 2024, are important for businesses to understand. By knowing these changes, companies can stay compliant and make the most of their tax strategies. Let’s […]

New ISD Registration Requirement for GST Taxpayers from April 2025

GST Taxpayers Must Register as ISD for Common ITC Distribution Introduction Starting April 1, 2025, GST taxpayers registered in multiple states must register as Input Service Distributors (ISD) to distribute common Input Tax Credit (ITC). This requirement, outlined in Notification No. 16/2024 – Central Tax and The Finance Act, 2024, aims to streamline ITC distribution […]

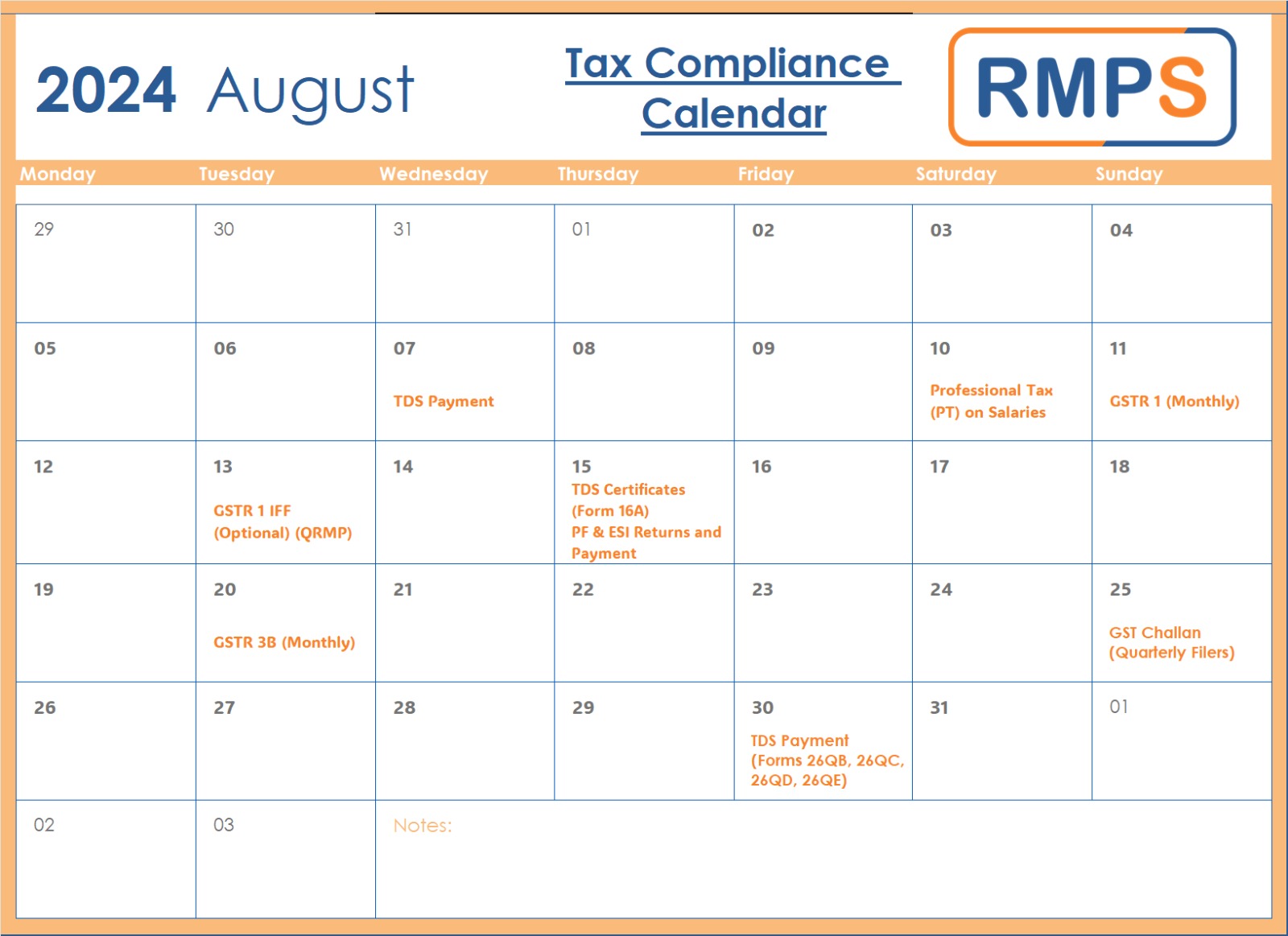

August 2024 Compliance Calendar: Key Deadlines for Businesses

As a business owner or financial professional, staying on top of compliance deadlines is crucial to avoid penalties and ensure smooth operations. Here’s a guide to the essential tax and regulatory deadlines for August 2024. 07 August: TDS Payment for July 2024 Ensure you complete your Tax Deducted at Source (TDS) payments for July by […]

GST Form 8 Updates: New TDS Rates Effective July 10, 2024

In a recent development, the Central Government has announced significant changes to GST Form 8 and TDS rates. Effective from July 10, 2024, these changes aim to streamline compliance for taxpayers and reduce the financial burden on businesses. Key Changes: Detailed Overview: The government has revised GST Form 8, used by e-commerce operators for filing […]

Understanding Form GSTR-1A: Amendments Made Easy

When it comes to managing GST returns, accuracy is key. Mistakes in filing can lead to discrepancies, affecting your business’s compliance and financial standing. Fortunately, the Indian GST system provides a mechanism to correct such errors: Form GSTR-1A. This blog will guide you through the essentials of GSTR-1A, its purpose, filing procedure, and critical considerations. […]

A Guide to Filing Form GSTR-1A: A New Opportunity for Taxpayers

Introduction The Government of India has introduced Form GSTR-1A, an optional tool for taxpayers. This form allows businesses to amend, add, or correct details of supplies reported in the current tax period’s GSTR-1. It was introduced following the Government’s notification no. 12/2024 dated 10th July 2024, and is available starting from the July 2024 tax […]

India Introduces Uniform 5% GST to Boost Aviation MRO Industry

The Indian government has introduced a uniform 5% Integrated Goods and Services Tax (IGST) on all aircraft and aircraft parts. This new policy, effective from July 15, 2024, aims to streamline the tax system. And support the growth of India’s Maintenance, Repair, and Overhaul (MRO) industry, positioning the country as a global aviation hub. A […]

Advisory for FORM GSTR-1A

The Government of India has introduced a significant update for GST taxpayers through notification No. 12/2024 – Central Tax dated 10.07.2024. That allows taxpayers to add or amend supply details of the current tax period that were either missed out or wrongly reported. This can be done before filing the GSTR-3B return for the same […]

Time of Supply for Construction and Maintenance Services under Hybrid Annuity Model (HAM)

Introduction The Central Board of Indirect Taxes and Customs (CBIC) has issued Circular No. 221/15/2024-GST, dated 26th June 2024. This circular aims to clarify the time of supply concerning the supply of services for the construction and maintenance of National Highway Projects under the Hybrid Annuity Model (HAM) implemented by the National Highways Authority of […]

Place of Supply for Custodial Services Provided by Banks to FPIs.

Introduction The Central Board of Indirect Taxes and Customs (CBIC) has issued Circular No. 220/14/2024-GST to provide clarity on the place of supply for custodial services provided by banks to Foreign Portfolio Investors (FPIs). Place of supply of services provided by a banking company to account holders is the location of the supplier. Background The […]