Section 14 – Time of supply in case of a change in Rate of tax.

One of the critical sections under the Central Goods and Services Tax (CGST) Act is Section 14. This section deals with the change in the rate of tax in respect of the supply of goods or services. What is Section 14 of the CGST Act? Section 14 of the CGST Act provides guidelines on how […]

Clarification on Input Tax Credit for Optical Fiber Cable Network Components

The Ministry of Finance recently issued a crucial circular. This circular clarifies the availability of Input Tax Credit (ITC) for ducts and manholes used in optical fiber cable (OFC) networks. This update is essential for the telecommunications sector. It aims to ensure uniform implementation of the law and to prevent unnecessary litigation. Background The Cellular […]

Enhancements to Address-Related Fields in GST Registration Functionalities

The Goods and Services Tax Network (GSTN) has introduced several enhancements to address-related fields in the GST registration functionalities. These changes aim to improve the GST registration process for taxpayers by incorporating user feedback and analyzing tickets. Here are the details of these enhancements: 1. Update in Validations for Address Fields a. Address is in […]

GST Reconciliation Made Easy: Compliance Tips for Businesses

Introduction Navigating the complexities of Goods and Services Tax (GST) compliance can be a daunting task for businesses of all sizes. Ensuring accurate GST reconciliation is essential for maintaining compliance and avoiding penalties. This blog will outline the key aspects of GST reconciliation and provide a comprehensive GST compliance checklist to help businesses streamline their […]

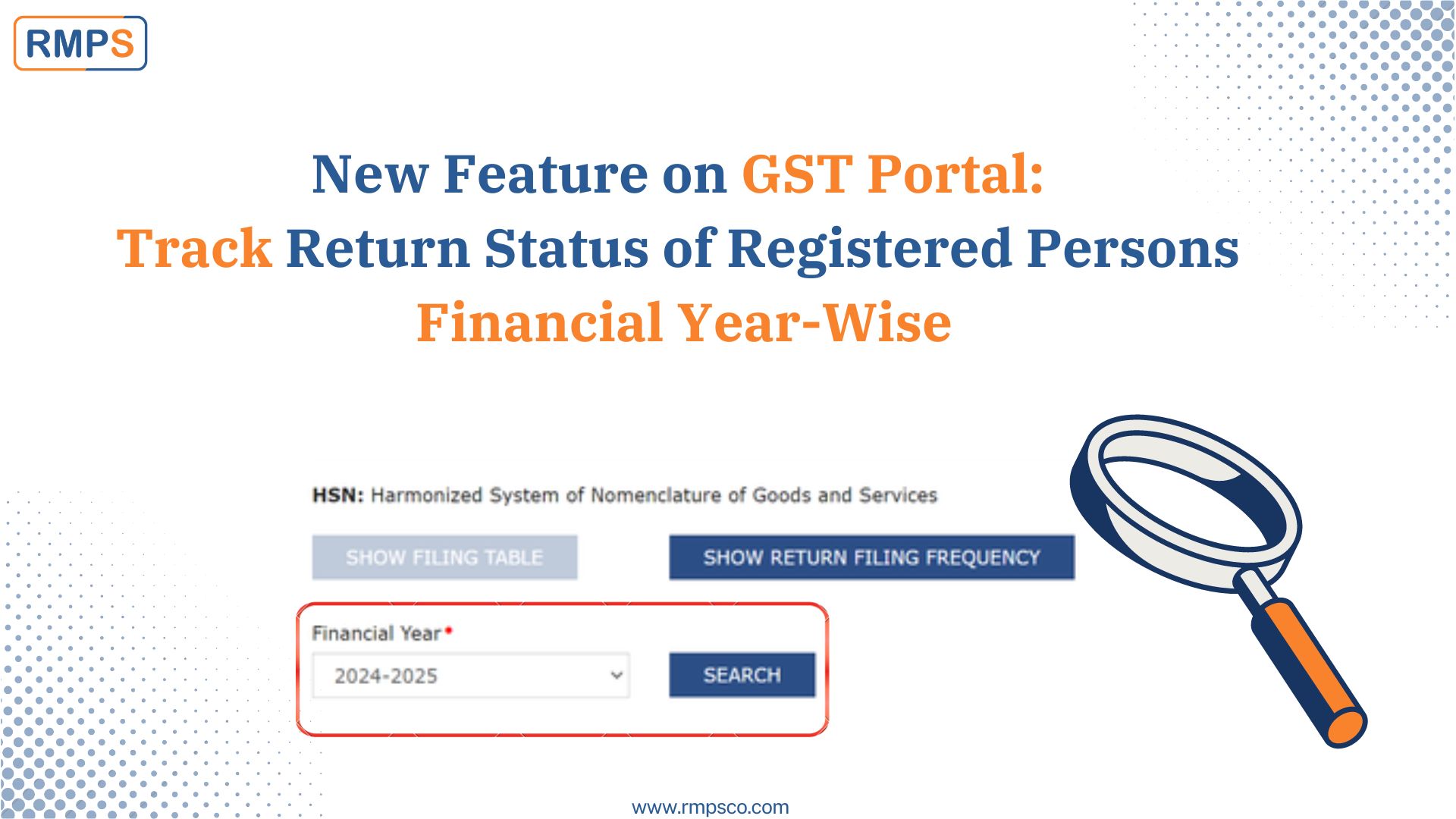

New Feature on GST Portal: Track Return Status of Registered Persons Financial Year-Wise

New functionality on the GST portal that will significantly ease the process of tracking the return status of registered taxpayers. This new feature allows you to see the status of GST taxpayers on a yearly basis through the “Search Taxpayer” tab. Key Benefits Yearly Overview Gain a comprehensive view of the return status for each […]

7 Years of GST Has Benefited the Indian Economy

Since its implementation, GST has undergone several phases of evolution, facing both achievements and challenges. Here is a detailed analysis of the 7 years of GST in India. Year 1: Implementation and Initial Challenges (2017-2018) Achievements: Challenges: Year 2: Stabilization and Adjustments (2018-2019) Achievements: Challenges: Year 3: Enhancements and Rationalization (2019-2020) Achievements: Challenges: Year 4: […]

Navigating GST Payment Grievances: A Simple Guide

Dealing with payment issues on the GST Portal can be frustrating. However, knowing when and how to raise a grievance can make the process much smoother. Here’s a guide to help you understand the types of issues for which you can raise a grievance and the steps involved. Issues Eligible for Raising a Grievance You […]

Detailed Look at GST Implications on Sponsorship Services

Introduction In the world of business, Sponsorship Services play a pivotal role in promoting brands, logos, and products. Understanding the Goods and Services Tax (GST) implications on these services is crucial for compliance and efficient tax management. What Are Sponsorship Services? Sponsorship services refer to contractual agreements where a service provider promotes or displays a […]

New GST Portal Feature: Search GST Numbers Using Mobile Numbers

The Government of India has introduced a new update to the Goods and Services Tax (GST) portal, allowing users to search for a GST number using a mobile number. This update aims to enhance the ease of use and improve the verification process of taxpayers. What’s New? Previously, users could search for a GST number […]

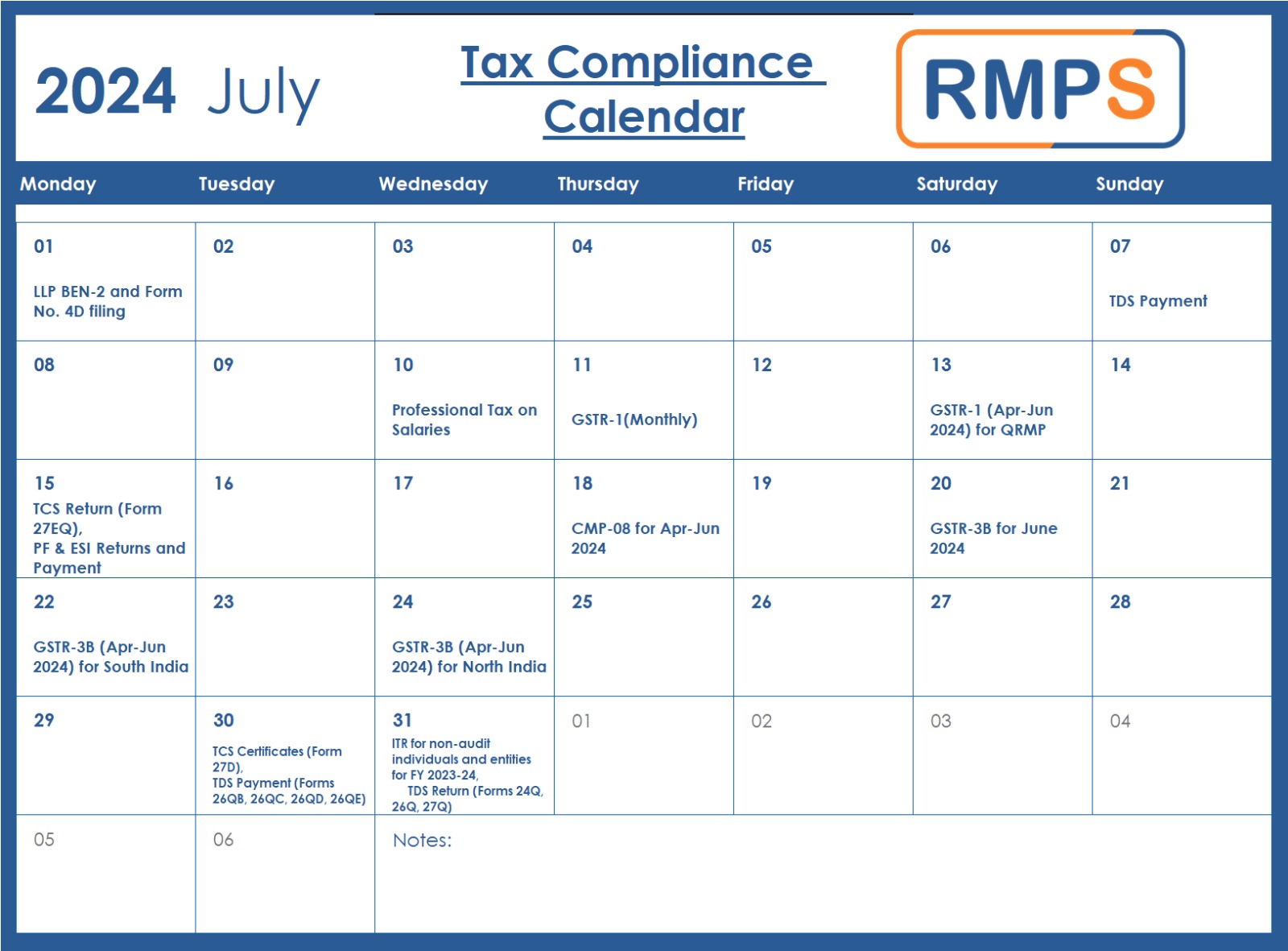

Essential Compliance Deadlines: July 2024 – Your Ultimate Guide

Staying on top of tax and regulatory filings is vital for every business. Here’s a detailed, easy-to-follow guide to the key compliance deadlines in July 2024. Mark these dates to ensure you remain compliant and avoid penalties. Key Compliance Dates for July 2024 1st July LLP BEN-2 and Form No. 4D Filing:Make sure to submit […]