Builders & Promoters: GST Rules for RCM and 80% Purchase Compliance

Builders & Promoters must follow Reverse Charge Mechanism (RCM) rules when purchasing goods and services. To qualify for a lower 1% or 5% tax rate, they must buy at least 80% of input goods and services from registered dealers. If they fail to meet this rule, they must pay 18% GST under RCM on the […]

GST on Export of Services: A Complete Guide to Refunds and Compliance

GST on Export of Services offers several advantages, yet businesses must navigate tax compliance requirements carefully. This guide simplifies the GST framework for exporting services, covering refunds, compliance, and essential documentation to ensure a smooth process. Table of Contents Understanding GST on Export of Services Under GST, the export of services is classified as a […]

Form ENR-03: E-Way Bill Enrolment for Unregistered Dealers

The E-Way Bill (EWB) system has introduced a new feature that simplifies compliance for unregistered dealers engaged in goods transportation. Starting February 11, 2025, businesses without GST registration can enrol using Form ENR-03 to obtain a unique Enrolment ID. Consequently, they can now generate e-Way Bills effortlessly without requiring a GSTIN. This update, introduced through […]

GST Registration Process: Key Guidelines for Taxpayers

Introduction With recent changes in the GST Registration process, taxpayers must follow updated procedures to ensure a smooth experience. Rule 8 of the CGST Rules, 2017 outlines specific steps based on Aadhaar authentication preferences. Below is a simplified guide to help you complete your registration without delays. 1. Steps for Applicants Not Opting for Aadhaar […]

New Income Tax Bill 2025: Key Changes Taxpayers Can Expect

The Income Tax Bill, 2025, introduced in Parliament on February 13, 2025, marks a significant step toward modernizing India’s taxation framework. This new bill replaces the Income Tax Act, 1961, aiming to simplify tax laws, improve compliance, and enhance transparency. The government’s objective is to align taxation with the evolving economic landscape, making it easier […]

GST Update: Taxability of Vouchers & Department Appeals – Key Clarifications

Introduction The Central Board of Indirect Taxes and Customs (CBIC) has issued Instruction No. 02/2025-GST on February 7, 2025. This instruction clarifies the procedure for department appeals involving interest and penalty disputes under Section 128A of the CGST Act, 2017. Many businesses face challenges when tax amounts are fully paid, but disputes over interest or […]

Decoding Budget 2025 All-in-One Insights on GST Changes

The Union Budget 2025, presented on February 1, 2025, introduces significant GST amendments. These changes aim to streamline compliance, simplify tax procedures, and enhance trade efficiency. Below is a breakdown of the most critical updates. 1. Key Changes in GST Definitions a) Input Service Distributors (ISD) – ITC Distribution for RCM on Inter-State Supplies 📢 […]

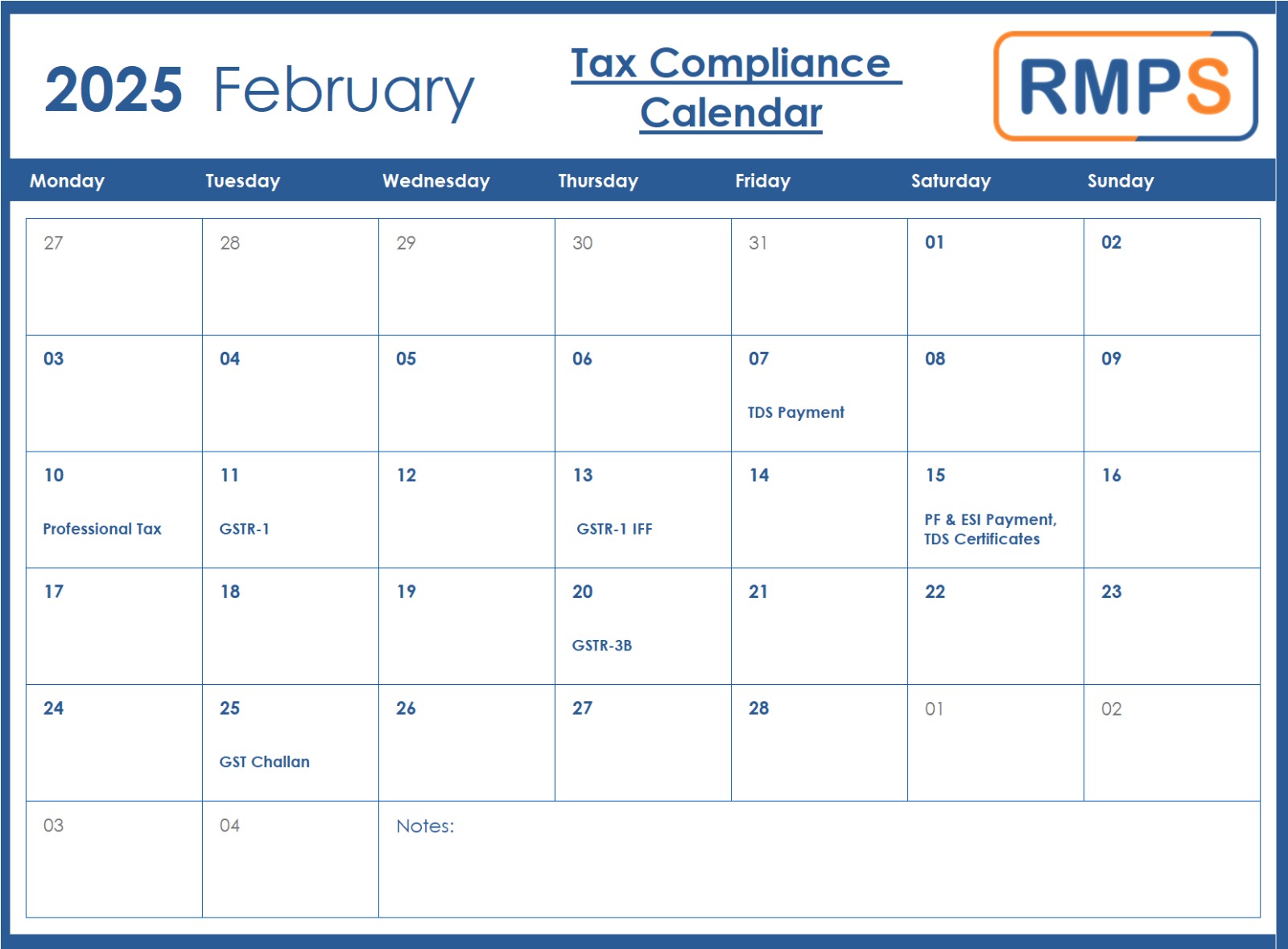

Key Tax Compliance Deadlines for February 2025: A Simple Guide

Tax compliance is essential for smooth business operations. Missing deadlines can lead to penalties, interest charges, and unnecessary hassles. By staying informed and planning ahead, businesses can avoid financial burdens and ensure compliance. Below are the critical tax deadlines for February 2025. Important Tax Deadlines – February 2025 7th February – TDS Payment for January […]

TDS & TCS Rates for FY 2025-26 Key Budget Updates You Need to Know

1. Rationalization of TDS Rates and Thresholds (A) Reduction in TDS Rates for Section 194LBC (B) Increase in TDS Thresholds for Various Payments In addition to the changes to TDS/TCS rates, the budget proposals also aim to rationalize various TDS provisions by adjusting the thresholds beyond which tax must be deducted. Below is the detailed […]

2025 Customs Duty Update: Key Increases, Decreases, and Their Impact on Various Sectors

The Customs Tariff Act, 1975 is undergoing significant changes in its duty rate schedule. With the Finance Bill, 2025 introducing amendments that will come into effect from February and May 2025, businesses across various sectors must understand how these changes affect import and export duties. In this post, we break down the amendments sector‑wise, covering […]