“GST Updates: Reversing ITC When Suppliers Miss the September 30th Deadline”

Summary: Rule 37A is applicable if for a particular Invoice/Debit Note, Supplier has duly filed GSTR-1 (along with details of such invoice/debit note) but not its GSTR-3B for that period. Also, Buyer has availed credit based upon its GSTR-2B (auto populated from such GSTR-1 filed by the Supplier). Heading Reversal of Credit (Required or Not) […]

Refunds Under GST

Allowable Refunds 1. Refund of unutilized input tax credit (ITC) on account of exports without payment of tax. 2. Refund of tax paid on export of services with payment of tax; 3. Refund of unutilized ITC on account of supplies made to SEZ Unit/SEZ Developer without payment of tax. 4. Refund of tax paid on […]

🎉 Exciting Launch: Presenting the ‘Mera Bill Mera Adhikaar’ Scheme with opportunities to win up to 1 Crore! 🏆

If you have questions or need more information about how to join in the ‘Mera Bill Mera Adhikaar’ Scheme, simply call us at 📞 9512453531. We’re ready to assist! https://www.rmpsco.com/%f0%9f%8e%89-exciting-launch-presenting-the-mera-bill-mera-adhikaar-scheme-with-opportunities-to-win-up-to-1-crore-%f0%9f%8f%86/ This Vlog is only a knowledge-sharing initiative and is based on the Relevant Provisions as applicable and as per the information existing at the time of […]

🎉 Exciting Launch: Presenting the ‘Mera Bill Mera Adhikaar’ Scheme with opportunities to win up to 1 Crore! 🏆

In an ambitious move to transform our purchasing culture, the ‘Mera Bill Mera Adhikaar’ Scheme encourages every Indian to confidently demand bills/invoices for all their purchases. 🗓 Launch Details: 📌 Key Aspects of the Scheme: 🎁 Prize Breakdown: 🔍 How Do You Participate? 📣 Important Information: This pilot scheme is not just a chance to […]

Job Work Under GST

What is Job-Work Under GST? The definition of Job-work under GST is covered under section 2(68) of the CGST Act, 2017 states “Any treatment or process undertaken by a person on goods belonging to another registered person”. Therefore, a job worker is a person (registered or unregistered) who is processing or treating the goods of […]

30 Days Of IRN Reporting Effective From 1 November 2023

In a significant development for businesses in India, the Goods and Services Tax (GST) Authority has introduced a new reporting deadline for e-invoices. Effective from 1st November 2023, this regulation mandates that taxpayers with an Aggregate Annual Turnover (AATO) greater than or equal to 100 crores have a 30-day window to report invoices from the […]

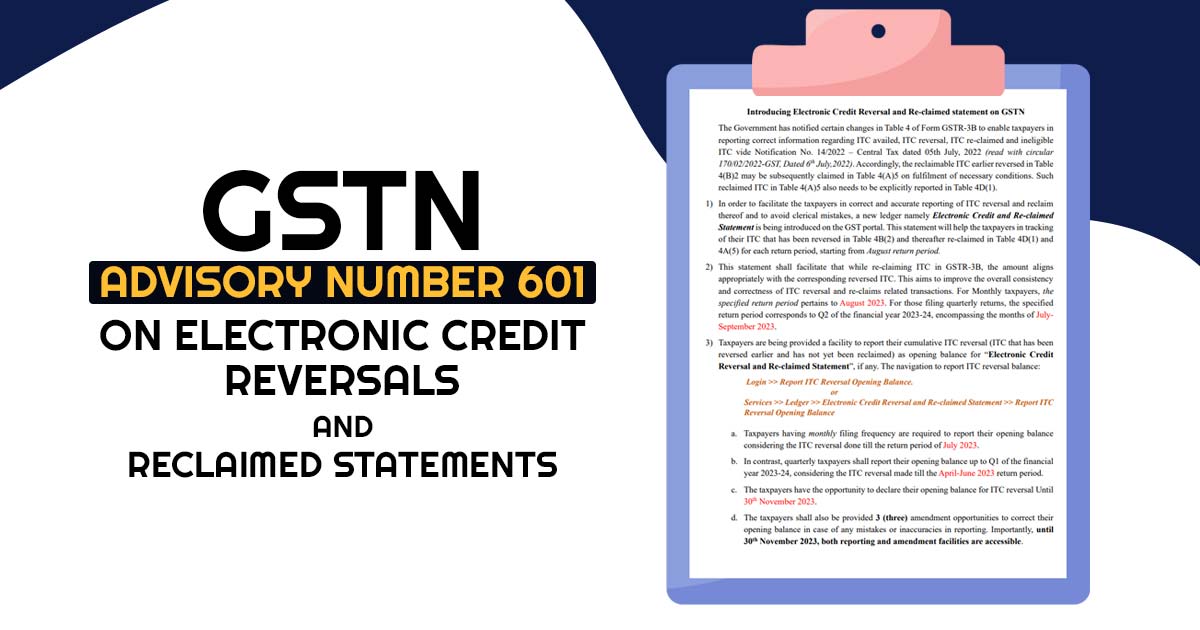

Maximize Your ITC Tracking Efficiency with GSTN’s New Electronic Credit Reversal and Re-claimed Statements!

You can Refer the below link for detail blog : https://www.rmpsco.com/maximize-your-itc-tracking-efficiency-with-gstns-new-electronic-credit-reversal-and-re-claimed-statements/ This Vlog is only a knowledge-sharing initiative and is based on the Relevant Provisions as applicable and as per the information existing at the time of the preparation. In no event RMPS & Co. or the Author or any other persons be liable for […]

Maximize Your ITC Tracking Efficiency with GSTN’s New Electronic Credit Reversal and Re-claimed Statements!

A new feature called Electronic Credit Reversal and Re-claimed Statements on the GSTN portal has been introduced. This statement is here to help you keep track of your ITC, from reversing it (Table 4B(2)) to reclaiming it (Table 4D(1) and 4A(5)). It covers each return period, starting from the August 2023 return period. Correct Reporting, […]

Latest Notifications Related to E-commerce Operators:

Notification No. 34/2023-Central Tax on 31st July 2023 This notification specifies the category of persons who are exempted from obtaining registration under the said Act, subject to certain conditions. Here are the key points mentioned in the notification: Notification No. 36/2023 – Central Tax on 4th August 2023 CBIC has empowered e-commerce operators with specific […]

Amendment in Import Policy of Laptops, Tablets, Computers etc.

The move seems to be aimed at promoting domestic manufacturing, and probably targeted at China since more than 75 per cent of India’s total $ 5.33 billion imports of laptops and personal computers in 2022-23 was from the neighboring country. Policy conditions are introduced as under: This Article is only a knowledge-sharing initiative and is […]