The Downfall of an Uncontrolled Mind

Bhagavad Gita: Chapter 2, Verse 63 Sanskrit Verse: क्रोधाद्भवति संमोह: संमोहात्स्मृतिविभ्रम: | स्मृतिभ्रंशाद्बुद्धिनाशो बुद्धिनाशात्प्रणश्यति || Translation: “From anger, delusion arises; from delusion, confusion of memory; from confusion of memory, loss of intelligence; and when intelligence is lost, one is destroyed.” Understanding the Verse Krishna describes the chain reaction of a disturbed mind, leading to irrational […]

Job Work Under GST: Compliance, Documentation & Input Tax Credit

Introduction Job work plays a crucial role in the Indian manufacturing and processing industries. Under the Goods and Services Tax (GST) regime, job work refers to a process where one party performs specific treatments or modifications on goods owned by another registered business. This ensures operational flexibility while maintaining compliance with GST regulations. This blog […]

The Delhi High Court’s Verdict on GST Registration Cancellation: A Landmark Decision

Introduction In a significant ruling, the Delhi High Court set aside the retrospective cancellation of GST registration for JSD Traders LLP. The case, W.P.(C) 2608/2025, challenged the arbitrary cancellation of GST registration dating back to 2017. It raised crucial questions about procedural fairness and legal compliance under the Central Goods and Services Tax Act, 2017 […]

The Chain Reaction of Desire in Entrepreneurship:

Sanskrit Verse: ध्यायतो विषयान्पुंस: सङ्गस्तेषूपजायते | सङ्गात्सञ्जायते काम: कामात्क्रोधोऽभिजायते || Translation: “When a person constantly thinks about sense objects, attachment to them arises. From attachment, desire is born, and from desire, anger arises.” Krishna explains a mental progression that leads to emotional instability: 1️⃣ Constant thinking about an object → Leads to attachment 2️⃣ Attachment […]

Small Business? Simplify GST with Composition Levy – Deadline March 31

The Goods and Services Tax (GST) framework provides a Composition Levy scheme for eligible taxpayers seeking a simplified tax compliance process. This guide outlines the key details, eligibility, and process for opting for Composition Levy under GST for the financial year 2025-26. What is the Composition Levy under GST? The Composition Levy is a simplified […]

The Battle of the Mind in Entrepreneurship- Bhagavad Gita 2.60

Sanskrit Verse: यततो ह्यपि कौन्तेय पुरुषस्य विपश्चित: | इन्द्रियाणि प्रमाथीनि हरन्ति प्रसभं मन: || Translation: “O Kaunteya (Arjuna), even a wise person who strives to control the mind may still be overpowered by the turbulent senses.” Understanding the Verse Krishna highlights the difficulty of controlling one’s senses and emotions. Even the most disciplined individual can […]

Advisory: Biometric Authentication Now Available for Directors in Home State

Introduction In a significant move towards streamlining the GST registration process, GSTN has introduced an enhancement in Biometric Authentication functionality. This update allows certain Promoters/Directors to complete Biometric Authentication at any GST Suvidha Kendra (GSK) within their Home State, rather than being restricted to their jurisdictional GSK. This initiative aims to improve convenience and reduce […]

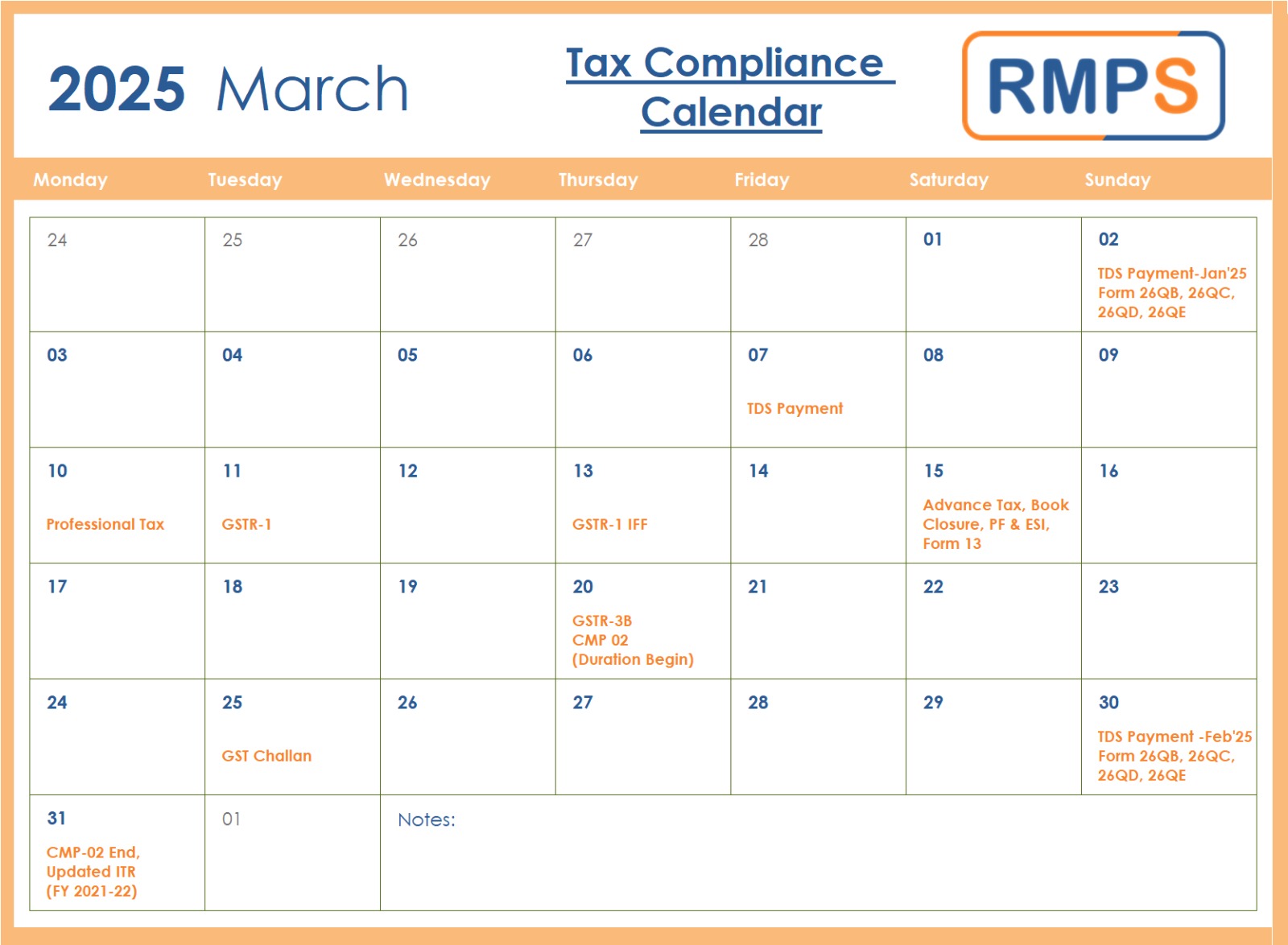

March 2025 Tax Compliance Calendar: Key Deadlines & Due Dates

March is a crucial month for tax compliance, with several key deadlines for businesses and individuals. Staying on top of these due dates helps avoid penalties and ensures smooth financial operations. Below is a structured compliance calendar for March 2025. Key Tax Deadlines for March 2025 Early March Compliance Mid-March Compliance Late March Compliance Why […]

GST Rates Clarifications as per Circular No. 247/04/2025-GST

The Ministry of Finance, Department of Revenue (Tax Research Unit) has issued Circular No. 247/04/2025-GST, dated 14th February 2025, to clarify GST Rates and product classifications. These updates stem from the 55th GST Council Meeting held on 21st December 2024 in Jaisalmer. The goal is to ensure consistent tax implementation across different regions. Below are […]

GST in E-Commerce: Impacts, Advantages, and Challenges

Introduction The Goods and Services Tax (GST) has revolutionized India’s tax landscape since its introduction on July 1, 2017. Designed to streamline taxation, reduce cascading taxes, and promote transparency, GST has played a pivotal role in shaping the e-commerce sector. While GST has simplified tax compliance for many industries, e-commerce sellers face unique challenges due […]