From Product to Platform: Transitioning Your Business Model

In today’s rapidly evolving marketplace, businesses are no longer confined to traditional product or service-based models. The shift towards platform-based business models is transforming industries, offering new growth opportunities, and creating unprecedented value for customers and stakeholders alike. This blog explores what it takes to transition your business from a product-centric approach to a platform-driven […]

Key GST Compliance Activities for the Financial Year-End

As the financial year draws to a close, businesses must prioritize GST compliance to avoid potential issues and ensure smooth operations. This checklist provides actionable steps for seamless compliance. 1. Sales Reconciliation 2. Input Tax Credit (ITC) Reconciliation for FY 2024-25 3. Reverse Charge Mechanism (RCM) Compliance 4. Letter of Undertaking (LUT) Application 5. Refund […]

How Recent Amendment Impact Tax Rules for Sponsorship Services

The GST Council has introduced significant updates to the Reverse Charge Mechanism (RCM) under Notification No. 13/2017 (Central Tax – Rate), specifically Entry No. 4. These changes, effective from January 16, 2025, as per Notification No. 07/2025, aim to enhance tax compliance and clarify the responsibilities under RCM for sponsorship services. RCM (Reverse Charge Mechanism) […]

New GST Update: Redefinition of “Specified Premises” Effective April 2025

The Indian government has introduced a crucial update under GST with Notification No. 08/2025-Central Tax (Rate), redefining the concept of “Specified Premises.” This change, effective from April 1, 2025, aims to bring greater clarity and compliance to hotel accommodation services. What Are “Specified Premises”? As per the latest notification, premises offering hotel accommodation services with […]

What Are the Challenges of Business Valuation Beyond Financial Metrics?

Introduction In the realm of business valuation, investors and analysts often depend on various financial techniques, such as the Discounted Cash Flow (DCF) model and market comparable, to estimate a company’s worth. However, the process is rarely as straightforward as these structured approaches suggest. For instance, the DCF method relies on forecasting future cash flows […]

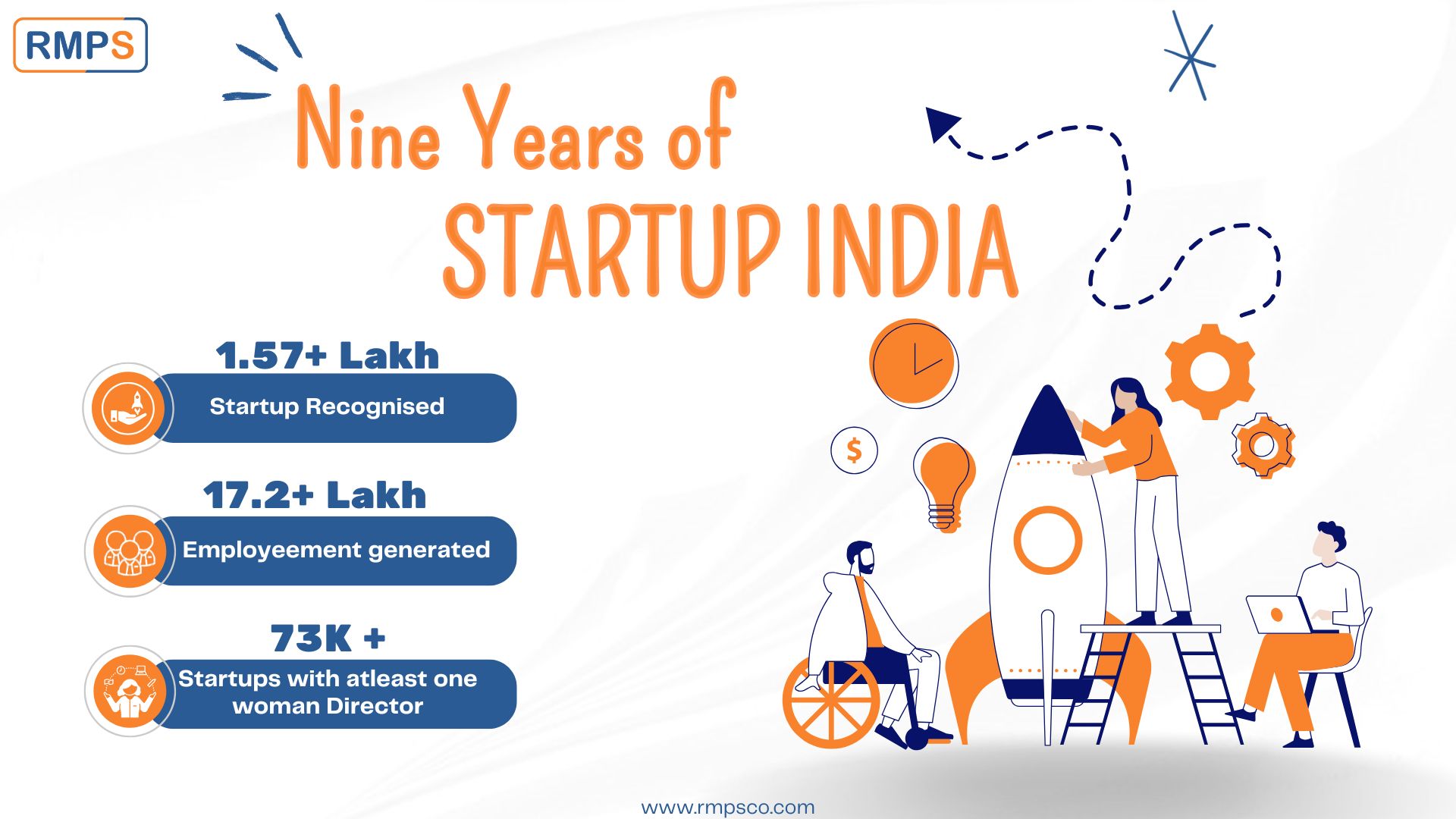

9 Years of Startup India: Transforming the Entrepreneurial Landscape!

In 2016, India’s startup ecosystem was at a nascent stage. With only a handful of startups and minimal representation on the global map. The idea of a thriving entrepreneurial culture seemed ambitious. Fast forward nine years, and the landscape has been completely transformed. Thanks to the vision and initiatives under the Startup India campaign. From […]

Advisory on Waiver Scheme under Section 128A: A Guide for Taxpayers

The Goods and Services Tax Network (GSTN) has recently issued an important advisory regarding the waiver scheme under Section 128A. To help taxpayers benefit from the scheme, this guide simplifies the advisory and provides actionable steps. Key Updates and Guidelines 1.Official NotificationThe advisory was released on December 29, 2024. Taxpayers can find the complete details […]

Streamlining GST Compliance: Phase-III Updates for Table 12 of GSTR-1

The Goods and Services Tax Network (GSTN) has introduced Phase-III enhancements for Table 12 of GSTR-1 and GSTR-1A, effective from January 2025. These changes simplify reporting, improve accuracy, and ensure better compliance with GST regulations. This article highlights the key updates, making it easier for taxpayers to understand and implement them. What’s New in Table […]

Refund on Account of Export of Goods (With Payment of Tax)

Exporting services while complying with tax regulations is essential for businesses operating internationally. Understanding the process to claim refunds under such circumstances can help exporters maintain their cash flow and ensure compliance. Below, we outline the steps to file for a refund on the GST Portal effectively. Steps to File Refund for Export of Services […]

Enabling Filing of Application for Rectification Under Notification No. 22/2024-CT

The Central Government, based on recommendations from the 54th GST Council, has introduced a new facility under Notification No. 22/2024-CT dated October 8, 2024. This notification allows registered taxpayers to rectify demands related to incorrect Input Tax Credit (ITC) claims that were previously issued due to non-compliance with sub-section (4) of section 16 of the […]