A Comprehensive Guide to E-Invoicing and Tax compliance

E-invoicing has revolutionized the way businesses handle invoicing and tax compliance. This blog explains what e-invoicing is, how it works, and why it is beneficial for businesses in India. What is E-Invoicing? E-invoicing is a digital system where businesses report their invoices to an Invoice Registration Portal (IRP) for validation under GST rules. After uploading […]

Comprehensive Checklist for Accountants During GSTR-9 and 9C Filing

As the financial year concludes, the responsibility of ensuring accurate GST compliance intensifies. Filing the GST annual return (GSTR-9) and reconciliation statement (GSTR-9C) are crucial for maintaining transparency and avoiding penalties. This blog provides a comprehensive checklist for accountants to ensure seamless GST compliance, especially when filing GSTR-9 and GSTR-9C. Understanding GSTR-9 and GSTR-9C Before […]

Understanding Tax Collected at Source (TCS) and Its Accounting Entries

Introduction Tax Collected at Source (TCS) is a provision under the Income Tax Act, 1961, where the seller collects tax at the time of sale and deposits it with the government. This system ensures tax compliance, minimizes evasion, and promotes accountability. For businesses, accurate accounting of TCS is essential for both financial management and legal […]

RCM Time of Supply Rule Changes Effective from November 1, 2024: What Businesses Need to Know

The Central Board of Indirect Taxes and Customs (CBIC) has introduced critical updates to the Reverse Charge Mechanism (RCM) under the Goods and Services Tax (GST), effective from November 1, 2024. These changes aim to enhance compliance, streamline self-invoicing, and ensure accurate input tax credit (ITC) claims. Here’s a detailed breakdown of the updates and […]

Why Virtual CFOs Are a Game-Changer for SMEs!

Small and Medium Enterprises (SMEs) are the backbone of the global economy, driving innovation, job creation, and local development. However, many SMEs struggle to balance growth aspirations with financial challenges, often lacking the resources to hire a full-time Chief Financial Officer (CFO). This is where Virtual CFOs (Chief Financial Officers) step in as a transformative […]

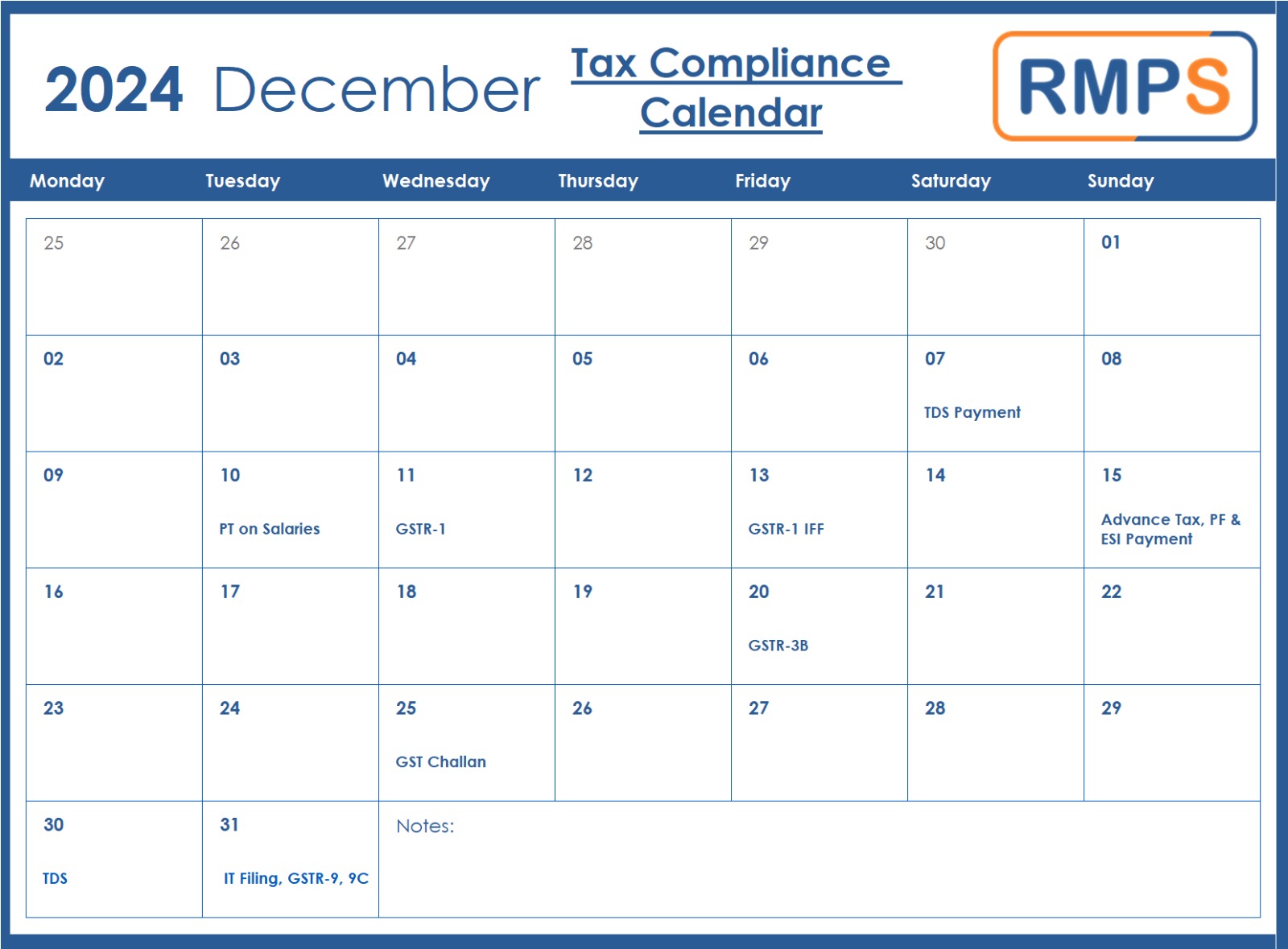

December 2024 Tax Compliance Calendar: Deadlines You Can’t Miss

Managing tax compliance is essential for businesses. Missing key deadlines can lead to penalties, which can be avoided by careful planning. The December 2024 Tax Compliance Calendar outlines important dates for tax filings, payments, and submissions. Let’s explore the key deadlines and how you can meet them effectively. Important Tax Deadlines in December 2024 December […]

AI-Powered Outsourcing: The Future is Here!

The outsourcing industry is undergoing a transformative evolution thanks to artificial intelligence (AI). By integrating cutting-edge AI Powered technologies, businesses are experiencing unparalleled efficiency, enhanced decision-making, and innovative service offerings. Here’s how AI is reshaping the outsourcing landscape: 1. Enhanced Efficiency and Productivity 2. Elevated Customer Experience 3. Enhanced Data Analysis and Insights 4. Increased […]

Comprehensive Guide: E-Invoice Glossary and Step-by-Step Process

To support businesses in complying with GST regulations, the Goods and Services Tax Network (GSTN) has released two valuable resources: an E-Invoice Glossary and a Step-by-Step Guide. These documents are designed to make the e-invoicing process clear and easy to follow. Let’s dive into a detailed overview and simplified explanation of e-invoicing. What is E-Invoicing? […]

Advisory for Reporting TDS Deducted by Scrap Dealers in October 2024

Effective October 10, 2024, as per Notification No. 25/2024-Central Tax, all registered persons receiving supplies of metal scrap (classified under Chapters 72 to 81 of the Customs Tariff Act, 1975) from other registered persons must deduct Tax Deducted at Source (TDS) under Section 51 of the CGST Act, 2017. Issue: Reporting TDS Deducted in October […]

The Role of a Virtual CFO in Decision-Making: Financial Insights on Demand!

In today’s fast-paced business environment, decision-making has never been more critical or more complex. Entrepreneurs and business leaders face a constant stream of financial choices, from budgeting and forecasting to investments and risk management. However, not every business can afford or justify hiring a full-time Chief Financial Officer (CFO). Enter the Virtual CFO (Chief Financial […]