The 1x10x100 Strategy: Your Blueprint for Business Success!

Is your business ready to take off? Are you searching for a straightforward yet powerful approach to spark growth and accelerate your journey to success? Every business owner dream of growth but achieving it consistently can be challenging. That’s why we’ve created the 1x10x100 Strategy—a simple, powerful framework that helps businesses transform ideas into measurable […]

New Three-Year Limit for GST Returns Filing: What You Need to Know

Introduction The Finance Act, 2023, has introduced a new rule that limits the time taxpayers have to file their GST returns. Starting from October 1, 2023, taxpayers must file their returns within three years from the due date. This blog will explain this change, its impact, and the steps you should take to stay compliant. […]

Setting the Week for Business Growth and Success!

Every week, we’re here to kickstart your week with practical tips and insights for growing your business and advancing your leadership skills. Monday Mentoring is all about gaining momentum early in the week, so you can navigate challenges with confidence and steer your business towards success. Today, let’s dive into why mentorship matters for business […]

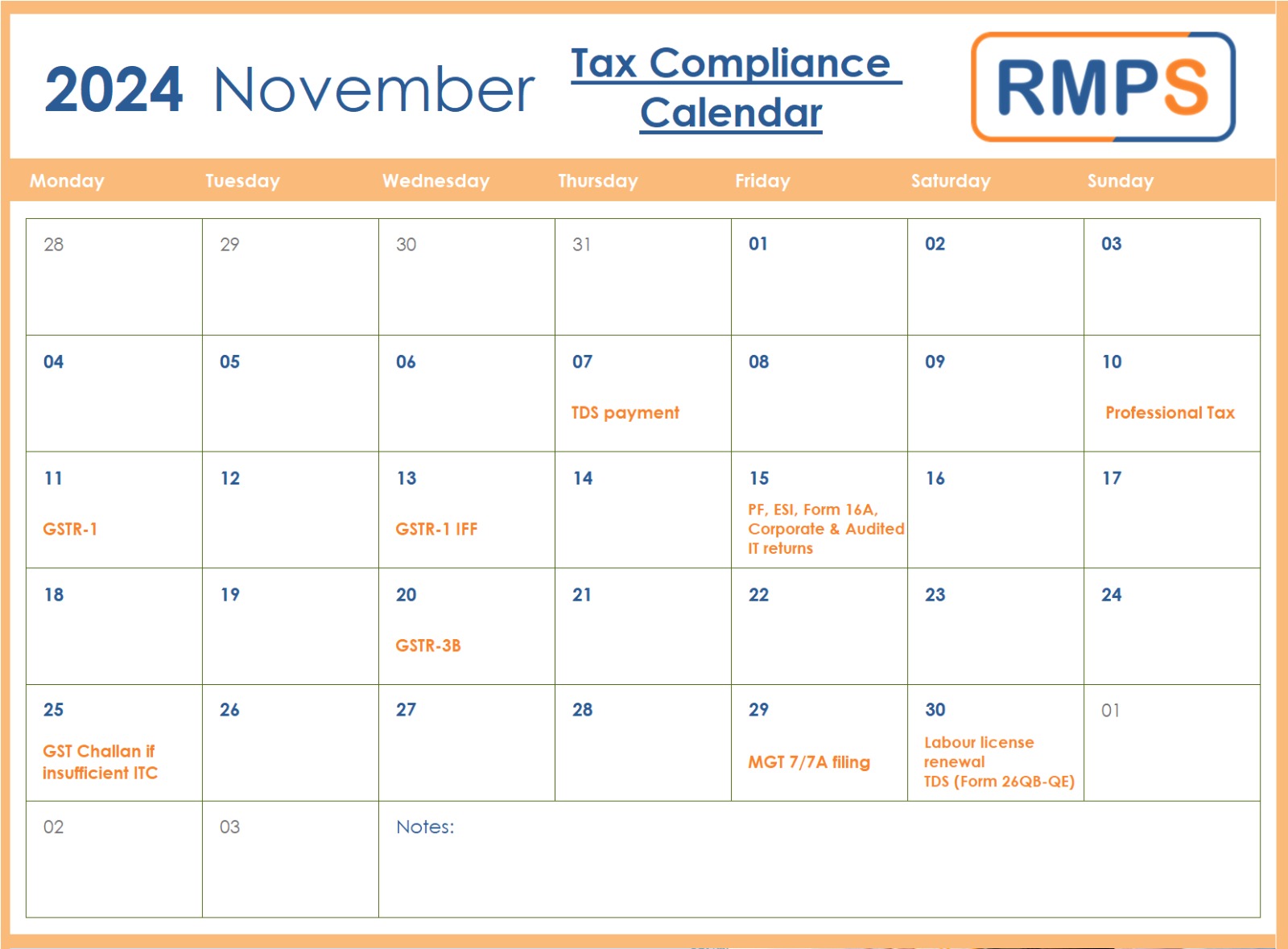

Essential Tax and Compliance Deadlines in November 2024: A Quick Guide for Businesses

November is a significant month for businesses, with multiple tax and regulatory deadlines. Meeting these deadlines is essential to avoid penalties, maintain compliance, and ensure seamless business operations. Here’s a quick rundown of what to keep in mind for November 2024. 1. TDS Payment (Due by November 7th) Businesses need to deposit the Tax Deducted […]

Advisory on Waiver Scheme Under Section 128A of the CGST Act

The GST Council’s recent decision to waive interest and penalties under Section 128A of the CGST Act, 2017, offers welcome relief for many taxpayers. Announced at the Council’s 53rd meeting on June 22, 2024, the waiver applies to cases where no fraud is involved, helping reduce tax disputes and simplifying compliance. Key Points About the […]

Form GST DRC-03A: A Guide for Taxpayers to Ensure Accurate Payment Adjustment

The Goods and Services Tax (GST) system recently introduced Form GST DRC-03A to help taxpayers link their demand payments accurately to outstanding demand orders. This update addresses issues where payments made via Form GST DRC-03 do not close the demand in the electronic liability register. This blog provides a step-by-step guide to using Form DRC-03A, […]

The Secret to Business Growth: Mastering Effective Communication!

In the competitive business world, effective communication is more than just exchanging information; it’s the key to driving sustainable growth. From improving team collaboration to enhancing customer relationships, mastering communication can transform your business. In this blog, we’ll explore how effective communication can propel business growth, and we’ll share practical tips to help you harness […]

The New Locking Feature for Auto-Populated Liability in GSTR-3B Benefits and Challenges.

The Goods and Services Tax Network (GSTN) issued an advisory on October 17, 2024, regarding the hard locking of auto-populated values in GSTR-3B. This new step aims to reduce human errors and improve accuracy in GST return filings. What is Form GSTR-3B? Form GSTR-3B is a simplified summary return. Taxpayers use this form to report […]

Understanding the Waiver of Interest and Penalty under Section 128A of the CGST Act

On October 15, 2024, the Indian government introduced Circular No. 238/32/2024-GST. This circular explains Section 128A of the CGST Act, 2017, which aims to help businesses reduce their tax burden. By using this waiver, businesses can avoid penalties and interest charges on specific tax demands. However, to take full advantage, businesses must meet certain conditions […]

Actionable Strategies to Promote a Growth Mindset within Your Business Culture!

A growth mindset is the belief that abilities and intelligence can be developed through dedication, learning, and hard work. In today’s fast-paced business world, fostering a growth mindset is crucial for long-term success. By promoting a growth mindset within your business culture, you can encourage continuous learning, innovation, and resilience among your employees. This not […]