Invoice Management System (IMS): A Comprehensive Update

With the launch of the Invoice Management System (IMS), the GST landscape is set for a major upgrade. Effective from October 1, 2024, IMS empowers taxpayers to manage invoices more efficiently, allowing you to accept, reject, or keep invoices pending. This blog dives deep into the functionalities of IMS, covering frequently asked questions (FAQs) and […]

High-Quality Virtual CFO Services: Tailored Solutions for Every Business!

In today’s fast-paced business environment, having a Chief Financial Officer (CFO) on your team is crucial for maintaining financial health and ensuring long-term success. However, many small and medium-sized businesses (SMEs) may not have the resources to hire a full-time CFO. That’s where Virtual CFO services come in, offering a cost-effective and high-quality solution tailored […]

Understanding GST on Rent After the 54th GST Council Meeting: Key Updates and Changes

The 54th GST Council Meeting introduced several important updates regarding GST on rent for both commercial and residential properties. These changes impact both landlords and tenants based on their GST registration status. Let’s explore these updates clearly and concisely. Commercial Property: GST Rules Explained 1. Both Landlord and Tenant Registered When both the landlord and […]

Growth Hacking for Startups: Low-Cost Strategies for Big Impacts !

Growing a startup on a limited budget is challenging, but growth hacking offers creative solutions for rapid success. Growth hacking focuses on leveraging innovative, data-driven strategies to boost user acquisition with minimal costs. What is Growth Hacking? Growth hacking is a strategy aimed at scaling a business quickly using creative, low-cost techniques and data-driven insights. […]

Revolutionizing GST Compliance: The New Invoice Management System (IMS)

In a major leap for the GST ecosystem, the GST Common Portal has launched the Invoice Management System (IMS). This system transforms how recipient taxpayers handle invoices. Now, taxpayers can easily accept, reject, or keep invoices pending for future use. As a result, the process becomes more streamlined, improving reconciliation and boosting accuracy. Key Features […]

Streamlining Your Operations: Key Strategies for Sustained Business Growth!

In today’s fast-paced and competitive business world, success isn’t just about launching great products or services. It’s about ensuring that your internal processes are efficient, cost-effective, and scalable. Streamlining your operations is essential for maintaining efficiency, cutting unnecessary costs, and ultimately driving sustained business growth. In this blog, we’ll explore the key strategies that can […]

Understanding Advance Tax: A Comprehensive Guide

Advance tax is an essential part of income tax management in India. It allows taxpayers to spread their tax payments throughout the financial year rather than making a large payment at the end. This guide will explain what advance tax is, who needs to pay it, important due dates, and how you can pay it […]

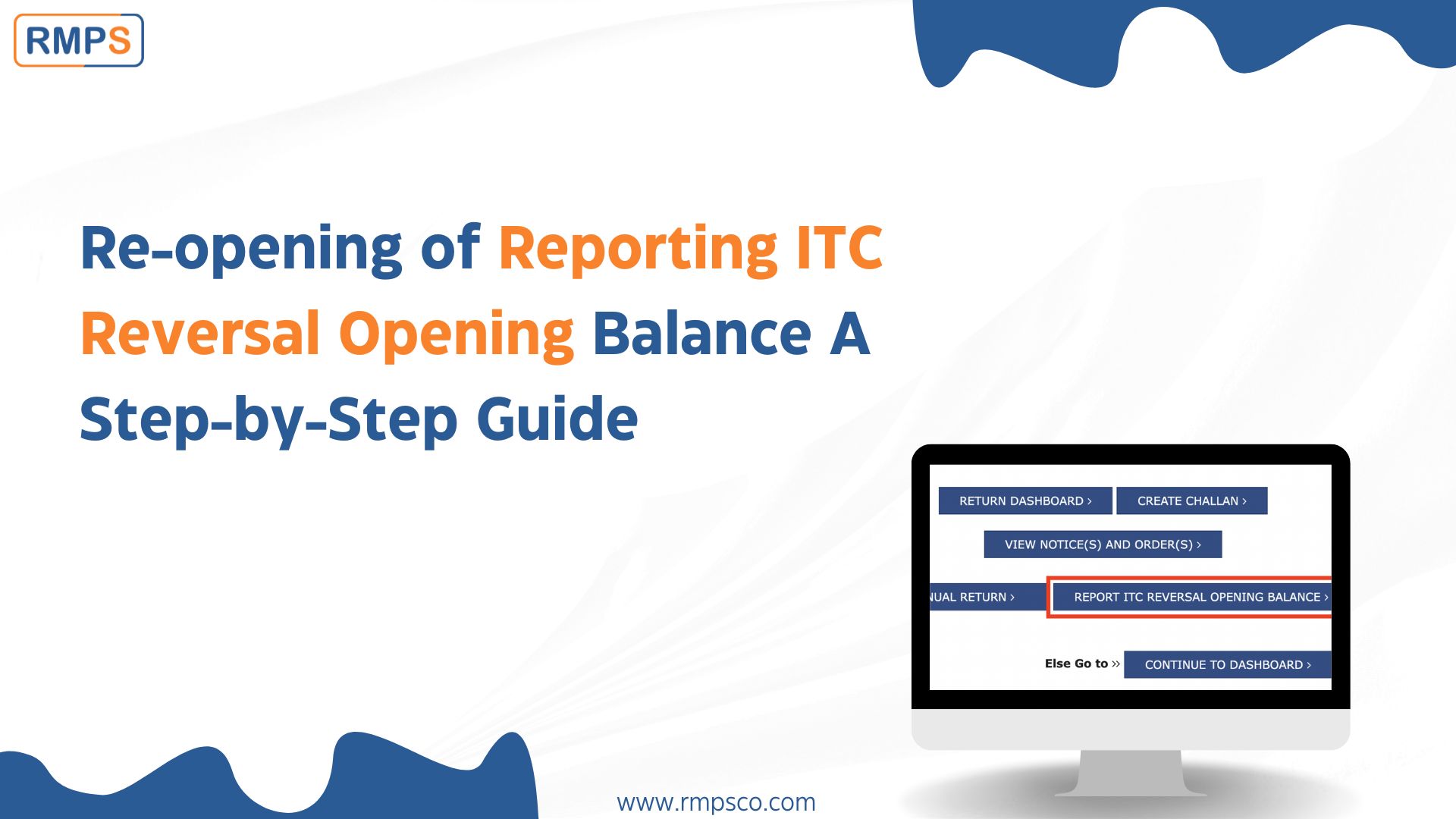

Re-opening of Reporting ITC Reversal Opening Balance: A Step-by-Step Guide

The government has re-opened the reporting of ITC (Input Tax Credit) reversals. Businesses need to follow new steps to comply with this update. In this blog, we’ll explain the changes and how you can report your ITC reversal correctly. What Has Changed? In July 2022, the government introduced Notification No. 14/2022 – Central Tax. This […]

RE-Invest 2024: A Global Call to Renewable Energy Investors !

India is fast emerging as a leader in the renewable energy sector and RE-Invest 2024 is set to be the cornerstone of this transformation. In a world that is rapidly diversifying its renewable energy supply chain. The RE-Invest 2024 brings stakeholders together to explore investments in India’s rapidly growing energy market. A prime opportunity! India’s […]

Transforming Indian Industry: A Journey of Improvement and Innovation!

India has always been a land of opportunities, rich in culture, diversity, and talent. However, one of the greatest challenges the Indian industry faces is transforming. It’s vast industrial landscape into one that thrives on innovation, efficiency, and continuous improvement. While many may feel daunted by the scale of such a transformation, the truth is […]