7 Things to Learn About Virtual CFO Services

As businesses navigate the complexities of growth and financial management, many are turning to Virtual CFO services for expert guidance without the cost of a full-time executive. But what exactly are Virtual CFO services, and how can they benefit your business? Here are seven crucial things to learn about Virtual CFO services that can help […]

Small Businesses Exempt from 2023-24 Annual Return Filing!

In an effort to reduce compliance burdens on small businesses, the Government of India has issued a significant update under the GST regime. On July 10, 2024, the Ministry of Finance released Notification No. 14/2024 – Central Tax, which provides much-needed relief by exempting small enterprises from filing annual GST returns for the financial year […]

Virtual CFO Services: Tailored Solutions for Diverse Business Needs!

In today’s fast-paced business environment, having access to expert financial guidance is crucial for sustainable growth and success. However, not every business has the resources to hire a full-time Chief Financial Officer (CFO). This is where Virtual CFO services come into play. Offering tailored financial solutions to meet the unique needs of diverse businesses. What […]

Key Updates to the Central GST(CGST) Rules 2024

The Indian government recently issued Notification No. 12/2024 – Central Tax. This notification introduces changes to the Central Goods and Services Tax (CGST) Rules, 2017. These updates, effective from July 10, 2024, are important for businesses to understand. By knowing these changes, companies can stay compliant and make the most of their tax strategies. Let’s […]

Revenue Rethink: Creative Business Models That Drive Profit

In today’s fast-paced business environment, traditional revenue models are being challenged by innovative approaches that redefine how companies generate profit. To stay competitive, businesses must rethink their revenue strategies and adopt creative business models that not only drive profit but also provide sustainable growth. In this blog, we’ll explore some of the most effective and […]

The Biggest Hurdle in the Startup Journey: Employee Problems !

Starting a new business is an exhilarating journey filled with opportunities and challenges. Among a lot of obstacles that startups face, employee problems stand out as one of the most significant hurdles. From hiring the right talent to maintaining a motivated workforce, managing employee-related issues can make or break a startup. In this blog, we’ll […]

New ISD Registration Requirement for GST Taxpayers from April 2025

GST Taxpayers Must Register as ISD for Common ITC Distribution Introduction Starting April 1, 2025, GST taxpayers registered in multiple states must register as Input Service Distributors (ISD) to distribute common Input Tax Credit (ITC). This requirement, outlined in Notification No. 16/2024 – Central Tax and The Finance Act, 2024, aims to streamline ITC distribution […]

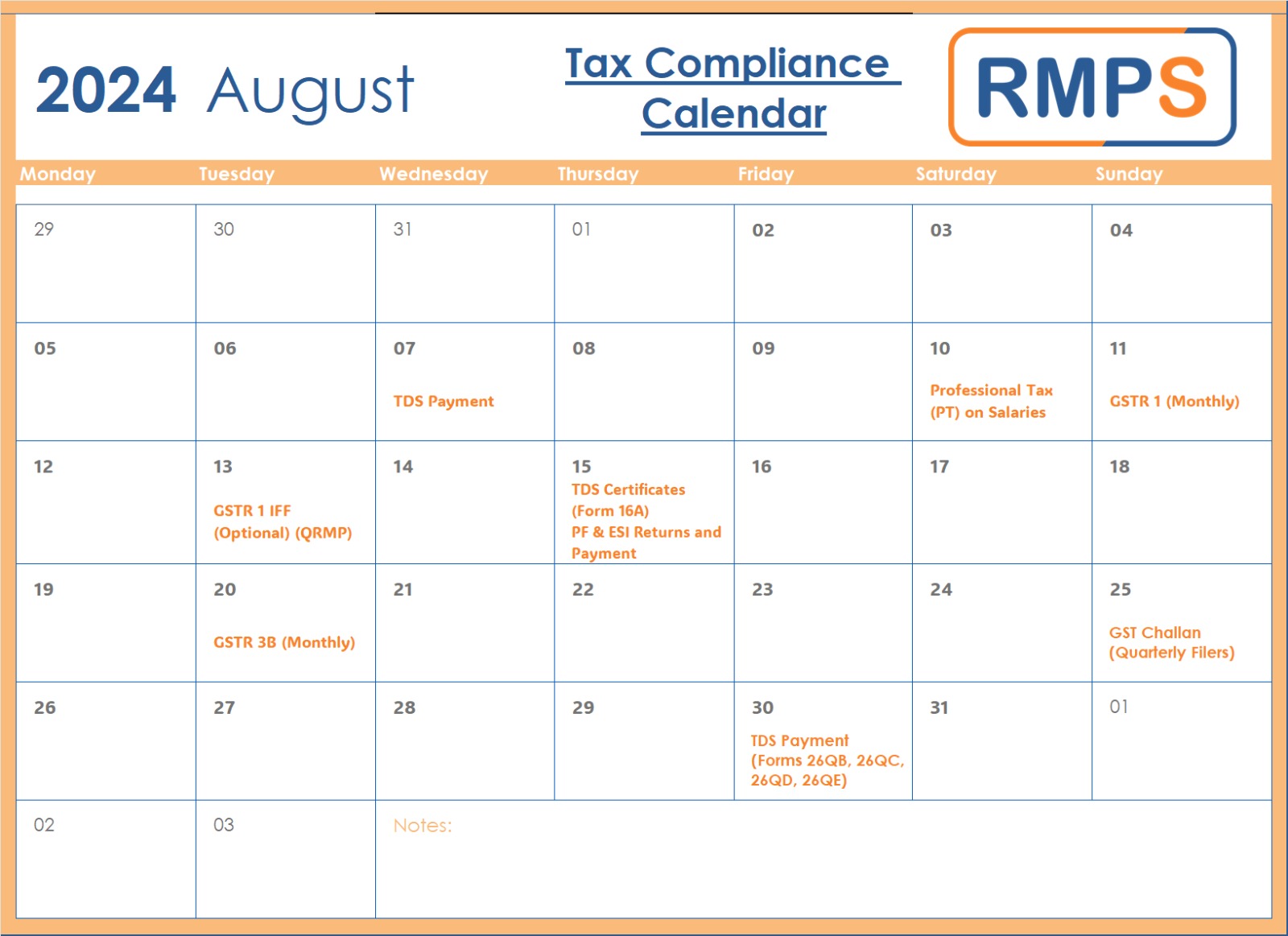

August 2024 Compliance Calendar: Key Deadlines for Businesses

As a business owner or financial professional, staying on top of compliance deadlines is crucial to avoid penalties and ensure smooth operations. Here’s a guide to the essential tax and regulatory deadlines for August 2024. 07 August: TDS Payment for July 2024 Ensure you complete your Tax Deducted at Source (TDS) payments for July by […]

GST Form 8 Updates: New TDS Rates Effective July 10, 2024

In a recent development, the Central Government has announced significant changes to GST Form 8 and TDS rates. Effective from July 10, 2024, these changes aim to streamline compliance for taxpayers and reduce the financial burden on businesses. Key Changes: Detailed Overview: The government has revised GST Form 8, used by e-commerce operators for filing […]

Understanding Form GSTR-1A: Amendments Made Easy

When it comes to managing GST returns, accuracy is key. Mistakes in filing can lead to discrepancies, affecting your business’s compliance and financial standing. Fortunately, the Indian GST system provides a mechanism to correct such errors: Form GSTR-1A. This blog will guide you through the essentials of GSTR-1A, its purpose, filing procedure, and critical considerations. […]