Complying with the Law: Mandatory Bank Account Details Submission for GST Registered Taxpayers

Introduction: Ensuring compliance with the Central Goods and Services Tax (CGST) Act, 2017, is paramount for businesses operating within the GST framework. One critical aspect of this compliance is the mandatory submission of bank account details by registered taxpayers. In this blog post, we will explore the legal provisions requiring this submission, the consequences of […]

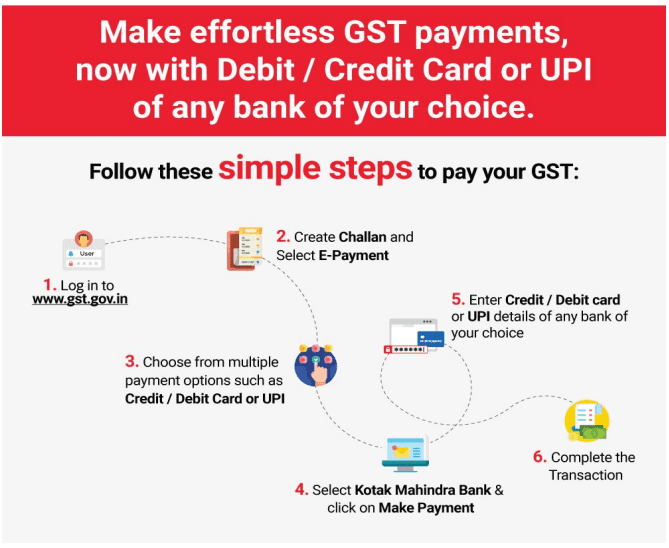

Expanding Horizons: New Payment Options for GST Taxpayers

Introduction: In a move to enhance convenience for taxpayers registered under the Goods and Services Tax (GST), the government has introduced two additional methods of payment under the e-payment system. These new facilities, namely Credit Card (CC) and Debit Card (DC), along with Unified Payments Interface (UPI), offer taxpayers more flexibility in managing their financial […]

“Simplified Steps: Understanding GSTR-1/IFF’s Tables 14 and 15”

Introduction: The ever-evolving landscape of Goods and Services Tax (GST) in India has brought forth a new advisory – Notification No.: 26/2022 – Central Tax dated December 26, 2022. This advisory sheds light on the introduction of Tables 14 and 15 in the GSTR-1/IFF (Invoice Furnishing Facility), impacting businesses involved in E-Commerce transactions or liable […]

GST Portal Unveils Unified Interface for Notices and Orders Tab.

The Goods and Services Tax (GST) Portal introduces a user-friendly redesign, consolidating “Notice and Order” and “Additional Notices and Orders” tabs into a single window. This unified interface enhances efficiency and simplifies access for users. It offers a comprehensive view of diverse tax-related communications, including registration, return defaults, and assessment orders. Notably, the Refund module […]

Navigating the Financial Year End: Essential Checkpoints for GST and Accounting Compliance

Introduction: As the financial year draws to a close, businesses must gear up for the annual ritual of evaluating their financial health, ensuring compliance with tax regulations, and preparing for the upcoming year. In this blog post, we will explore the crucial checkpoints that businesses need to consider for Goods and Services Tax (GST) compliance […]

Breaking News: Decision Of Blocking Generation Of E-Way Bill Without GST E-Invoice Withdrawn.

Introduction: Hey, fellow business enthusiasts! 🌐✨ We’ve got some exciting news to share in the world of electronic invoicing. Brace yourselves for a game-changing update – the blockage of E-Way Bill generation without e-InvoiceIRN has officially been lifted! 🎉💼 Why the Change? on analysis, it is found that some of the taxpayers, who are eligible […]

GST E-Invoice System Update: Mandatory Inclusion of 6-Digit HSN Code for High-Turnover Taxpayers

In a significant development for businesses operating in the financial landscape, a new regulation is set to reshape the way e-Invoices are handled. Effective from December 15, 2023, taxpayers with an Aggregate Annual Turnover (AATO) of 5 Crores and above will now be required to incorporate at least a 6-digit HSN (Harmonized System of Nomenclature) […]

Good News: GSTN Extends Deadline for ITC Reversal Opening Balance Declaration

The Goods and Services Tax Network (GSTN) has recently issued an advisory to provide taxpayers with guidance on reporting their ITC Reversal opening balance. In this blog post, let’s dive into the advisory and its implications for taxpayers. Key Highlights of the Advisory Purpose of the Facility The GSTN has provided this facility to aid […]

Facing GST Audit Notices? Here’s Your Checkpoints and Responses

Introduction: The Goods and Services Tax (GST) audit for the financial year 2017-18 introduced several complexities for businesses. One of the key aspects of this process is responding to notices from the GST department. In this blog, we’ll explore the types of notices that businesses may encounter during the GST audit for 2017-18, delve into […]

Advisory: Two-factor Authentication for Taxpayers

Dear Taxpayers, This Article is only a knowledge-sharing initiative and is based on the Relevant Provisions as applicable and as per the information existing at the time of the preparation. In no event RMPS & Co. or the Author or any other persons be liable for any direct and indirect result from this Article or […]