Introduction: In today’s digital era, the use of technology has transformed the way taxpayers interact. The Goods and Services Tax (GST) system is providing a user-friendly seamless communication between taxpayers on GST portal. This article explores the communication features available on the GST portal, focusing on the ability to notify suppliers regarding pending invoices and the subsequent intimation through email and SMS.When a user composes a notification, an email and SMS are automatically sent to the registered email address and mobile number of the supplier. This multi-channel communication ensures that the supplier stays informed even if they are not actively using the GST portal.

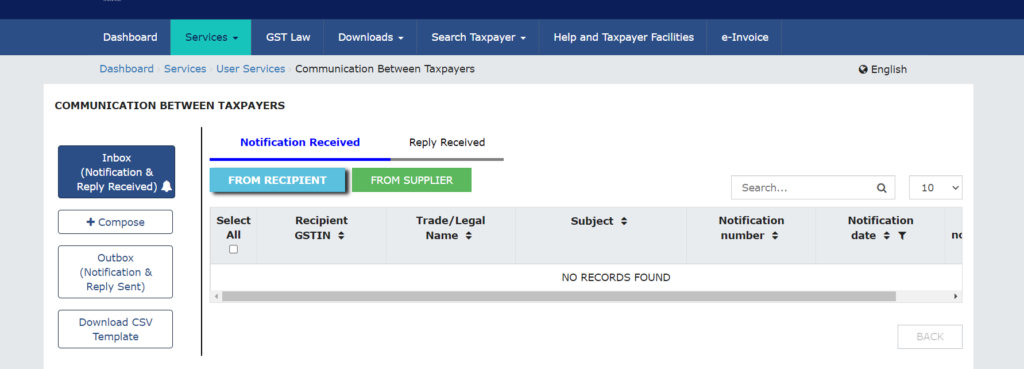

To access this functionality, users need to navigate to the “Dashboard” section on the portal. Under the “Services” tab on the GST portal, users can find a dedicated section called “User Services.” This section offers features to enhance the communication between taxpayers.

Sending Notifications to Suppliers: Once in the “Communication Between Taxpayers” tab, taxpayers can compose and send notifications to their suppliers regarding pending invoices. This feature enables efficient communication and serves as a reminder for suppliers to take necessary action.

| Communication for the following issues can be done on GST PORTAL: |

| File Missing Documents – Buyer can inform the Supplier to upload the required missing documents. |

| Reject Amendment Required – Buyer can inform the counterparty to amend the invoice, debit note or a credit note |

| Reject – Wrongly sent to Me – Buyer can inform the counterparty that the document’s supply is ‘wrongly sent to me’. |

| Re-uploaded Document – Taxpayer can inform the Supplier to delete or re-upload the uploaded document. |

| Payment Made – Recipient can inform the Supplier that the payment has been made. |

| Other – Any other information can be added. |

File Missing Document: This option allows taxpayers to communicate regarding situations where a required document is missing from their records or submission i.e., Supplier has not reported invoices in their GSTR. I

Reject Amendment Required: In instances where an amendment to a previously filed document is deemed necessary, taxpayers can communicate this requirement through the GST Portal. This facilitates the exchange of information, enabling taxpayers to provide the necessary clarifications or rectifications.

Rejected – Wrongly sent to me : This communication feature is utilized when a document or communication is erroneously sent to a taxpayer, i.e., Invoice which is not pertaining to us is reflecting in our GSTR-2B we can communicate the same with supplier.

Re-uploaded Document: In cases where a document needs to be re-uploaded due to errors or omissions, taxpayers can communicate this action through the GST Portal. This functionality ensures that the taxpayers are duly informed about the updated or corrected version of the document, enabling seamless compliance.

Payment Made: This communication option enables taxpayers to report and communicate the details of a payment made towards their GST obligations.

Other: This category covers various additional issues or queries that taxpayers may need to communicate on the GST Portal. It serves as a general channel for initiating conversations with the authorities on matters not specifically categorized in the preceding options. Taxpayers can provide comprehensive descriptions for their specific concerns.

Conclusion: The communication feature available on the GST portal has revolutionized the way taxpayers interact with each other. By leveraging this platform, taxpayers can easily notify their suppliers about pending invoices and track the progress of their communication.

Disclaimer: This Article is only a knowledge sharing initiative and is based on the Relevant Provisions as applicable and as per the information existing at the time of the preparation. In no event RMPS & Co. or the Author or any other persons be liable for any direct and indirect result from this Article or any inadvertent omission of the provisions, update etc if any.

Published on: May 21, 2023