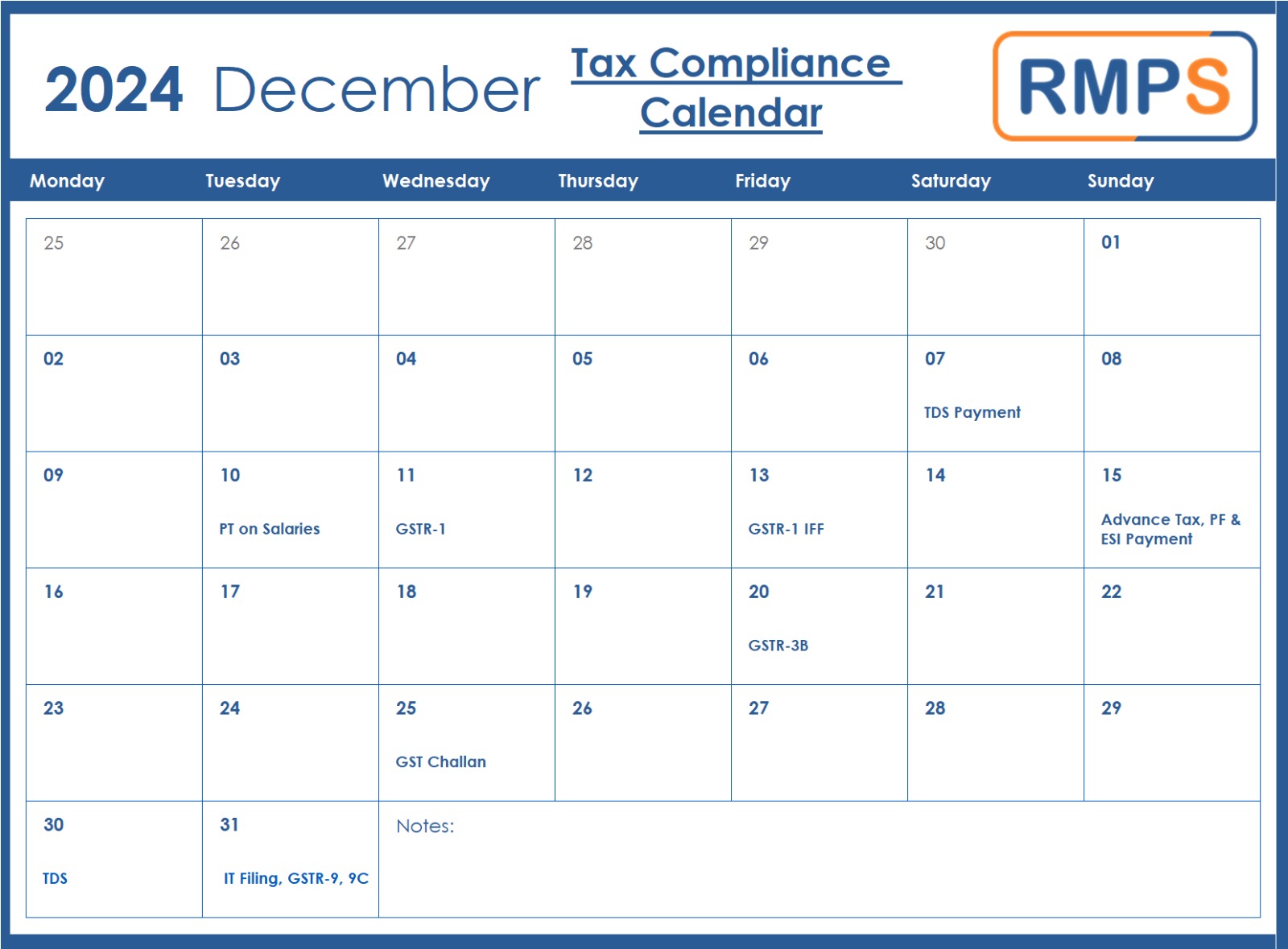

Managing tax compliance is essential for businesses. Missing key deadlines can lead to penalties, which can be avoided by careful planning. The December 2024 Tax Compliance Calendar outlines important dates for tax filings, payments, and submissions. Let’s explore the key deadlines and how you can meet them effectively.

Important Tax Deadlines in December 2024

December 7: TDS Payment

Ensure you pay Tax Deducted at Source (TDS) for the previous month on time. This payment allows the deductee to claim tax credits smoothly, so don’t delay.

December 10: Professional Tax on Salaries

Employers must deposit Professional Tax (PT) on employees’ salaries. This state-level tax is mandatory and late payments can result in fines.

December 11: GSTR-1 Filing

File GSTR-1 to report outward supplies of goods and services. Verify that all details are accurate to avoid issues during the GSTR-3B filing process.

December 13: GSTR-1 IFF (Invoice Furnishing Facility)

Small taxpayers using the QRMP scheme should submit their November invoices via the IFF by this date. Staying prompt ensures that buyers can claim their Input Tax Credit (ITC) without delays.

December 15: Advance Tax, PF, and ESI Payments

Advance Tax: This is the due date for the third installment of advance tax. Paying on time helps avoid interest under sections 234B and 234C of the Income Tax Act.

Provident Fund (PF) and Employee State Insurance (ESI): Employers should deposit contributions for both PF and ESI to remain compliant with labor laws.

December 20: GSTR-3B Filing

GSTR-3B is a summary return that includes both sales and GST liability. It is crucial to reconcile Input Tax Credit (ITC) before submission.

December 25: GST Challan Payment

If any GST liability remains unpaid, be sure to generate and settle the GST challan by this date to avoid interest or penalties.

December 30: TDS Payment

Before December ends, double-check to ensure all TDS obligations are fulfilled.

December 31: Annual Returns (IT Filing, GSTR-9, and 9C)

Income Tax Filing: Avoid penalties by filing income tax returns before the year ends.

GSTR-9 and GSTR-9C: Large taxpayers must submit annual returns and reconciliation statements for FY 2023-24 by this date.

Tips to Stay Compliant

- Use Digital Tools: Set automated reminders for each deadline to ensure you never miss a payment or filing.

- Maintain Accurate Records: Regularly update and reconcile your financial data to simplify tax filing.

- Consult Experts: Reach out to a tax consultant or CA for guidance on complex filings like GSTR-9C.

Conclusion

By staying organized and following the December 2024 Tax Compliance Calendar, you can meet all deadlines effortlessly. This not only ensures smooth business operations but also helps avoid unnecessary penalties.

LinkedIn Link : RMPS Profile

This article is only a knowledge-sharing initiative and is based on the Relevant Provisions as applicable and as per the information existing at the time of the preparation. In no event, RMPS & Co. or the Author or any other persons be liable for any direct and indirect result from this Article or any inadvertent omission of the provisions, update, etc if any.

Published on: December 3, 2024