CBIC has made the e-invoicing system mandatory for all registered persons with a turnover of more than Rs.5 crore from 1st August ,2023. (Turnover exceeds in any FY from 2017-18 and onwards).

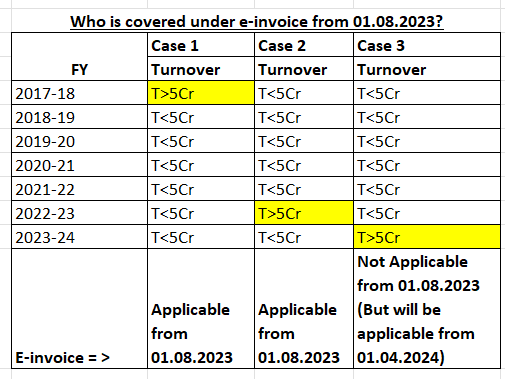

Tabular presentation for understanding applicability of E-invoice:

Once E-invoicing is implemented, it will be implemented for all subsequent financial years. As a result, once E-invoicing is implemented, tax payer can not exit even though turnover comes below the applicable limit in any of the succeeding financial year.

CASE 1/2: If in any of the preceding year it exceeds 5 crores then it will be applicable from 01.08.2023. (In the example crossing in F.Y 2017-18/ F.Y. 2022-23.

CASE 3: If turnover is exceeding 5 crores in F.Y 2023-24 then E-invoice will be applicable from 01.04.2024.

The threshold limit for e-invoicing has changed as per CBIC Notification No. 10/2023-Central Tax dated May 10, 2023.

This Article is only a knowledge-sharing initiative and is based on the Relevant Provisions as applicable and as per the information existing at the time of the preparation. In no event RMPS & Co. or the Author or any other persons be liable for any direct and indirect result from this Article or any inadvertent omission of the provisions, update etc. if any.

Published on: August 1, 2023