The Economic Survey 2024-25 provides a detailed outlook on the state of the Indian economy, highlighting both opportunities and challenges for businesses and industry leaders. As India navigates a dynamic global environment, industry players must strategize and adapt to leverage growth potential while mitigating risks. Below are the key takeaways for Indian businesses and industries from this year’s survey.

1. India’s Economic Resilience and Growth Prospects

📈 Projected GDP Growth: 6.4% in FY25, positioning India among the fastest-growing major economies. ✅ Opportunity: Businesses should focus on expansion, innovation, and export growth to capitalize on economic momentum.

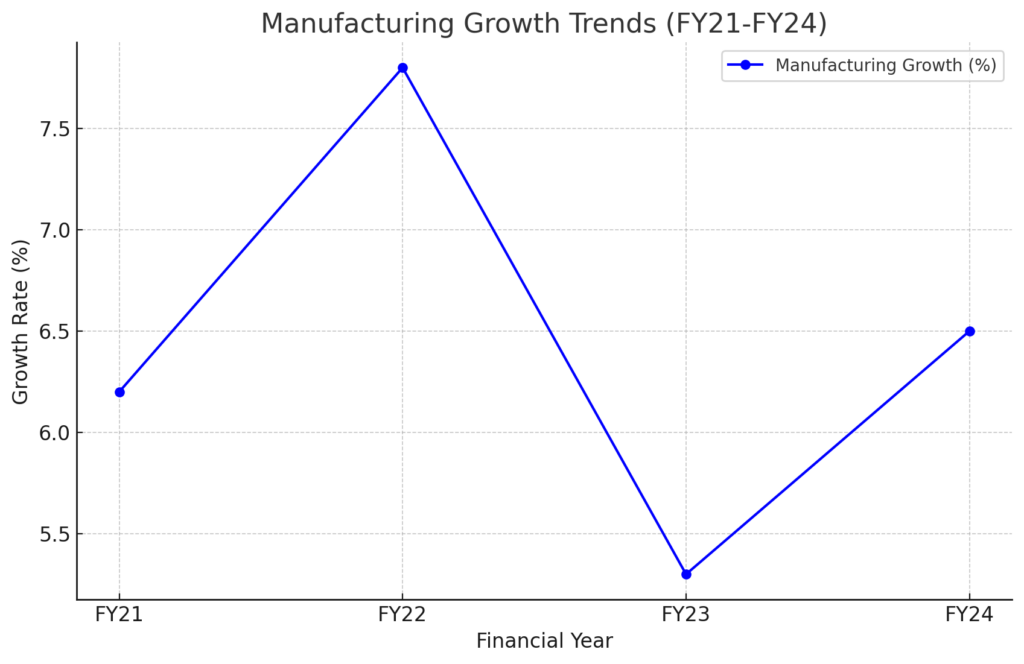

2. Manufacturing Sector: Challenges and Revival

- Global demand slowdown impacting Indian exports.

- Domestic demand remains strong, reducing reliance on international markets.

- PLI schemes continue to support key sectors like electronics, automobiles, and pharmaceuticals.

Manufacturing Growth Trends

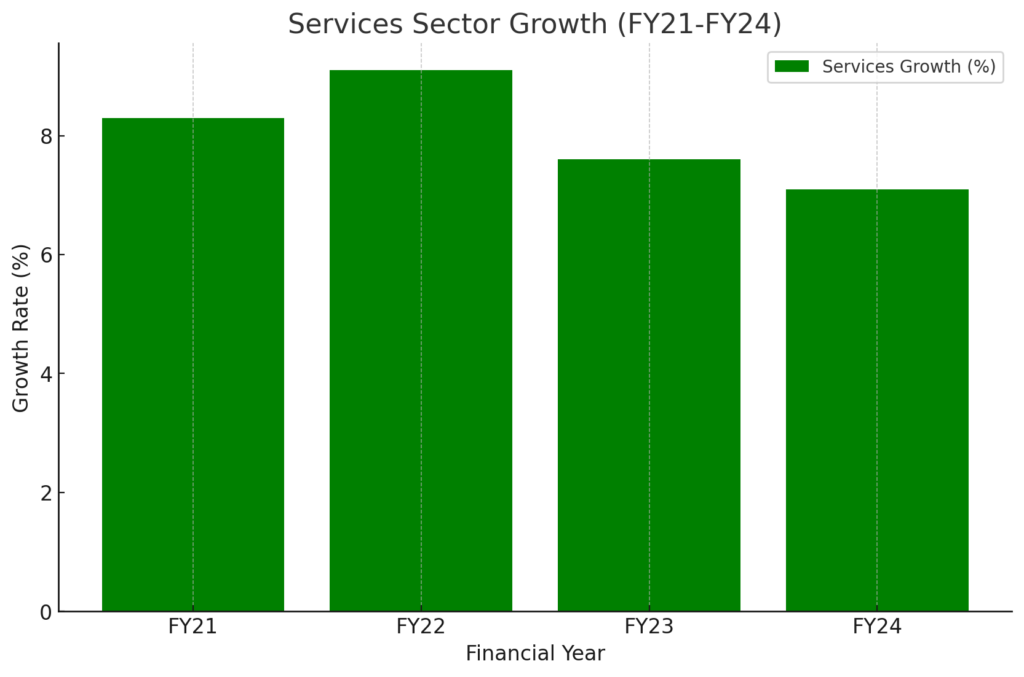

3. Services Sector: The Growth Engine

- 7.1% growth in H1 FY25, led by IT, fintech, tourism, and real estate.

- Digital services, AI, and fintech present lucrative opportunities.

- Booming corporate and leisure travel supports hospitality and aviation.

Services Sector Growth Trends

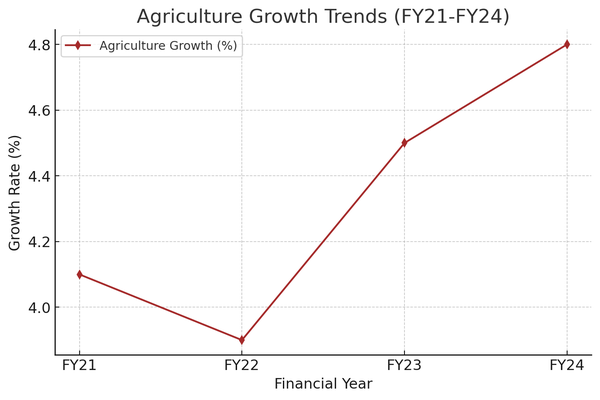

4. Rural Demand and Agriculture’s Growth Potential

- Record Kharif production boosting agriculture and FMCG sector.

- Expanding digital infrastructure enables better rural market penetration.

- Government support for Agri-tech and food processing industries.

Agriculture Growth Trends

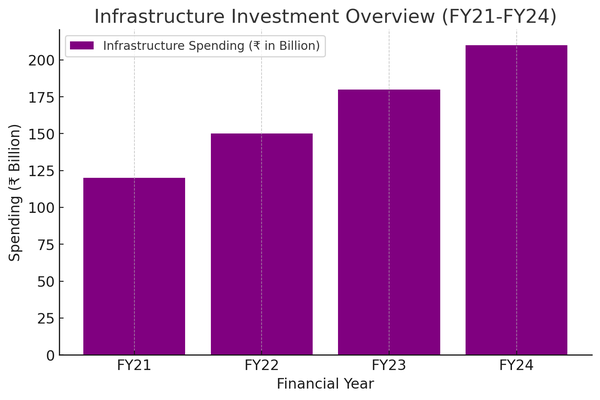

5. Infrastructure Investment: Boost for Construction and Allied Sectors

- Increased capital expenditure (capex) in railways, highways, and urban development.

- Construction, steel, and cement industries set to benefit.

- Private sector investment in infrastructure remains crucial.

Infrastructure Investment Overview

6. Inflation, Supply Chain Disruptions & Energy Security

- Food inflation volatility impacting FMCG and retail sectors.

- Global shipping and trade disruptions require diversified supply chains.

- India’s push for green energy & EVs presents investment opportunities in renewables and battery manufacturing.

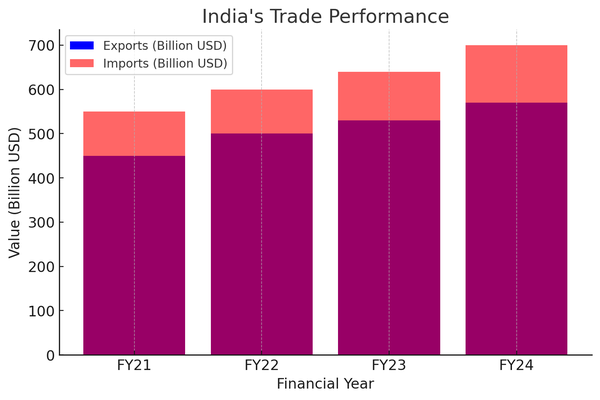

7. Trade and External Sector: Navigating Global Uncertainties

- Export diversification crucial amid global demand slowdown.

- China’s economic slowdown creates supply chain opportunities for India.

- Strengthening global trade agreements to expand export markets.

India’s Trade Performance

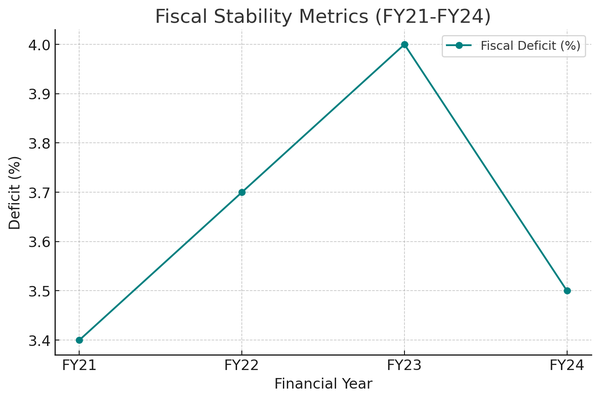

8. Policy & Fiscal Stability: Positive for Business Confidence

- Stable fiscal policies and strong tax revenues ensure macroeconomic stability.

- Higher state-level tax devolution supports local infrastructure projects.

- Regulatory reforms & ease of doing business are key growth drivers.

Fiscal Stability Metrics

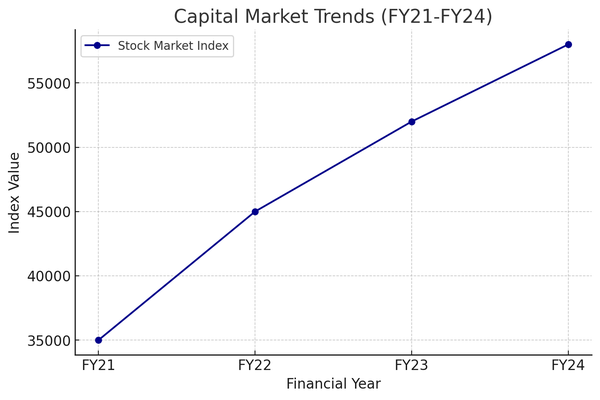

9. Investment and Capital Market Trends

- FDI inflows strong, but portfolio investments remain volatile.

- Businesses planning IPOs should leverage India’s stable financial environment.

- Corporate bond market growth presents alternative funding options.

Capital Market Trends

10. Workforce & Skills Development: Future-Proofing Industries

- Growing demand for skilled workers in AI, automation, and tech-driven sectors.

- Businesses must invest in employee upskilling & digital transformation.

- Enhancing female workforce participation to boost economic output.

Strategic Takeaways for Business Leaders

Unlock domestic potential by tapping into India’s resilient consumer demand and expanding rural markets, while enhancing supply chain stability through diversified sourcing strategies to mitigate geopolitical risks and inflationary pressures. Leverage government support, including PLI schemes and policy reforms, to drive business expansion, and adopt digital transformation with AI, fintech, and automation to revolutionize industrial growth and efficiency. Embrace sustainability and green energy by aligning with India’s energy transition policies for long-term resilience, and invest in workforce development by upskilling employees in emerging sectors to future-proof business operations.

Conclusion

The Economic Survey 2024-25 presents a roadmap for businesses to navigate economic uncertainties while capitalizing on India’s growth momentum. Deregulation, infrastructure development, and trade diversification will shape the future business landscape. Industry leaders who adapt to these trends will be well-positioned for sustained growth and competitiveness.

How are you preparing for these economic shifts? Share your thoughts in the comments! 🚀📈

LinkedIn Link : RMPS Profile

This article is only a knowledge-sharing initiative and is based on the Relevant Provisions as applicable and as per the information existing at the time of the preparation. In no event, RMPS & Co. or the Author or any other persons be liable for any direct and indirect result from this Article or any inadvertent omission of the provisions, update, etc if any.

Published on: January 31, 2025