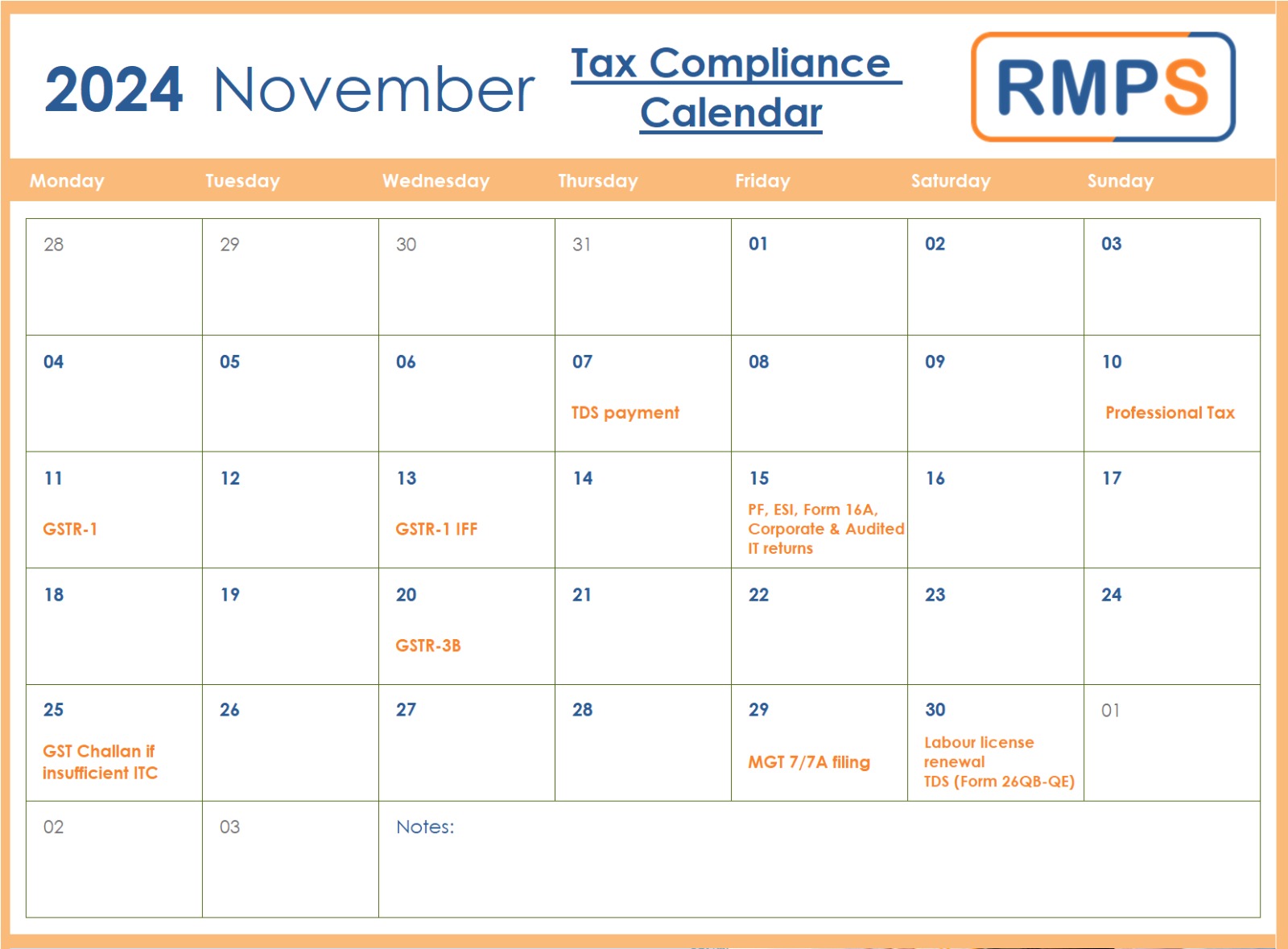

November is a significant month for businesses, with multiple tax and regulatory deadlines. Meeting these deadlines is essential to avoid penalties, maintain compliance, and ensure seamless business operations. Here’s a quick rundown of what to keep in mind for November 2024.

1. TDS Payment (Due by November 7th)

Businesses need to deposit the Tax Deducted at Source (TDS) for October 2024 by this date. Timely payment is crucial to avoid interest and penalties on late remittances.

2. Professional Tax on Salaries (Due by November 10th)

Professional Tax (PT) on October salaries is due on the 10th. Since PT deadlines vary by state, businesses should confirm the specific due dates applicable in their region to stay compliant.

3. GSTR-1 Monthly Filing (Due by November 11th)

The monthly GSTR-1 return, detailing outward supplies made during October 2024, is due on the 11th. Accurate filing of this return is critical, as it forms the basis of GST input claims for recipients.

4. GSTR-1 IFF for QRMP (Due by November 13th)

Quarterly taxpayers under the Quarterly Return Monthly Payment (QRMP) scheme can optionally file their Invoice Furnishing Facility (IFF) for October by November 13th. This helps them share their monthly invoices with clients promptly.

5. Provident Fund (PF) & ESI Payments and Form 16A (Due by November 15th)

- PF & ESI Contributions: All contributions for October 2024 should be deposited by November 15th to ensure compliance with labor laws.

- Form 16A TDS Certificates: For TDS deducted between July and September 2024, businesses must issue Form 16A certificates to vendors by November 15th.

6. Corporate & Audited Income Tax Returns (Due by November 15th)

For corporates and businesses requiring audits, the Income Tax Return (ITR) for FY 2023-24 has been extended to November 15th from the original October 31st deadline. It’s crucial to avoid any further delays in filing.

7. GSTR-3B Monthly Filing (Due by November 20th)

The monthly GSTR-3B, summarizing October 2024’s GST liabilities, must be filed by the 20th. This includes reporting of sales, input tax credit (ITC), and the net tax payable.

8. GST Challan Payment for QRMP Taxpayers (Due by November 25th)

For quarterly GST filers under the QRMP scheme, the GST challan payment is due by November 25th if there is insufficient ITC. Timely payment prevents interest charges on any outstanding tax.

9. MGT 7/7A Filing for Companies & OPCs (Due by November 29th)

Companies and One Person Companies (OPCs) must file their annual return in MGT 7 or 7A for FY 2023-24 by November 29th. This filing provides a comprehensive view of the company’s operations and changes in the past financial year.

10. Labour License Renewal (Due by November 30th)

Companies that require a labor license need to renew it for the calendar year 2025 by November 30th. Staying updated with labor license renewals is critical to maintaining a company’s compliance status.

11. TDS Payment for Property, Rent, Contractors, and Crypto Assets (Due by November 30th)

The deadline for filing TDS on specific payments, such as property transactions (Form 26QB), rent (Form 26QC), contractor payments (Form 26QD), and crypto assets (Form 26QE), is November 30th.

Wrapping Up

November’s deadlines cover an array of tax and compliance requirements, from monthly GST returns to income tax and professional tax filings. Proactive planning and timely submissions can prevent unnecessary fines and ensure smooth compliance.

LinkedIn Link : RMPS Profile

This article is only a knowledge-sharing initiative and is based on the Relevant Provisions as applicable and as per the information existing at the time of the preparation. In no event, RMPS & Co. or the Author or any other persons be liable for any direct and indirect result from this Article or any inadvertent omission of the provisions, update, etc if any.

Published on: November 11, 2024