Introduction:

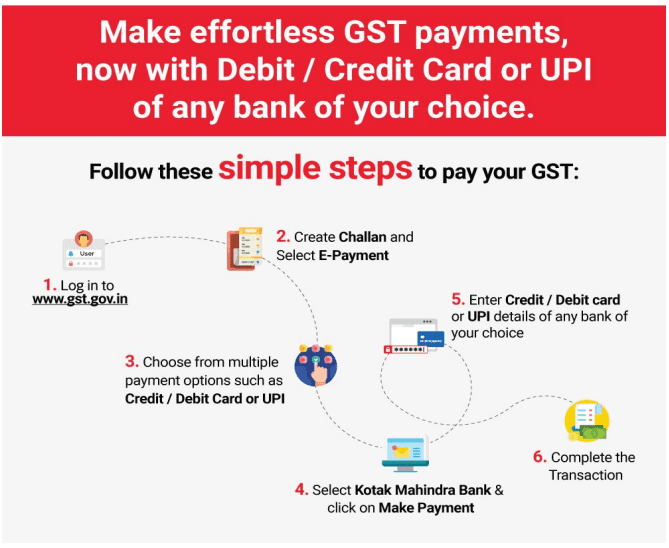

In a move to enhance convenience for taxpayers registered under the Goods and Services Tax (GST), the government has introduced two additional methods of payment under the e-payment system. These new facilities, namely Credit Card (CC) and Debit Card (DC), along with Unified Payments Interface (UPI), offer taxpayers more flexibility in managing their financial transactions. This blog serves as an advisory to shed light on the recent updates and provide guidance on utilizing these payment options securely.

New Payment Methods:

The introduction of Credit Card (CC) and Debit Card (DC) payments broadens the spectrum of available options for GST taxpayers. The Cards facility encompasses major card networks, including Mastercard, Visa, RuPay, and Diners Club (CC only), issued by any Indian bank. Additionally, Unified Payments Interface (UPI) has been incorporated to streamline the payment process, offering a direct bank-to-bank transfer mechanism.

Advisory Highlights:

Diverse Payment Options:

Taxpayers can now choose from a range of payment methods, including net-banking, Credit Card, Debit Card, and UPI, providing them with more flexibility.

Ease of Use:

The new facilities aim to simplify the payment process, allowing taxpayers to select the method that best suits their preferences and requirements.

Security Measures:

While embracing the convenience of these new payment options, it is crucial for taxpayers to prioritize security.

Ensure that transactions are conducted on secure platforms, and be cautious about sharing sensitive information.

Complete Advisory:

For detailed guidelines and information on using the new payment facilities, taxpayers are encouraged to refer to the complete advisory. A clickable link is provided here.

https://tutorial.gst.gov.in/downloads/news/advisory_ccdcupi_19012024.pdf

Conclusion:

The introduction of Credit Card, Debit Card, and UPI as additional methods of payment for GST taxpayers marks a progressive step towards a more inclusive and streamlined financial system. With diverse options at their disposal, taxpayers can now manage their transactions with greater flexibility. As we embrace these changes, it is paramount to prioritize security and adhere to the guidelines provided in the complete advisory.

This article is only a knowledge-sharing initiative and is based on the Relevant Provisions as applicable and as per the information existing at the time of the preparation. In no event, RMPS & Co. or the Author or any other persons be liable for any direct and indirect result from this Article or any inadvertent omission of the provisions, update, etc if any.

Published on: January 30, 2024