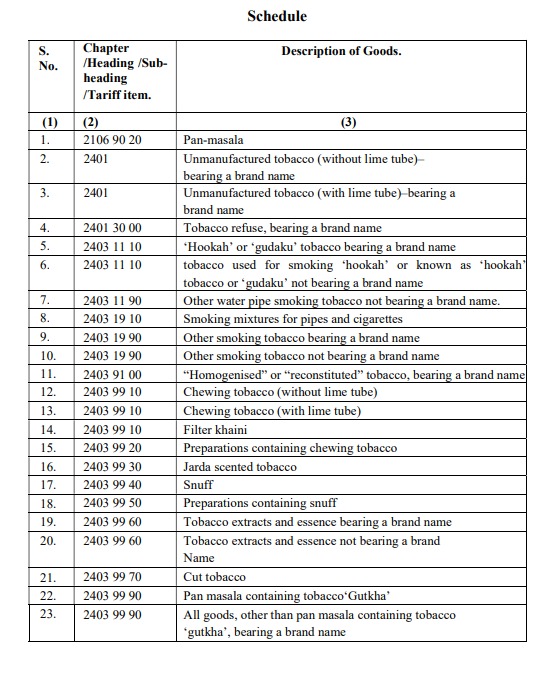

Government had issued a notification to seek information from taxpayers dealing in the Pan Masala and Tobacco manufacturing and goods mentioned therein vide Notification No. 04/2024 – Central Tax dated 05-01-2024. Two forms have been notified vide this notification namely GST SRM-I and GST SRM-II.

All taxpayers dealing in the items mentioned in the said notification may use the facility to file the information about Packing machines.

To begin with, facility to register the machines have been made available on the GST Portal to file the information in Form GST SRM-I. All taxpayers dealing in the items mentioned in the said notification may use the facility to file the information about machines. Form GST SRM-II will also be made available on the portal shortly.

In Notification NO. 04/2024–CENTRAL TAX 5th January,2024

1. Reporting Details of Packing Machines

Initial Reporting:

- Existing Manufacturers: All registered manufacturers of the specified goods must furnish details of their packing machines in FORM GST SRM-I on the GST portal within 30 days of the notification’s effect.

- New Registrations: Manufacturers who receive registration after the issuance of this notification must submit packing machine details in FORM GST SRM-I within 15 days of registration.

Updating Machine Details:

- New Installations: Any new packing machines installed at the registered business location must be reported within 24 hours of installation in PART (B) of Table 6 of FORM GST SRM-I.

- Capacity Changes: Any changes in the declared capacity of machines must be updated within 24 hours in Table 6A of FORM GST SRM-I.

- Disposal of Machines: Details of any existing machines disposed of must be reported within 24 hours in Table 8 of FORM GST SRM-I.

Unique Registration Number:

- Upon submission, a unique registration number will be generated for each machine, ensuring a unique identifier for regulatory purposes.

Reporting to Other Agencies:

- If the production capacity has been declared to any other government department or agency. This information must also be furnished in Table 7 of FORM GST SRM-I within 15 days. For declarations made before this notification, the latest certificate must be submitted within 30 days.

2. Special Monthly Statements

- FORM GST SRM-II: Manufacturers must submit a special monthly statement detailing inputs and outputs by the 10th day of the following month. This form is also filed electronically on the GST portal.

3. Certificate of Chartered Engineer

- Initial Certification:

- A certificate from a Chartered Engineer must be uploaded for each machine declared in Table 6 of FORM GST SRM-I.

- Subsequent Changes: Any amendments to machine details require a new certificate for the updated information.

Effective Date

This notification will take effect from April 1, 2024. Manufacturers are encouraged to familiarize themselves with these new requirements and ensure timely compliance to avoid penalties.

Steps for Compliance

- Access the GST Portal: Log into the GST portal to begin the process.

- Submit Machine Details: Complete FORM GST SRM-I with all required information about your packing machines.

- Regular Updates: Ensure any changes to machine capacity or new installations are promptly updated within 24 hours.

- Monthly Reporting: Prepare and submit FORM GST SRM-II by the 10th of each month.

- Obtain Engineer Certification: Upload the necessary Chartered Engineer certificates for your machines.

Conclusion

Compliance with Notification No. 04/2024 – CENTRAL TAX is crucial for manufacturers to ensure proper reporting and avoid regulatory issues. By following these procedures manufacturers can maintain transparency and efficiency in their operations. Stay informed and proactive to seamlessly integrate these requirements into your business processes.

LinkedIn Link : RMPS Profile

This article is only a knowledge-sharing initiative and is based on the Relevant Provisions as applicable and as per the information existing at the time of the preparation. In no event, RMPS & Co. or the Author or any other persons be liable for any direct and indirect result from this Article or any inadvertent omission of the provisions, update, etc if any.

Published on: May 21, 2024