One such development in the realm of Goods and Services Tax (GST) is the introduction of GSTN enabled functionality for furnishing the Letter of Undertaking (LUT) for the Financial Year 2024-25.

The Letter of Undertaking (LUT) plays a crucial role for exporters, allowing them to supply goods or services without paying integrated tax. Instead of paying taxes upfront and claiming refunds later, exporters can furnish an LUT to export goods or services without the burden of taxes, thereby streamlining their cash flow and reducing administrative hassles.

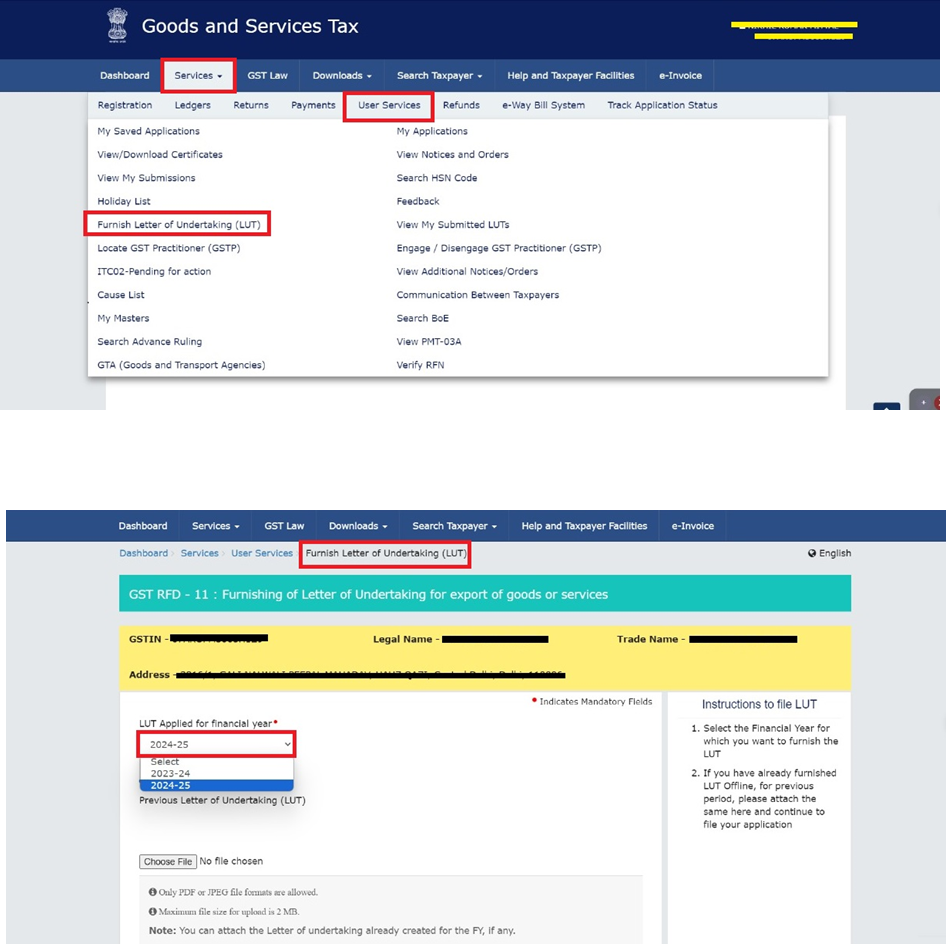

With the new GSTN enabled functionality, the process of submitting the LUT for the Financial Year 2024-25 has been further simplified and digitized. Here’s how businesses can leverage this functionality to their advantage:

Seamless Online Submission:

Businesses can now submit their LUT for the Financial Year 2024-25 directly through the GSTN portal, eliminating the need for manual paperwork and physical submission. This online submission process not only saves time but also reduces the chances of errors and ensures compliance with the latest regulations.

Enhanced Accessibility:

The GSTN portal is accessible round the clock, allowing businesses to submit their LUT at their convenience, without being constrained by office hours or geographical location. Whether it’s during business hours or after-hours, taxpayers can complete the submission process hassle-free.

Real-Time Updates and Notifications:

Upon submission of the LUT, taxpayers receive real-time updates and notifications regarding the status of their application. This transparency and instant feedback mechanism provide peace of mind to taxpayers, ensuring that their compliance requirements are met without delays.

Secure and Confidential:

The GSTN portal employs robust security measures to safeguard sensitive taxpayer information. Businesses can rest assured that their data is protected against unauthorized access or cyber threats, maintaining the confidentiality and integrity of their financial information.

User-Friendly Interface:

The GSTN portal is designed with the user in mind, featuring an intuitive interface that simplifies the entire submission process. Even taxpayers with limited technical expertise can navigate the portal effortlessly, thanks to its user-friendly design and clear instructions.

As we embark on the Financial Year 2024-25, let us embrace these technological advancements and leverage them to propel our businesses forward, fostering innovation, growth, and prosperity for all stakeholders involved.

This article is only a knowledge-sharing initiative and is based on the Relevant Provisions as applicable and as per the information existing at the time of the preparation. In no event, RMPS & Co. or the Author or any other persons be liable for any direct and indirect result from this Article or any inadvertent omission of the provisions, update, etc if any.

Published on: February 17, 2024