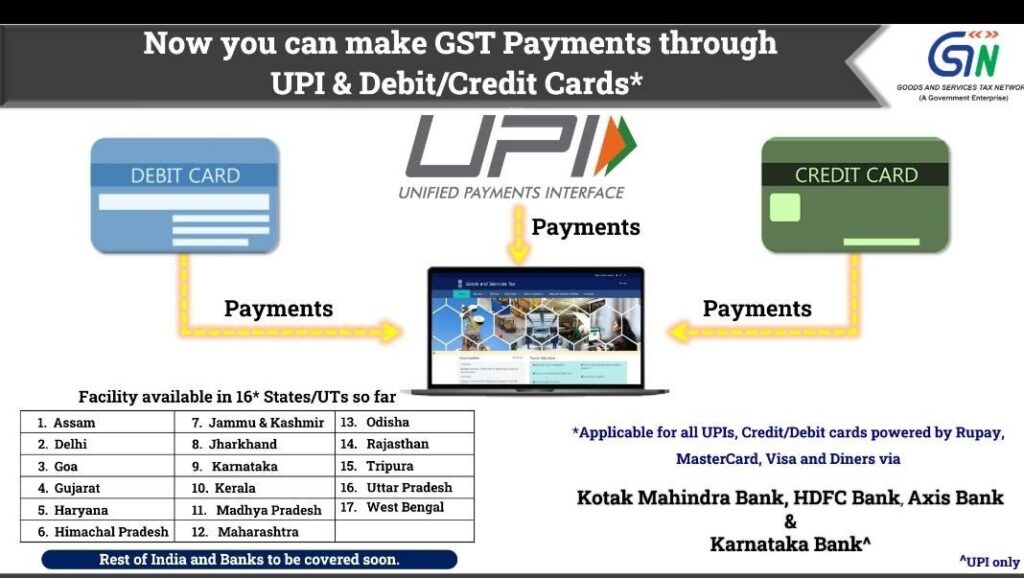

The Goods and Services Tax Network (GSTN) has introduced a new update that makes paying GST easier for taxpayers. Starting August 6th, 2024, taxpayers in 17 states and Union Territories (UTs) can now pay their GST using Unified Payments Interface (UPI) and Debit/Credit cards. This change is part of GSTN’s ongoing effort to simplify the tax payment process and align it with modern digital payment methods.

What’s New?

With this update, you can now make GST payments using major payment gateways from Axis Bank, HDFC Bank, Kotak Mahindra Bank, and Karnataka Bank. Additionally, you can pay your GST using any UPI platform or with Debit/Credit cards powered by Rupay, MasterCard, Visa, and Diners. This update is designed to make the payment process quicker and more secure for all businesses.

Where Is This Facility Available?

Currently, this new payment option is available in 17 states and UTs. These include Assam, Delhi, Goa, Gujarat, Haryana, Himachal Pradesh, Jammu & Kashmir, Jharkhand, Karnataka, Kerala, Madhya Pradesh, Maharashtra, Odisha, Rajasthan, Tripura, Uttar Pradesh, and West Bengal. GSTN plans to extend this service to the rest of India soon, making it even more accessible.

Why This Matters to You

This update offers several benefits:

- Simplified Payments: UPI is quick and easy to use. Now, making GST payments is as simple as paying for anything else online.

- Flexible Options: You can choose the payment method that works best for you, whether it’s UPI or a Debit/Credit card.

- Secure Transactions: UPI and card payments are encrypted, ensuring your transactions are safe.

- Less Hassle: With this update, you don’t have to rely on older methods like NEFT/RTGS. You can now make payments in a few clicks.

A Step Towards Digital India

This update is more than just about ease of payment. It is also a part of the larger Digital India initiative. By incorporating modern payment methods, the GST system is becoming more efficient and user-friendly. As a result, paying taxes is now quicker and easier, helping to improve the overall ease of doing business in India.

Conclusion

If you’re in one of the 17 states or UTs where this update is available, it’s time to take advantage of these new payment options. As GSTN expands this service to more regions, even more taxpayers will benefit from these convenient and secure payment methods. Don’t wait—start using these digital payment options today to experience the ease and efficiency they offer.

LinkedIn Link : RMPS Profile

This article is only a knowledge-sharing initiative and is based on the Relevant Provisions as applicable and as per the information existing at the time of the preparation. In no event, RMPS & Co. or the Author or any other persons be liable for any direct and indirect result from this Article or any inadvertent omission of the provisions, update, etc if any.

Published on: August 20, 2024