India’s external sector has demonstrated resilience despite global uncertainties, with steady growth in exports, foreign investments, and forex reserves. The Economic Survey 2024-25 provides crucial insights for businesses, investors, and policymakers to navigate global trade shifts, investment trends, and regulatory challenges.

1. Trade Performance: Resilience Amid Global Headwinds

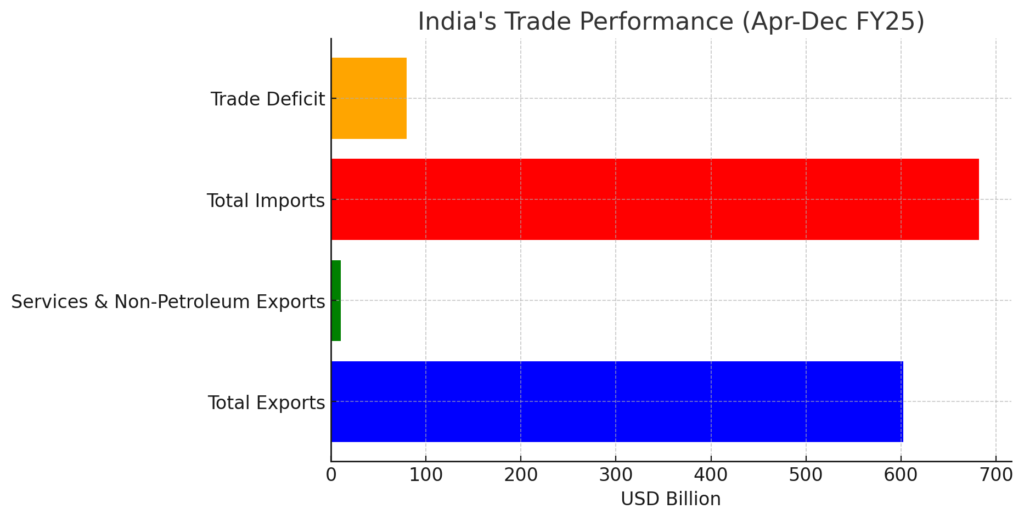

- Total Exports (Apr-Dec FY25): USD 602.6 billion, up 6% YoY.

- Services & Non-Petroleum Goods Exports: 10.4% growth, showcasing strength beyond traditional exports.

- Total Imports: USD 682.2 billion, rising 6.9% YoY, indicating robust domestic demand.

- Trade Deficit: Widened to USD 79.5 billion, driven by higher imports.

Key Takeaways:

- Diversification of exports beyond petroleum and gems is essential.

- Global trade disruptions require strategic adaptation to supply chain shifts.

2. Global Trade Trends: Navigating Protectionism and Policy Uncertainty

- Rise in Trade Protectionism: Governments imposing more non-tariff measures (NTMs) affecting global trade.

- Shifting Trade Alliances: Increased friendshoring & nearshoring reshaping global supply chains.

- Impact of Red Sea & Panama Canal Disruptions: Shipping delays and cost spikes affecting trade routes.

Key Takeaways:

- Indian exporters must adapt to trade shifts by targeting new markets.

- Supply chain resilience is key amid global trade route disruptions.

3. Foreign Investment Trends: Strong Fundamentals but Mixed Signals

- Foreign Portfolio Investments (FPIs): Show mixed trends due to global market volatility.

- Foreign Direct Investment (FDI): Gross inflows improving, but net FDI declined due to increased repatriation.

- Forex Reserves: USD 640.3 billion, covering 90% of external debt, providing a strong buffer.

Key Takeaways:

- India remains an attractive investment destination with stable economic fundamentals.

- Strengthening the domestic investment climate will boost long-term FDI inflows.

4. Sectoral Insights: Growth Opportunities & Policy Challenges

Textile Industry: Strengthening Competitiveness

- India’s Textile Exports (2023): USD 34 billion, contributing 2.3% of GDP.

- Challenges: Higher costs, lack of vertical integration, and complex regulations.

- Opportunities: Man-Made Fiber (MMF), which dominates global demand (77% of fiber consumption).

Key Takeaways:

- Investing in MMF & sustainable textiles is crucial for long-term growth.

- Streamlining regulations & boosting MSME competitiveness will enhance exports.

E-Commerce Exports: Unlocking Digital Trade Potential

- India’s B2C E-Commerce Market: Expected to grow from USD 83 billion (2022) to USD 150 billion (2026).

- Global Share: Currently 1.5%, projected to reach 2%.

- Government Support: Niryat Bandhu, Market Access Initiative, ONDC integration.

Key Takeaways:

- MSME digital transformation and logistics efficiency are vital for e-commerce export growth.

- Simplifying regulations will help India compete with global players in digital trade.

5. Key Policy Changes Impacting Indian Businesses

- Tariff Rationalization & Industrial Policy: Balancing domestic industry growth with global trade commitments.

- Carbon Border Adjustment Mechanism (CBAM) & EU Deforestation Regulation (EUDR): Affecting Indian exports to the EU.

- Trade Agreements: India’s focus on FTAs with the UK, EU, and new emerging markets.

Key Takeaways:

- Indian exporters must prepare for stricter climate & trade compliance rules.

- Expanding market access through FTAs is essential for trade resilience.

Strategic Takeaways for Businesses & Investors

- Expand export markets: Diversify trade partnerships beyond traditional regions.

- Strengthen supply chains: Adapt to global trade shifts, invest in friendshoring & nearshoring.

- Leverage digital trade: Boost e-commerce exports with better logistics and MSME support.

- Prepare for policy changes: Stay ahead of trade policy shifts like CBAM & NTMs.

- Boost FDI & domestic investments: Improve India’s investment climate to sustain capital inflows.

Conclusion

India’s external sector remains resilient, but businesses must navigate policy uncertainties, trade shifts, and investment trends to stay competitive. Proactive adaptation, digital transformation, and global market diversification will define success in 2024-25.

LinkedIn Link : RMPS Profile

This article is only a knowledge-sharing initiative and is based on the Relevant Provisions as applicable and as per the information existing at the time of the preparation. In no event, RMPS & Co. or the Author or any other persons be liable for any direct and indirect result from this Article or any inadvertent omission of the provisions, update, etc if any.

Published on: February 1, 2025