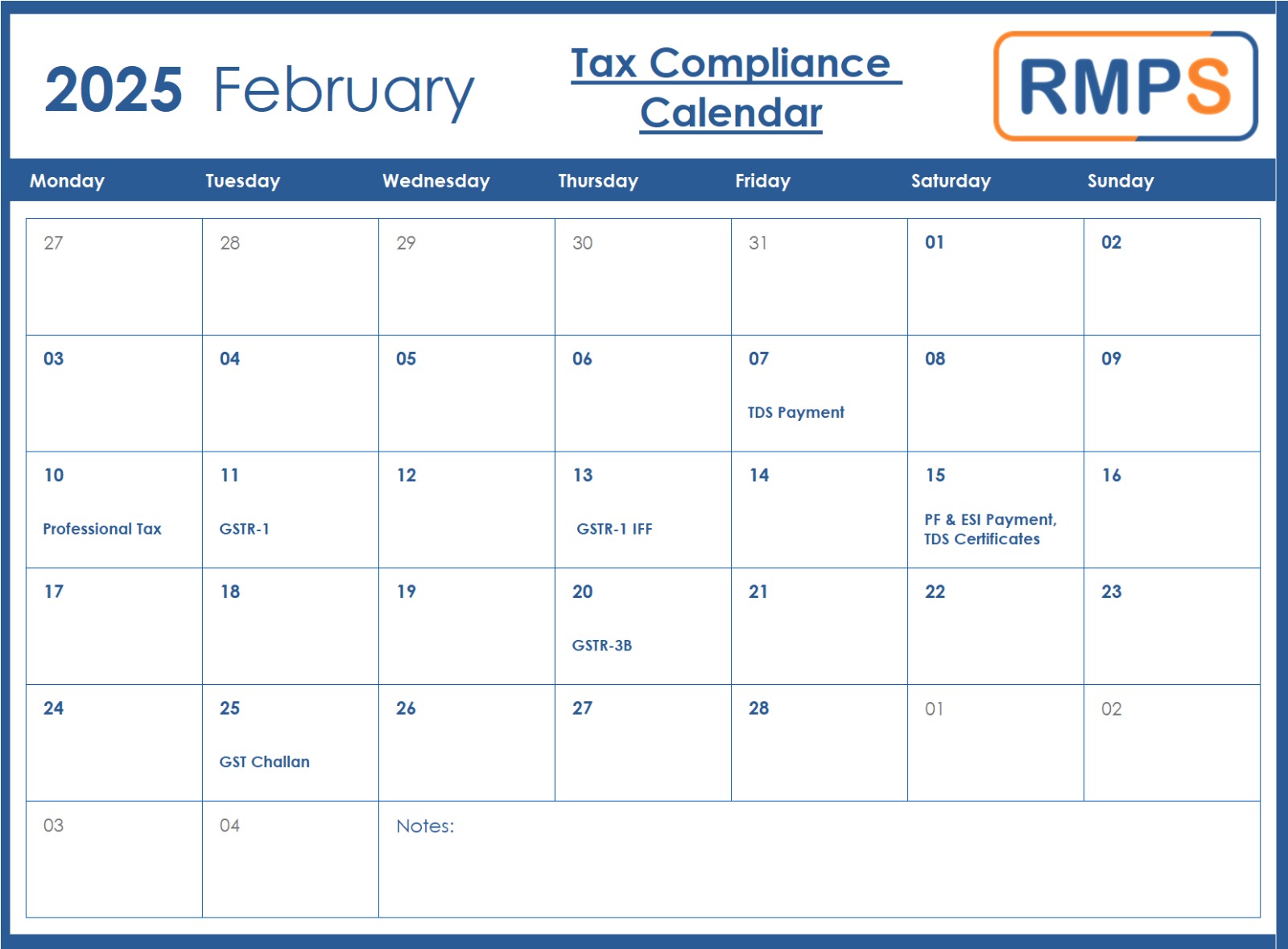

Tax compliance is essential for smooth business operations. Missing deadlines can lead to penalties, interest charges, and unnecessary hassles. By staying informed and planning ahead, businesses can avoid financial burdens and ensure compliance. Below are the critical tax deadlines for February 2025.

Important Tax Deadlines – February 2025

7th February – TDS Payment for January 2025

Tax Deducted at Source (TDS) collected in January must be deposited by this date. Late payments may attract interest and penalties. Timely payments ensure compliance and prevent financial strain.

10th February – Professional Tax (PT) Payment

Employers must remit Professional Tax on salaries for January 2025. Since due dates vary by state, verifying the applicable deadline is crucial. Late payments can result in fines.

11th February – GSTR-1 Filing (Monthly)

Businesses filing GST monthly must submit GSTR-1 for January 2025. This return details outward supplies, allowing buyers to claim Input Tax Credit (ITC). Filing on time prevents compliance issues.

13th February – GSTR-1 IFF for QRMP Filers

Quarterly Return Monthly Payment (QRMP) scheme taxpayers can submit the Invoice Furnishing Facility (IFF) for January 2025. Early submission helps buyers avail ITC benefits promptly, improving cash flow.

15th February – PF, ESI, and TDS Certificate Issuance

Employers must deposit Provident Fund (PF) and Employees’ State Insurance (ESI) contributions for January 2025. Additionally, TDS Certificates (Form 16A) for deductions made between October and December 2024 must be issued to recipients. Delays can result in penalties and compliance risks.

20th February – GSTR-3B Filing (Monthly)

Businesses filing GST monthly must submit GSTR-3B for January 2025. This return reports tax liabilities and ITC claims. Filing on time prevents late fees and disruptions.

25th February – GST Challan Payment for QRMP Filers

QRMP taxpayers with insufficient ITC must pay their GST liability via challan. Timely payments prevent penalties and ensure hassle-free compliance.

Why Timely Tax Compliance Matters?

Failing to meet deadlines can have serious consequences: ✔ Late fees and interest charges increase financial burdens.

✔ Loss of ITC affects cash flow and profitability.

✔ Greater scrutiny from tax authorities raises compliance risks.

Final Thoughts

Tax deadlines should never be overlooked. By tracking due dates and making timely payments, businesses can streamline tax planning and prevent compliance issues.

LinkedIn Link : RMPS Profile

This article is only a knowledge-sharing initiative and is based on the Relevant Provisions as applicable and as per the information existing at the time of the preparation. In no event, RMPS & Co. or the Author or any other persons be liable for any direct and indirect result from this Article or any inadvertent omission of the provisions, update, etc if any.

Published on: February 4, 2025