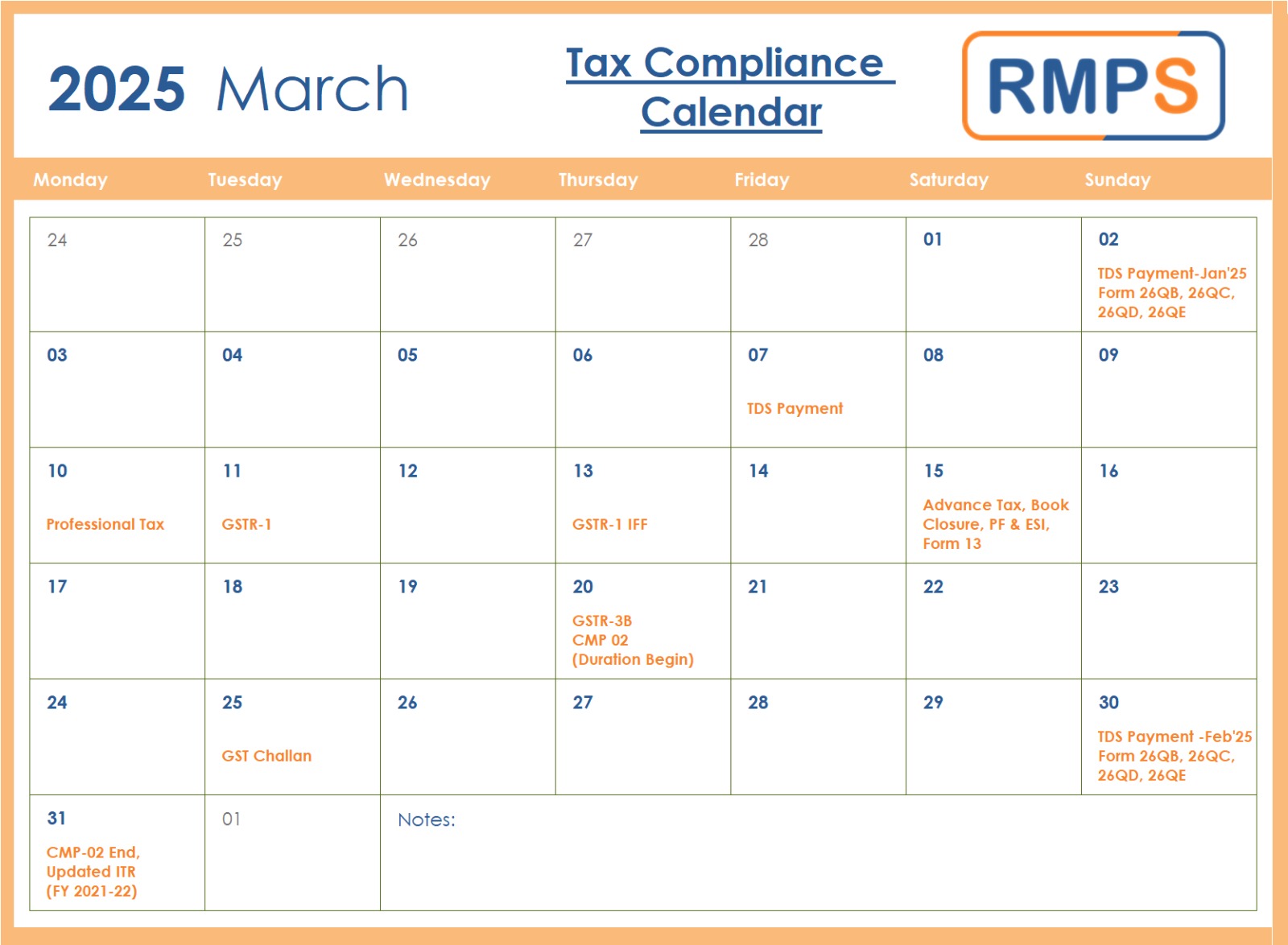

March is a crucial month for tax compliance, with several key deadlines for businesses and individuals. Staying on top of these due dates helps avoid penalties and ensures smooth financial operations. Below is a structured compliance calendar for March 2025.

Key Tax Deadlines for March 2025

Early March Compliance

- March 2, 2025 – Submit TDS payments for January 2025 under Forms 26QB (Property), 26QC (Rent), 26QD (Contractor Payments), and 26QE (Crypto Assets).

- March 7, 2025 – Ensure TDS payment for February 2025 is completed to avoid late fees.

- March 10, 2025 – Professional Tax (PT) payment is due for February 2025 salaries. Deadlines vary by state, so businesses must check their respective regulations.

Mid-March Compliance

- March 11, 2025 – File GSTR-1 (Monthly) for February 2025.

- March 13, 2025 – Businesses under the QRMP scheme can optionally file GSTR-1 IFF (Invoice Furnishing Facility) for February 2025.

- March 15, 2025 – Complete advance tax payment for the January-March 2025 quarter.

- March 15, 2025 – Finalize tax planning and book closure for FY 2024-25.

- March 15, 2025 – File Provident Fund (PF) and Employee State Insurance (ESI) returns and payments for February 2025.

- March 15, 2025 – Submit Form 13 to apply for Nil or Lower TDS certificates for FY 2024-25.

Late March Compliance

- March 20, 2025 – File GSTR-3B (Monthly) for February 2025.

- March 20, 2025 – The window for opting into the Composition Scheme (CMP-02) for FY 2025-26 opens.

- March 25, 2025 – Pay GST challan if Input Tax Credit (ITC) is insufficient for February 2025 liabilities. This applies to all quarterly filers.

- March 30, 2025 – Submit TDS payments for February 2025 using Forms 26QB, 26QC, 26QD, and 26QE.

- March 31, 2025 – Last day to opt into the Composition Scheme (CMP-02) for FY 2025-26.

- March 31, 2025 – Deadline for filing an updated Income Tax Return (ITR-U) for FY 2021-22.

Why Compliance is Essential

Meeting tax deadlines prevents unnecessary penalties, ensures smooth business operations, and simplifies financial management. Late payments or missed filings can lead to fines and compliance risks.

Final Thoughts

Tax compliance is critical, especially in March, as it marks the financial year’s closing. Planning and timely submissions can help businesses and individuals avoid last-minute hassles. Consulting a tax expert can provide additional clarity and streamline the compliance process.

LinkedIn Link : RMPS Profile

This article is only a knowledge-sharing initiative and is based on the Relevant Provisions as applicable and as per the information existing at the time of the preparation. In no event, RMPS & Co. or the Author or any other persons be liable for any direct and indirect result from this Article or any inadvertent omission of the provisions, update, etc if any.

Published on: March 3, 2025