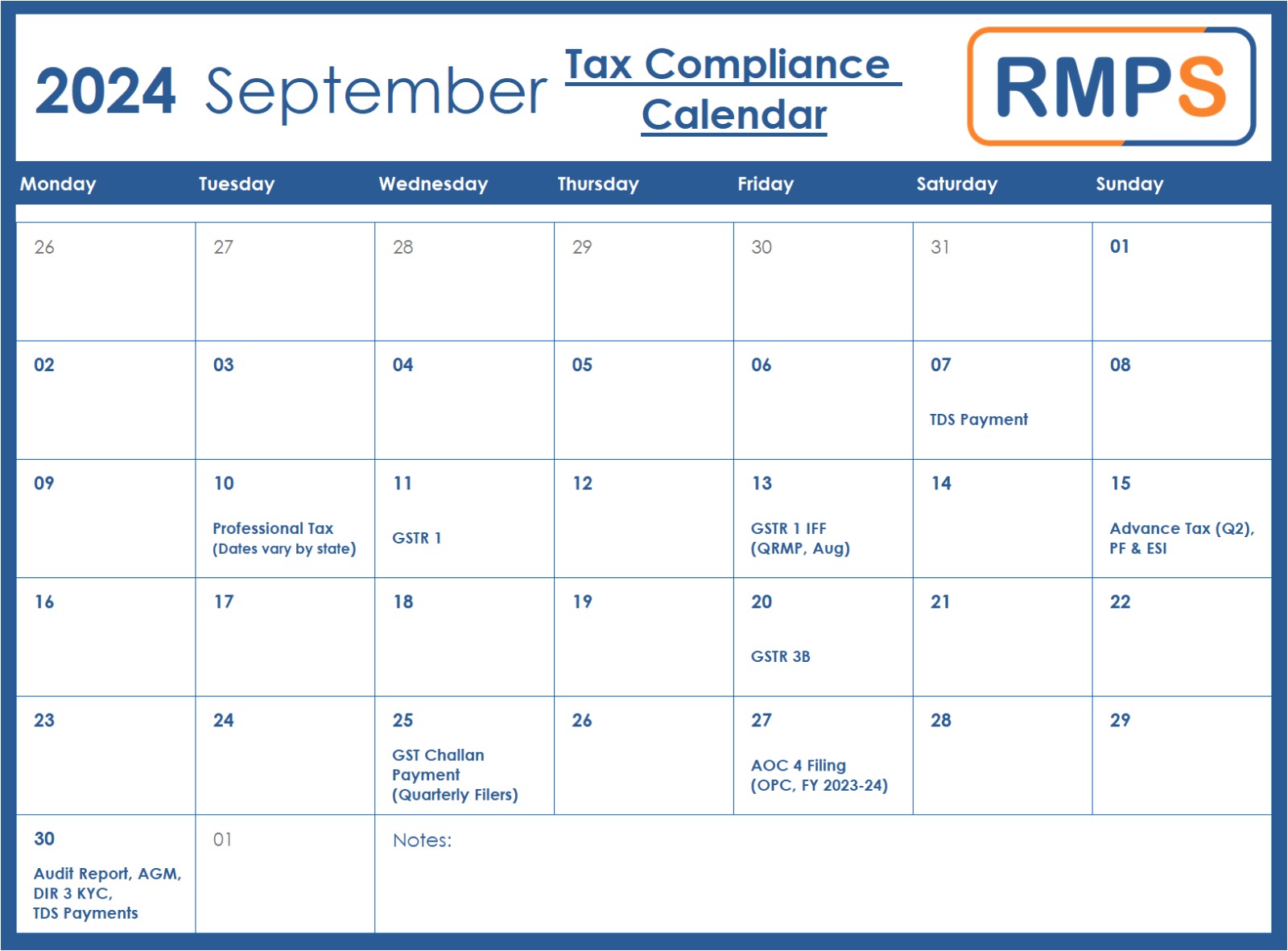

As September 2024 rolls in, it’s essential for businesses and professionals to stay on top of their compliance requirements. Missing key deadlines can lead to penalties, so here’s a quick guide to the crucial dates this month.

7th September: TDS Payment for August 2024

Ensure that your TDS (Tax Deducted at Source) for August 2024 is paid by this date to avoid any late fees or interest.

10th September: Professional Tax (PT) on Salaries for August 2024

If you’re responsible for deducting Professional Tax on employee salaries, remember to make the payment by this date. Note that the due date varies by state, so check with local authorities.

11th September: GSTR 1 (Monthly) for August 2024

Monthly filers must submit their GSTR 1 return for August 2024 by this date. This return covers all outward supplies made during the month.

13th September: GSTR 1 IFF (Optional) for QRMP (August 2024)

Taxpayers under the QRMP (Quarterly Return Monthly Payment) scheme can choose to file the Invoice Furnishing Facility (IFF) for August 2024 by this date.

15th September: Advance Tax Payment for July-September 2024

The second installment of advance tax for FY 2023-24 is due. Make sure to calculate and pay the required amount to avoid interest penalties.

15th September: PF & ESI Returns and Payment for August 2024

Companies must also file their Provident Fund (PF) and Employee State Insurance (ESI) returns and payments for August 2024 by this date.

20th September: GSTR 3B for August 2024 (Monthly)

This is the deadline for filing GSTR 3B for August 2024 for monthly filers. Ensure that your tax liability is paid and the return is filed to stay compliant.

25th September: GST Challan Payment for August 2024 (Quarterly Filers)

If you are a quarterly filer and do not have sufficient Input Tax Credit (ITC) to offset your liability, you must make the GST challan payment by this date.

27th September: AOC 4 Filing for One Person Companies (FY 2023-24)

One Person Companies (OPCs) are required to file their AOC 4 for the financial year 2023-24 by this date.

30th September: Audit Report in Form 3CB-3CD and 3CA-3CD for FY 2023-24

Businesses and professionals must submit their tax audit reports in Forms 3CB-3CD or 3CA-3CD for FY 2023-24 by this date.

30th September: Annual General Meeting (AGM) for Companies

For companies, the last date to hold the Annual General Meeting (AGM) for FY 2023-24 is 30th September 2024.

30th September: DIR 3 KYC for Directors of Companies and LLPs

All directors of companies and LLPs must complete their KYC formalities through DIR 3 by this date to avoid deactivation of their DIN.

30th September: TDS Payment in Forms 26QB, 26QC, 26QD, and 26QE for August 2024

This is the deadline for filing TDS payments related to property transactions (Form 26QB), rent (Form 26QC), contractor payments (Form 26QD), and crypto assets (Form 26QE) for August 2024.

Conclusion

Staying compliant with tax and statutory deadlines is crucial for the smooth operation of any business. September 2024 brings a series of important dates, each requiring timely action to avoid penalties and maintain your business’s good standing. Whether it’s filing returns, making payments, or holding essential meetings, make sure to mark these dates on your calendar.

LinkedIn Link : RMPS Profile

This article is only a knowledge-sharing initiative and is based on the Relevant Provisions as applicable and as per the information existing at the time of the preparation. In no event, RMPS & Co. or the Author or any other persons be liable for any direct and indirect result from this Article or any inadvertent omission of the provisions, update, etc if any.

Published on: September 2, 2024