Process-Level Control vs Entity Level Controls: What should be focus on First

INTRODUCTION Process-Level Controls vs Entity-Level Controls is a question many management teams face when strengthening internal controls, preparing for audits, ICFR reviews, or investor due diligence. In practice, most organizations begin by documenting policies, setting up committees, and defining governance frameworks. These steps feel reassuring and give a sense of control at the top. However, […]

Real Estate & Construction Sector – GST Updates from the 56th Council Meeting

Overview The 56th GST Council meeting held in September 2025 brought significant changes for the Real Estate and Construction sector. These updates focus on rationalising GST rates for key construction materials and clarifying the treatment of specified works contracts. Unless otherwise notified, the changes are effective from 22 September 2025. A) GOODS – Construction Materials […]

56th GST Council Meeting – Complete Sector-Wise GST Rate Changes & Key Announcements

56th GST Council Meeting

GST Made Simple: When You Exchange Goods and Services Without Money

Introduction: The exchange of goods and services without involving money may sound simple, but under GST it carries specific tax implications. Such transactions are common in business — for example, when companies swap advertising for products, or professionals exchange services. Even though no money changes hands, GST still applies because the law treats these exchanges […]

Missed Your ITR Filing or e-Verification Deadline? Here’s How to Fix It (2025 Update)

If you’ve missed filing your Income Tax Return (ITR) or didn’t e-verify it on time, you’re not alone. Many taxpayers run into this issue each year. Fortunately, the Income Tax Department offers a remedy — the Condonation Request. Think of it as your official request for a second chance to stay compliant without penalties. In […]

Brand Usage in Related Parties: GST Lessons from Mahindra & Mahindra’s ₹146 Cr Notice

Introduction: When companies in the same group use the same brand name, it might seem like a simple internal arrangement. However, the recent case with Mahindra & Mahindra (M&M) shows us that this can have serious tax consequences under the Goods and Services Tax (GST) law. M&M received a massive ₹146 crore tax notice because […]

Nil Rated, Exempted, Non-GST & Schedule III Items: A Practical Comparison for Businesses

Introduction: Understanding the different categories of supplies under GST, such as Nil Rated, Exempted, Non-GST Supplies, can be tricky, but it’s essential for businesses to get it right. Mistakes in classifying these supplies can lead to tax issues, missed opportunities to claim tax credits, and even fines. Whether you run a business or are involved […]

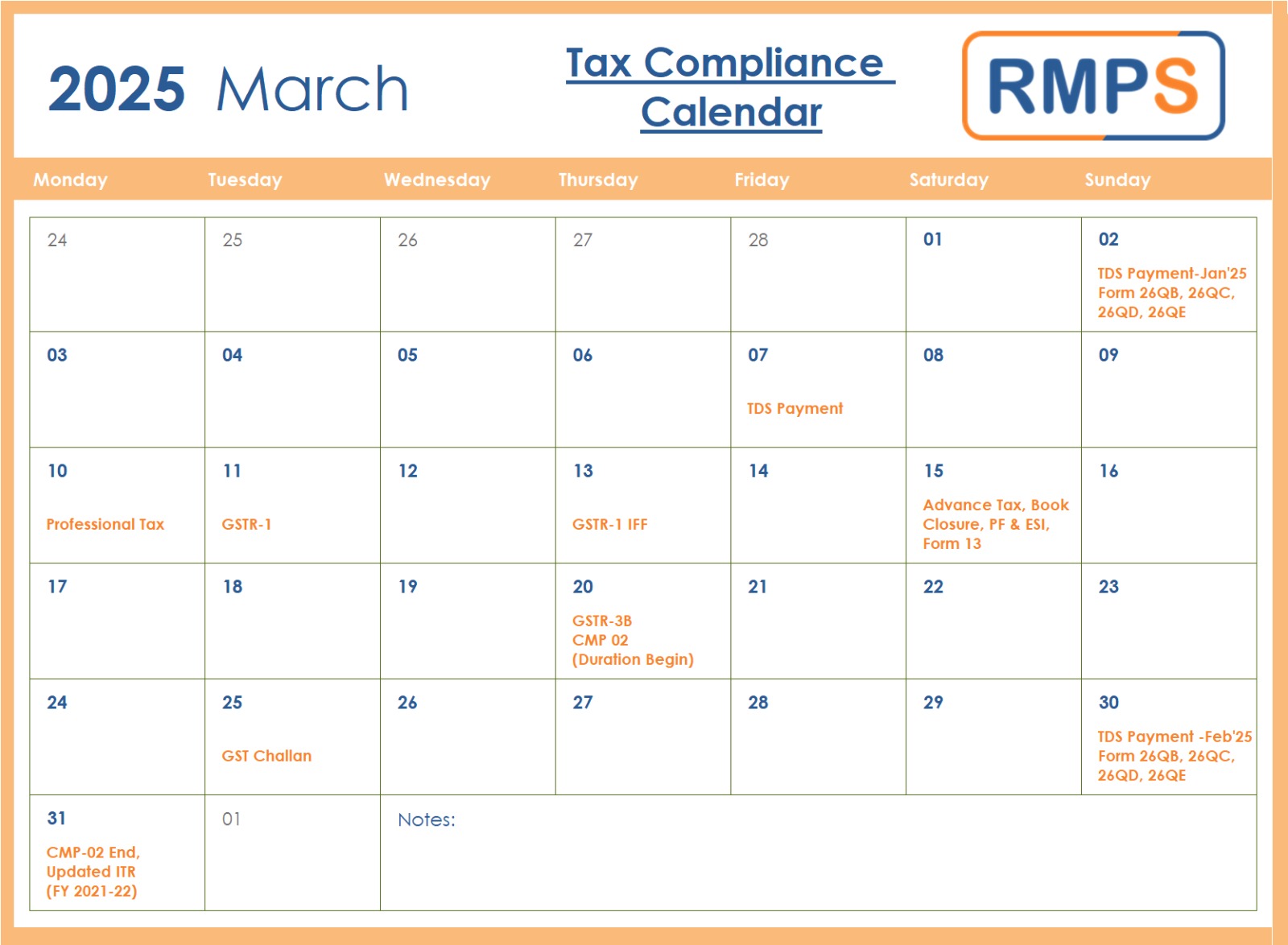

March 2025 Tax Compliance Calendar: Key Deadlines & Due Dates

March is a crucial month for tax compliance, with several key deadlines for businesses and individuals. Staying on top of these due dates helps avoid penalties and ensures smooth financial operations. Below is a structured compliance calendar for March 2025. Key Tax Deadlines for March 2025 Early March Compliance Mid-March Compliance Late March Compliance Why […]

New Income Tax Bill 2025: Key Changes Taxpayers Can Expect

The Income Tax Bill, 2025, introduced in Parliament on February 13, 2025, marks a significant step toward modernizing India’s taxation framework. This new bill replaces the Income Tax Act, 1961, aiming to simplify tax laws, improve compliance, and enhance transparency. The government’s objective is to align taxation with the evolving economic landscape, making it easier […]

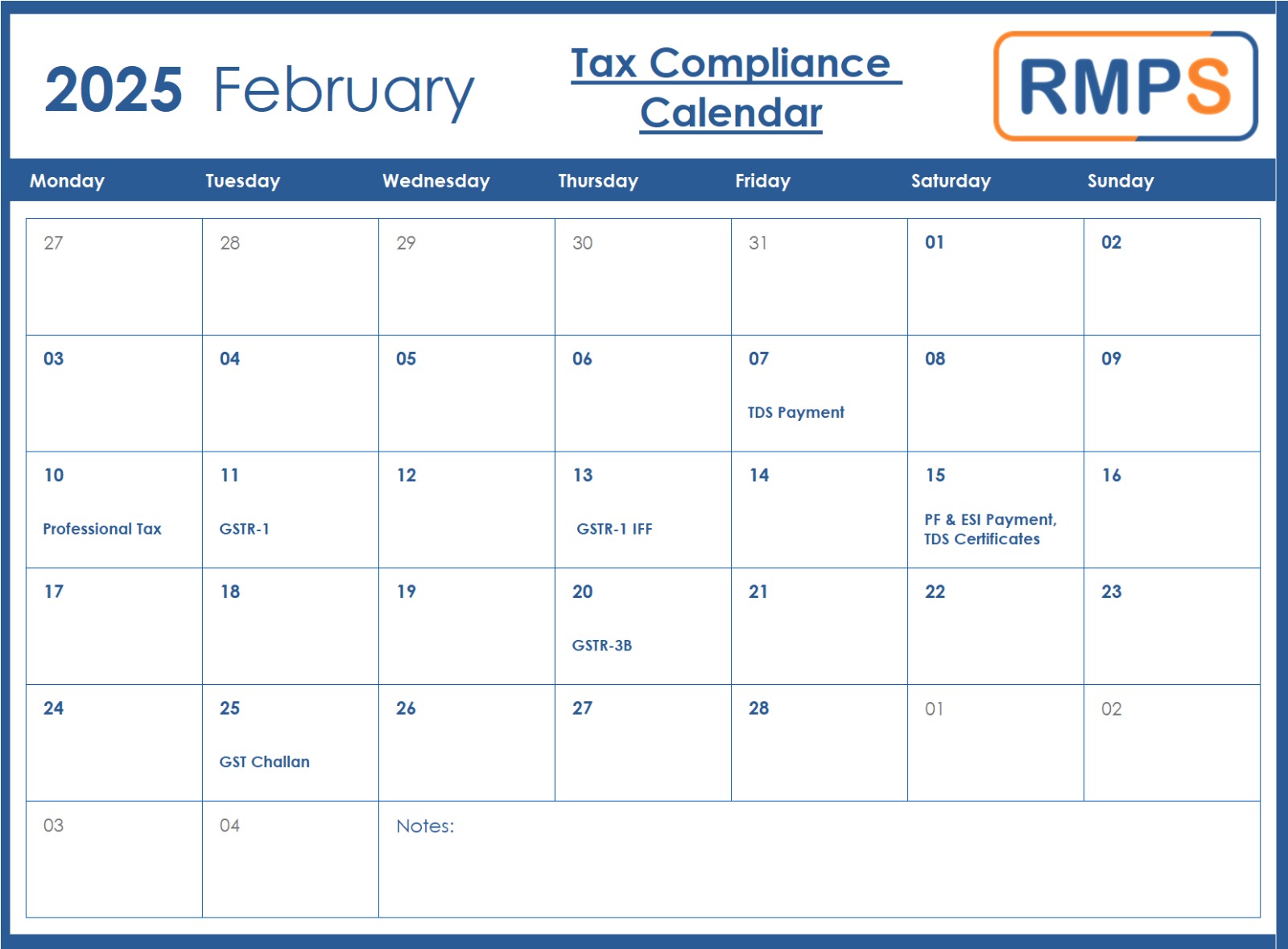

Key Tax Compliance Deadlines for February 2025: A Simple Guide

Tax compliance is essential for smooth business operations. Missing deadlines can lead to penalties, interest charges, and unnecessary hassles. By staying informed and planning ahead, businesses can avoid financial burdens and ensure compliance. Below are the critical tax deadlines for February 2025. Important Tax Deadlines – February 2025 7th February – TDS Payment for January […]